Beijing to boost role as national financial management center, as its vast potential highlighted at key forum

Forum highlights Chinese capital’s advantages, vast potential

Beijing Stock Exchange Photo:Chi Jingyi/GT

Beijing is eyeing a larger role as the country's financial management center, as the Chinese capital, which hosts its own stock exchange and financial court, seeks to expand its functionality beyond being the national political center, regulatory authorities and financial industry insiders said on Wednesday at the conclusion of a keenly watched financial forum.

In a speech to the Financial Street Forum 2022, an eponymous gathering of the Beijing Financial Street, Li Wenhong, director of the Beijing Local Financial Supervision and Administration, revealed plans to enhance the capital's role as the national financial management center.

That suggests Beijing will ramp up its services to support the implementation of major financial strategies and policies, and play a better part in financial decision-making, standard setting, financial legislation, payments and settlements, statistical publications, and international cooperation and financial security, among its other functionalities, Li said.

In addition, the capital envisions heavier clout as a financial market, she continued, citing the one-year-old Beijing Stock Exchange (BSE), which has become an important part of efforts to establish Beijing as the national financial management center.

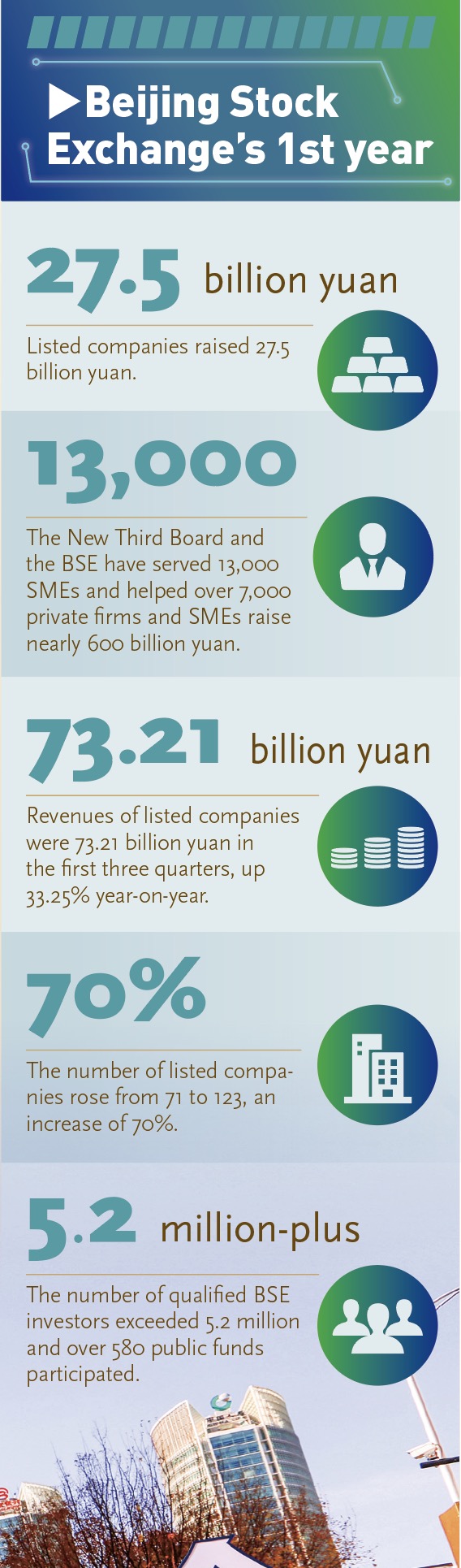

Companies listed on BSE raised 27.5 billion yuan ($3.84 billion) in total since the bourse started trading in November 2021, or 210 million yuan each, effectively meeting the capital needs of small and medium-sized businesses, Shang Qingjun, an official of the China Securities Regulatory Commission, disclosed at the forum on Wednesday.

"We'll support the BSE in expanding its transaction scale, enriching trading portfolios, and improving market liquidity and vitality," Li said.

Graphic: GT

On top of that, the capital will continue to facilitate financial opening-up, for there to be a fair, open, transparent, stable and predictable business environment for both domestic and foreign financial institutions.

Qian Yujun, president of UBS China and chairman of UBS Securities, said Wednesday at the forum that as a large number of overseas and domestic financial institutions are located in Beijing, it has long become China's national financial management center, undertaking multiple missions including asset management, market activities, capital, payments and settlements, and so forth.

The three-day forum, which ended on Wednesday, was also in celebration of the 30th anniversary of the Beijing Financial Street.

"The 30 years of Beijing Financial Street's development has been a process of embracing opening-up and innovation continuously," Qian told the forum, adding that it's also important for China to nurture the rules and concepts of a mature market, push positive competition, and use opening-up policies to promote reforms. "We are fully confident of the Chinese market's development," he said.

Since its establishment in 1992, the Beijing Financial Street has gradually embraced financial management departments under the State Council, large financial institutions, major financial infrastructure facilities and industry associations.

The street, covering an area of merely 2.69 square kilometers, is the key to accommodating the national financial management center, according to Li.

Beijing's total financial assets have soared to 190 trillion yuan from 85 trillion yuan over the past decade, and the financial industry has become the top pillar sector of the capital's economy, official data showed.

"Establishing a national financial management center is a crucial method raised in China, combining advanced international experience and China's own situation. It is of great significance to enhancing China's financial management capabilities, improving its financial governance system as well as coordinating development and safety," Zhang Weiwu, deputy head of the Industrial and Commercial Bank of China (ICBC), said at the closing ceremony of the Beijing forum on Wednesday.

According to Zhang, on the one hand, the national financial management center is an extension of Beijing as China's political center, which played a crucial role in enhancing China's core competence and stabilizing security. On the other hand, the center also undertook an important mission in building a modernized financial system and implementing China's mission of financial opening-up, Zhang noted.

A report on the development of the Beijing Financial Street, which was released during the forum, raised seven suggestions for better constructing the Beijing Financial Street as China's national financial management center.

The suggestions include perfecting financial infrastructural construction, directing finance to serve the real economy and improving the business environment.

Zhang also said that the ICBC would support the construction of the national financial management center from several perspectives, such as leading the digital upgrade of financial products and services, as well as strengthening normalized inter-banking cooperative mechanisms along the Belt and Road Initiative routes.

Beijing has the potential to develop into another world financial hub in China, though it should have a different point of focus than Shanghai, remarked Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China.

"Beijing is like China's financial brain with the cluster of regulatory departments, R&D centers and think tanks, while Shanghai is characterized by frontier financial market activities," Dong told the Global Times on Wednesday, adding that Beijing has advantages in policy sensitivity and strategic responsiveness.