Chinese automakers eye Latin American market, contributing to local industrial chain development

More economic cooperation expected following Lula’s Brazil election victory: expert

China-produced autos at Lianyungang, East China's Jiangsu Province, wait for being loaded on vessels to Mexico. Photo: VCG

With soaring overseas demand for Chinese automobiles and car components, leading Chinese automakers and component manufacturers such as BYD and Ningbo Tuopu Group Co have accelerated their presence and expansion in Latin American countries including Brazil and Mexico over recent years.Experts said that the entrance of Chinese automobile and component companies into the burgeoning market will yield win-win results by helping train workers and building industrial chains for local markets while making it convenient to export to markets such as the US and Canada. In particular, more economic cooperation opportunities between China and Brazil are expected following the election of Luiz Inacio Lula da Silva as president of Brazil.

BYD said on October 26 that it has entered into a partnership with Saga Group, the largest dealership group in Brazil, and established its first store in the capital city of Brasília. Currently, BYD boasts 10 dealerships operating in Brazil, with franchises across 31 major cities.

In the Brazilian market, BYD has worked with its local partners to introduce a series of BYD new-energy vehicles (NEVs), including the pure electric SUV Tang EVs, Premium Sedan Han EVs, and D1 EVs, and recently launched presales of the BYD plug-in hybrid model, the Song Plus DM-i, according to a statement published through the company's WeChat account.

Besides, Ningbo Tuopu Group Co, a Chinese enterprise specializing in R&D, manufacturing, and sales of auto parts, announced in September that the company will establish a subsidiary in Mexico with total investment no more than $200 million in order to win more orders and provide support for strategic clients.

The subsidiary will be engaged in the production of light-weighting auto chassis, automotive interiors and thermal management systems, among others products. "The establishment of the facility [in Mexico] will reduce tariffs and shipment costs, raise safety of supply chains and offer better products and services for clients," said the company, noting that it will also help identify potential opportunities in North America and contribute to the company's internationalization strategy.

In addition, other brands including Great Wall Motor, Zhejiang Sanhua Intelligent Controls Co and Suzhou Dongshan Precision Manufacturing Co have recently entered Latin America.

'Step for going global'

Expanding to Latin America is an important step for Chinese automakers going global, Feng Shiming, an auto analyst with Shanghai-based Menutor Consulting, told the Global Times on Tuesday.

"Compared with consumer preference for premium car brands as well as strict regulations in the US and the EU, the consumption profile in markets like Brazil, Argentina and Chile is more similar to that in China - consumers attach importance on high price performance and design," he said, noting that those markets also serve as a springboard for Chinese auto brands to enter first-tier markets like the US and Canada.

As the seventh-largest automobile manufacturing center and the fifth-largest component producer, Mexico's automobile industry includes more than 30 original equipment manufacturers and thousands of first-, second-, and third-tier suppliers. It saves over 30 percent labor costs to establish factories in Mexico than in the US, according to media reports.

Feng said the entrance of Chinese automakers, especially NEV brands, will stimulate local supply of auto parts, help train skilled workers and develop natural resources. "As China's NEV industry almost leads the global development, Chinese automakers would also pass on relevant technologies to local enterprises by expanding cooperation there," he said.

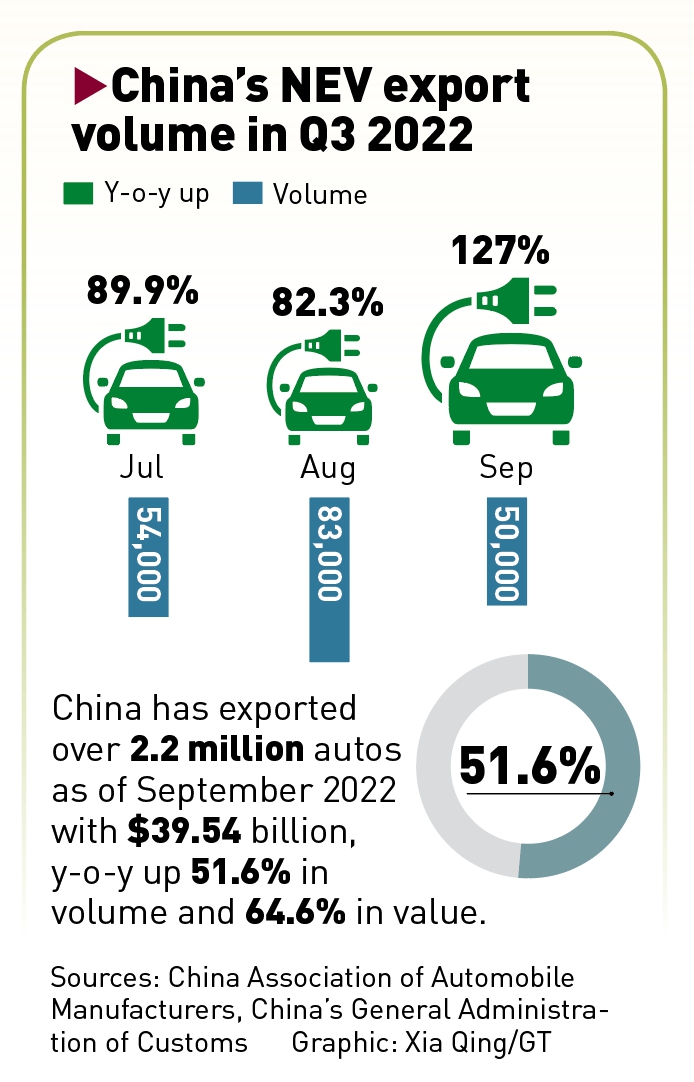

China's auto exports surged 55.5 percent year-on-year to top 2.11 million units in the first nine months of the year, according to the China Association of Automobile Manufacturers.

Meanwhile, the country's export of automobile components has surpassed that of its imports. Over the same period, China's export of auto parts reached $60.81 billion, an increase of 9.8 percent year-on-year, data from the General Administration of Customs (GAC) showed.

Graphic: Xia Qing/GT

Potential cooperation with BrazilStarting with cooperation in the automobile sector, China and Latin American countries are expected to launch more mutually beneficial cooperation in the future, especially with Brazil, according to experts.

Lula's return may greatly improve the atmosphere of cooperation between China and Brazil, with more cooperation opportunities expected, Zhou Zhiwei, an expert on Latin American studies at the Chinese Academy of Social Sciences, told the Global Times.

Amid shocks from the prolonged COVID-19, Lula faces challenges in boosting economic growth and improving living standards, Zhou said, noting that Lula may tap favorable external factors to stimulate the Brazilian economy.

"Brazil may look more actively to the Asia-Pacific region and China, especially the Belt and Road Initiative and cooperation on large-scale infrastructure projects," Zhou said.

China's continuous opening-up and optimizing trade structure make the country a stabilizer for China-Latin America bilateral trade. China's trade with Latin America grew by 12.5 percent year-on-year in the first nine months to reach $373.47 billion, of which Brazil accounts for almost a third, according to GAC data.