Beijing to strengthen role as national financial management center; BSE’s capacity to be further expanded

Capital to integrate sci-tech innovation linked to the real economy as central hub

A golden ox statue at Beijing's Financial Street Photo: VCG

With this year marking the 30th anniversary of the construction and development of Beijing's Financial Street, officials at this year's Financial Street Forum charted a course for the capital's future position as national financial management center in the new era, prioritizing the establishment of a multi-tiered capital market and developing a modern financial industry."We will ramp up efforts to strengthen the function of the national financial management center, guarantee the implementation of key national financial strategies and policies, boost the layout of national financial infrastructures in Beijing and support financial institutions to improve the function of their headquarters," Beijing's Party chief Yin Li said at the forum on Monday.

Yi Huiman, head of the China Securities Regulatory Commission (CSRC), said at the forum that authorities will further strengthen the function and market vitality of the Beijing Stock Exchange (BSE) so as to better serve small and medium-sized sci-tech innovators. He emphasized the need for continuous capacity expansion of the exchange as well as institutional reform with a view to attracting more investors.

An East China's Shandong-based petroleum equipment manufacturer that aims to list on the BSE told the Global Times on Tuesday that the lower threshold of the BSE and its increased share liquidity thanks to the mechanism of transferred listing to Shanghai's STAR board and the tech-heavy ChiNext market on the Shenzhen Stock Exchange greatly increased the BSE's attractiveness for smaller science and technology companies.

"We are approaching securities firms now so as to get listed as early as possible to raise funds for further research and development," the company said.

"The bourse has rolled out a raft of policies creating a sound environment in favor of companies' capital operations. It has also given the capital markets more options," Xiang Youliang, chairman of Honsun (Nantong) Co, a BSE-traded healthcare equipment maker, told the Global Times on Tuesday. Businesses should effectively take advantage of the favorable policies so as to inject new vitality into their development, Xiang said.

Rapid rise

Since its official launch in 1993, Beijing's Financial Street - where major banking, insurance, securities and currency services institutions are located - has attained noteworthy outcomes in contributing to the city's role as a national financial management center.

A variety of China-led investment funds such as the Silk Road Fund and China-Latin American Production Capacity Cooperation Investment Fund have been located on Beijing Financial Street since the 18th National Congress of the Communist Party of China, facilitating cooperation in finance and infrastructure between China and trading partners across the globe. In March 2021, the Beijing Financial Court was formally set up, ensuring the implementation of the country's financial strategies.

