Chinese NEV-makers spearhead into SEA with affordable models, aiming to unseat dominant Japanese players

Vehicles woo local consumers, set to unseat dominant Japanese players

NEVs ready for export in Shanghai Photo: VCG

Chinese new-energy vehicles (NEV) companies have been spearheading into Southeast Asia (SEA) at an unprecedented speed since the beginning of the year, from exporting NEVs, setting up assembling factories to providing localized services. In a vehicle market historically dominated by Japanese automakers, things could be quite different now, as Chinese entrants are reshaping the competitive landscape with a variety of affordable, high-tech EV models."Without any doubt, SEA has become one of our company's most strategically important overseas markets this year. Our company is gearing up investment and marketing, as are many Chinese NEV makers," an industry insider from a large Chinese NEV company told the Global Times on the condition of anonymity over the weekend.

According to the insider, most NEVs that Chinese enterprises sold in Southeast Asia are small-sized EV models, priced at around $20,000 to make them appealing to mass markets, a marketing strategy that has proven to be a huge success.

"The popularity of our models in some SEA countries, such as in Thailand and Indonesia, have been way beyond our expectations. Many local consumers had to wait for several months for delivery, and the long waiting time also has led to an increase in scalping," the insider explained.

In September, China's largest NEV maker BYD announced it would set up a NEV factory in an industrial park run by local giant WHA Group in Thailand, according to a statement the company sent to the Global Times. The new factory, BYD's first wholly-owned passenger car factory outside China, is expected to begin operation in 2024, with a designed annual capacity of 150,000 units.

In addition to BYD, Shanghai-based upstart Hozon New Energy Automobile Co. opened its first Thai showroom in the capital's glittering Central Rama 2 mall in September, Bloomberg reported. Chinese automaker Great Wall Motor also committed in November to double its investment in Thailand, after entering the Thai market two years ago, news portal Nikkei Asia reported.

In line with this trend, foreign direct investment from China to Thailand has almost doubled in the first nine months of 2022, compared with last year. And much has diverted to the local EV sector, another Bloomberg report said.

Betting big

Compared with other markets, the SEA markets remain relatively stable, both from a geopolitical dimension and a supply chain perspective, industry observers stressed, underscoring stability as one of the key reasons bolstering Chinese NEV-makers' local presence.

"There is a strategic window of opportunity in Europe this year, as demands for China-made NEVs experience explosive growth due to the lack of auto parts and chips in the continent that are critical to NEV manufacturing. But this opportunity won't last long, and political risks are spiraling upwarding, which are working to reduce Chinese companies' incentives for long-term investment," the insider said.

Meanwhile, the EV market in SEA is still not large, which means the room for future expansion is very promising and could translate into a range of opportunities for Chinese automakers.

According to data from the ASEAN Automotive Federation, auto sales in SEA stood at 2.79 million units in 2021, up 14 percent year-on-year, and the growth was led by the NEV market. Another report issued by research firm Research and Markets predicted that by 2027, the NEV market could hit a volume of $2.67 billion, up from a market valuation of $500 million last year, expanding at 32.73 percent annually.

Amid a global carbon neutrality push, SEA countries also have rolled out a series of policies to boost the development of the NEV sector and associated infrastructure, building a solid foundation for the development of the local market.

According to a roadmap announced by Thai government, EV production is set to account for at least 50 percent of its total vehicle output by 2030, up from a previous target of 30 percent.

"Thailand has an edge in developing NEV business. It is the largest auto market in ASEAN and the center of auto manufacturing in SEA. The government also unveiled a number of policies linked to building charging facilities and tax reduction for NEVs, making the industry embark on a fast track of development," a spokesperson from BYD told the Global Times.

