China EU Photo:VCG

European lawmakers on Thursday approved new rules to curb acquisitions of companies or bids for public contracts by subsidized foreign companies. Although it has not been indicated which country the rules are targeting, it is widely believed they are aimed particularly at fending off competition from China.

Chinese experts said the most potential targets should be companies from the US, as the country provides the most subsidies for its companies.

According to the Foreign Subsidies Regulation, companies will need to let the EU's executives know about planned mergers and acquisitions if one of the parties involved has an EU turnover of at least €500 million ($515 million) and there is a foreign financial contribution of at least €50 million. The European Commission will also investigate tenders in public procurements if the value of a procurement is at least €250 million.

The EU is a particularly open economy: it is one of the world's largest trading blocs making up 16 percent of global trade, and in 2021 it received €117 billion in foreign direct investment. There has been a growing number of instances in which foreign subsidies appear to have facilitated the acquisition of EU undertakings, influenced investment decisions or distorted trade in services, to the detriment of fair competition, said the European Parliament.

Parliament rapporteur, Luxembourg MEP Christophe Hanssen, argued "it's difficult to imagine that the sale of strategic stakes in companies as important as the port of Hamburg could happen without the Commission looking more closely at where the funds are coming from," according to euronews.com, alluding to COSCO Shipping's stake in the German port of Hamburg, which was approved by the German cabinet on October 26.

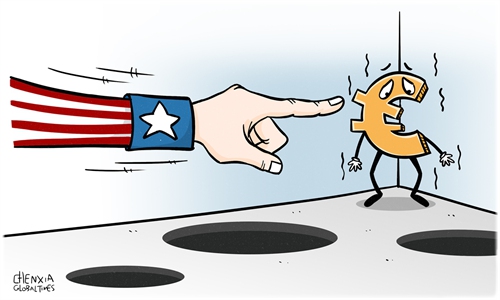

The current direction of Western public opinion is that no matter what problems Europe is facing, it will lay the blame for its misfortune on China, which could be the result of efforts from the US, Cui Hongjian, director of the Department of European Studies at the China Institute of International Studies, told the Global Times on Friday.

"Europe wants to use the rules as a policy tool to maintain European competitiveness. In fact, for Europe, the blame should be directed at the US rather than China," Cui said.

Since the Russia-Ukraine conflict began, the US has become the biggest beneficiary of the European energy crisis. Not only has the US started selling liquefied natural gas to Europe, it also passed the Inflation Reduction Act in August, with a subsidy policy aimed at attracting European companies to relocate to the US, according to media reports.

"The US has engaged in exclusive subsidies for some of its industries and companies, exemplified by its Inflation Reduction Act of 2022, which makes the EU unable to sit still," Cui said.

The fact that Western public opinion is linked to China for the first time means it must be a politicized operation, Cui added.

Europe has a kind of concern or fear about the rise of China, which is also consistent with the strategy of containing China pursued by the US, Zhao Junjie, a research fellow at the Chinese Academy of Social Sciences' Institute of European Studies, told the Global Times on Friday.

Zhao explained that various crises in Europe in the past two years, such as its economic downturn, inflation, the energy crisis, and the social welfare crisis, have made the political situation in the continent turbulent and accelerated the process of de-globalization, which treats normal competition as abnormal.

"The above-mentioned law is a manifestation of the EU's turn toward the US to impose restrictions on Chinese investment," Huo Jianguo, vice president of the China Institute for World Trade Organization Studies, told the Global Times on Friday.

He added that this decision by the EU is very unwise, especially when European economic prospects are unclear, as the implementation of trade protectionism and blocking of normal market business behavior will ultimately damage European companies.

According to customs data, the EU is China's second largest trading partner. The total trade value between China and the EU was 4.68 trillion yuan ($658 billion) in the first 10 months, an increase of 8.1 percent, accounting for 13.5 percent of China's trade.