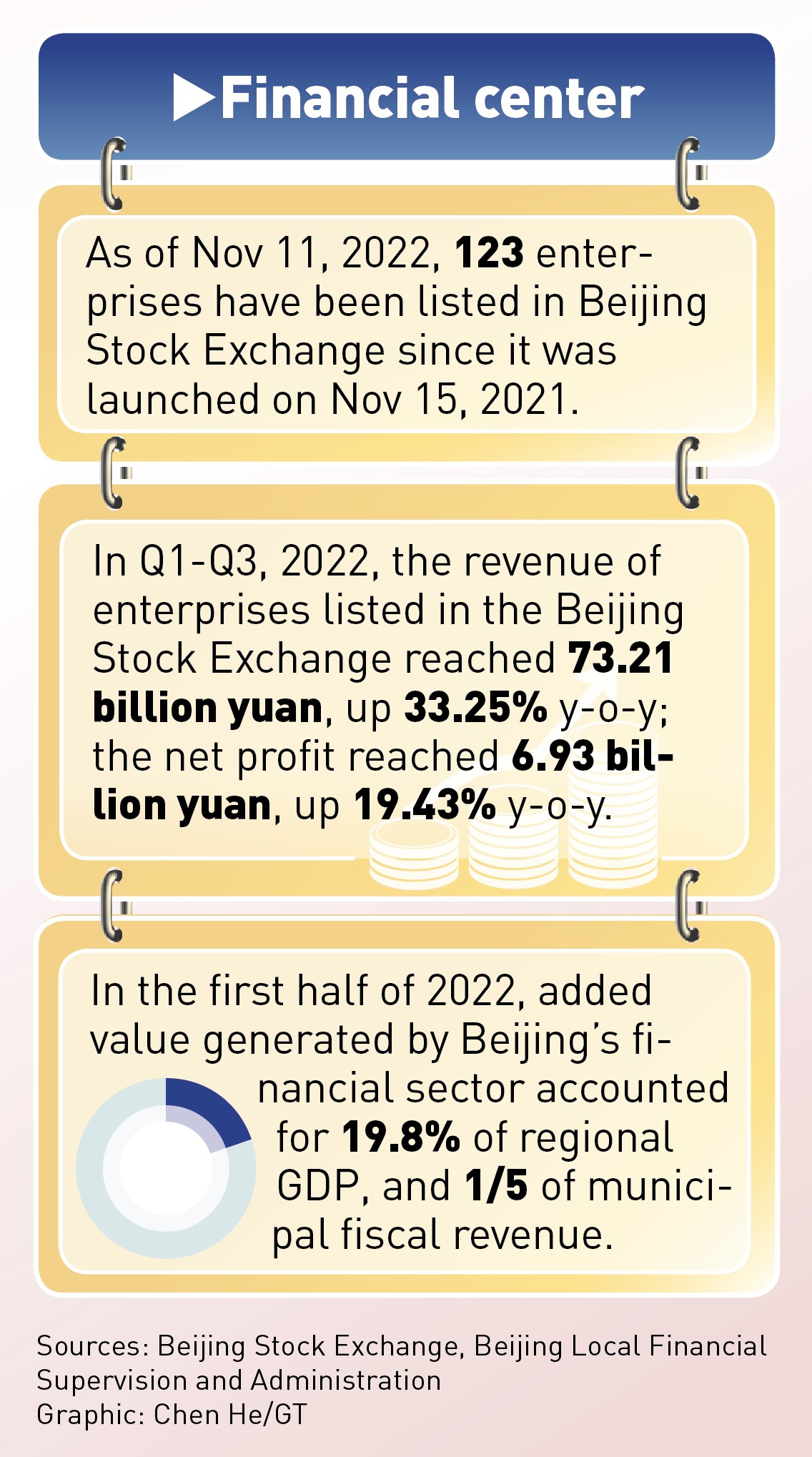

The establishment of the BSE in September 2021 further refined the capital market ecosystem of Beijing, and improved its capacity to better serve the building of an international center for sci-tech innovation. By November 11, a total of 123 companies had listed on the exchange, with those from strategic emerging industries and advanced manufacturing sectors accounting for over 80 percent.

Along with the continuous opening-up of the country's financial sector, the internationalization of Beijing's local capital market has been significantly improved.

Goldman Sachs, UBS, Credit Suisse, Morgan Stanley and other international investment banks have increased their investment and business layout in Beijing by adding their stakes in local joint ventures, and foreign institutions including Daiwa Securities Group and Oaktree Capital Management set up new businesses in the city. Meanwhile, Beijing has launched the pilot program of Qualified Domestic Limited Partner (QDLP) and Qualified Foreign Limited Partner system (QFLP), attracting the participation of international institutions.

Graphic: Chen He/GT

A holistic blueprint

As China has embarked on a new journey toward building the country into a modern socialist country in all respects and advanced toward the second centenary goal, the 20th National Congress of the Communist Party of China stresses promoting high-quality development and continuing to focus on the real economy. This provides new opportunities for the development of China's financial sector.

In August, the Beijing municipal government released a blueprint for the development of the sector during the 14th Five-Year Plan period (2021-25), aiming to continuously cement the strategic supportive role of the finance industry in the capital city's economic and social development, improve the city's financial system and market structure and build market-oriented international business environment that is governed by sound legal framework so as to comprehensively support technological innovation, rural revitalization, common prosperity and other key strategies.

As a national financial management center, the capital city's financial development will focus more on policy guidance and research, complementing the role of Shanghai and the Hong Kong Special Administrative Region, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times.

With the most high-tech companies from around the country, Beijing should take advantage in combining technological innovation and the digital economy with the financial sector supporting sustainable development, he said.