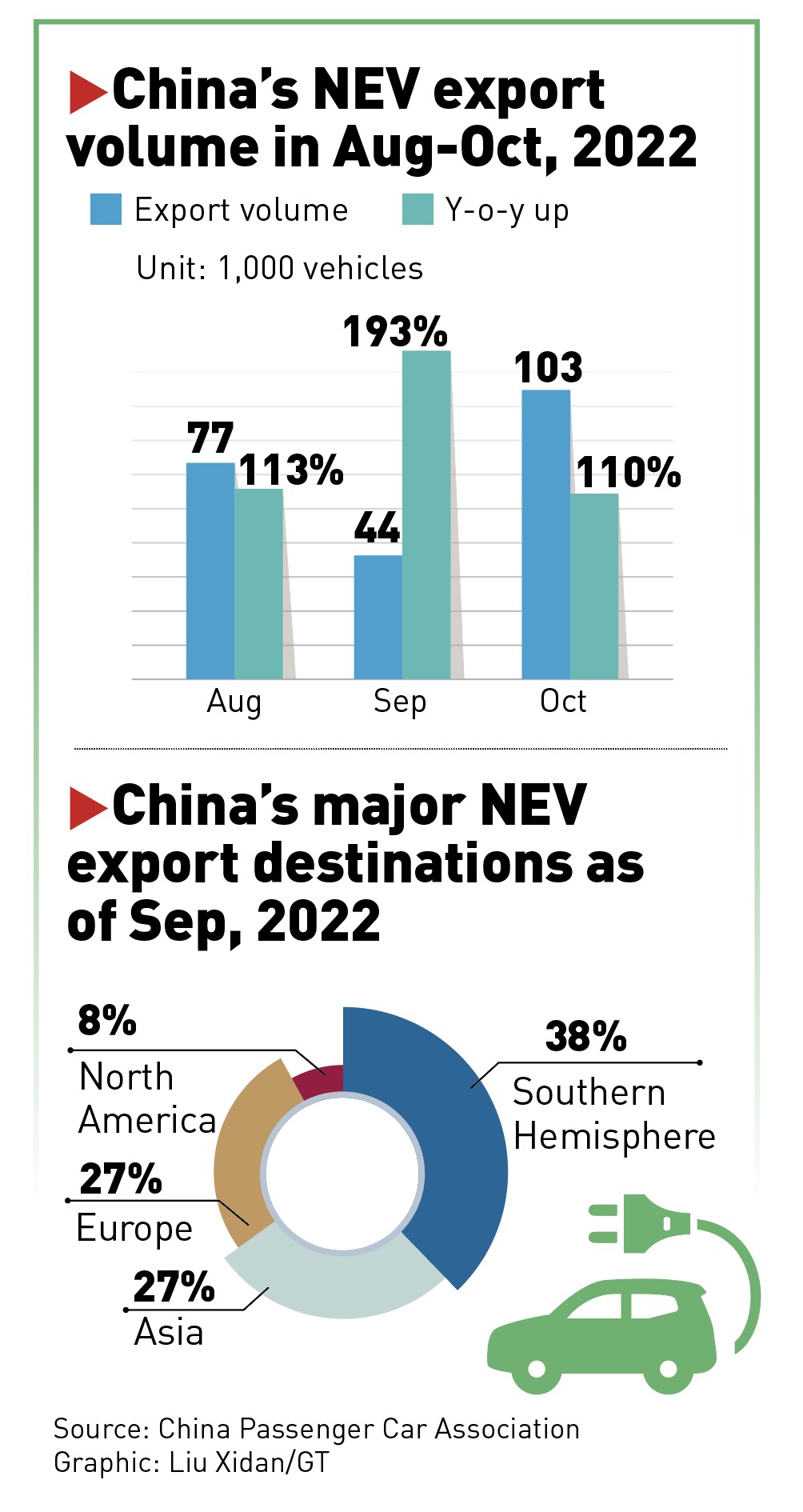

Graphic: Liu Xidan/GT

A new raceThe entrance of new Chinese players in the SEA market is also projected to unseat a number of dominant players like Toyota and Honda, whose market share in the petrol vehicle market has hit 80 percent in some SEA countries.

"Compared with Chinese NEV-makers which have gained a global leading position thanks to whole-supply-chain building capacity and competitive cost of production - as a result of economies of scale - the adaption of Japanese brands seems quite slow," the insider noted. But nevertheless, he pointed out that SEA's long-term preference with Japanese models also means that Chinese NEV-makers need to spend more on raising brand awareness.

Last week, BYD announced it has produced and delivered 3 million NEVs, making it one of the first automakers in the world to hit this sales milestone, which speaks volumes for China's auto manufacturing prowess.

According to a statement the company sent to the Global Times, sales figures are one of the best items of evidence underscoring China's transformation from a "big auto nation" to a "strong auto nation."

In January 1, 2022, the mega free trade deal, the Regional Comprehensive Economic Partnership, took effect, which is also conducive to further promoting the integration of the NEV industrial chains across the Asia Pacific, and leveraging the comparative advantage of both China and ASEAN to its full extent, observers noted.