Illustration: Chen Xia/Global Times

British finance minister Jeremy Hunt said, in order to tackle a 55 billion-pound hole in Britain's budget, he will set out tax rises and spending cuts when announcing a budget plan on Thursday, which is seen as the first major test of Sunak's administration, US media outlet CNBC reported.The release of Hunter's fiscal plan, two weeks later than originally planned on October 31, comes at a time when the UK economy heads into what is expected to be the longest recession on record, showing just how difficult the current challenges facing the UK economy are for economic policymakers.

Speaking before announcing the budget plan, Hunt said he did not want to aggravate an expected recession. Yet, it remains to be seen whether his tax hike plan can help the UK economy buck the downturn trend in face of multiple challenges including surging inflation and energy crisis.

The UK economy shrank in the third quarter, signaling a dip into recession. UK GDP fell 0.2 percent between July and September and is now 0.4 percent smaller than it was at the end of 2019, before the coronavirus pandemic began, according to data from the Office for National Statistics released on last Friday, making it the only G7 economy to have contracted in the third quarter.

In fact, two months ago, the world economic community had predicted that the British economy would enter a technical recession. At a time when UK is sliding into a recession and public discontent in the country is intensifying amid the energy crisis and high inflation, it is time for UK economic policymakers to confront the real problems that are causing the UK's economic woes.

Although some analysts have pointed out that the current economic crisis in the UK is directly triggered by the latest large-scale tax reduction policy, the UK's economic woes are also a result of the contradictory economic policies. In order to bring the British economy out of its current difficulties as soon as possible, British policy makers should consider how to restore its business reputation and economic policy consistency.

More importantly, the foundation of the British economy is market rules and free trade. In order to tackle the current challenges, the British economy must focus on revitalizing its financial and trade advantages. At the same time, it should expand opening up and promote free trade to offset the impacts from Brexit, COVID-19 and an ongoing energy crisis.

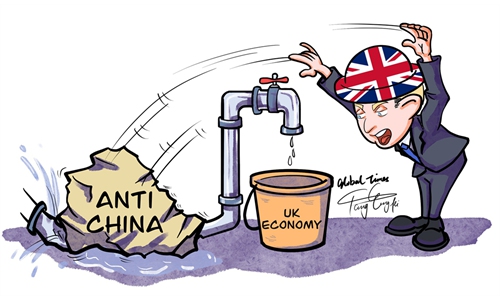

The UK's economic model dominated by the free market has its own laws of development that should not be affected by political interference. Politicizing economic and trade issues can only lead to consequences that are harmful to both others and itself. However, the UK has repeatedly used the guise of "national security" to create artificial barriers in the fields of 5G development, business investment, and scientific and technological cooperation.

China is an important trading partner of the UK. Promoting trade with China and attracting Chinese investment will help the UK economy get out of the predicament. After the Brexit and since the pandemic, China has surpassed Germany becoming UK's largest source of imports. Trade with China has become an important support for the UK's economic growth.

Despite global economic gloom, the stock of two-way direct investment between China and the UK reached $47.8 billion in 2021, an increase of nearly $5 billion from before the COVID-19. The economic structures of China and the UK are complementary and the potential for economic and trade cooperation is huge.

The tax rise plan may indeed help the British economy to solve its immediate problems, but the improvement of the business climate will undoubtedly attract more funds for the further recovery of the British economy. It is hoped that the UK will reconsider the Huawei ban and other restrictive measures imposed on Chinese companies to prevent further damages.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn