Retail industry eyes vast market in China's counties amid growing consumption power

Growing consumption power to further boost sector development

Tourists splash in the water in Bailongqiao township in Jinhua, East China's Zhejiang Province. The township has taken the lead in developing night economy to attract more tourists and stimulate local consumption. Photo: VCG

"Grab a coffee" now seems to become an omnipotent invitation among Chinese consumers, from meeting the social demand for basically all scenarios to refreshing the mind for hard workers all at a sip.Large cities such as Shanghai along with major first- and second-tier cities have always been popular options for brands to invest and expand due to their huge consumption power and market potential in comparison with small cities and towns.

While competition remains fierce among the top locations, more and more businesses have already deployed their strategic expansion targeting markets in third- and fourth-tier cities and counties for their foreseen potential.

For instance, US coffee giant Starbucks opened 229 new stores in China in the last 90 days, with the new ones settled in places that people may be less familiar with, such as Qingyuan in South China's Guangdong Province, Xinyu in East China's Jiangxi Province and other places, news portal jiemian.com reported on Monday.

The coffee industry is a representation of many sectors such as new-energy vehicles (NEVs) and home appliances that have been eyeing the indispensable potential from county-level market and third- and fourth-tier cities.

Uplifting market potential

When it comes to market expansion, Starbucks prioritizes China's nearly 3,000 or so county-level markets as equal as more than 300 prefecture-level markets, aiming to enter 70 new cities in China in 2025, Liu Wenjuan, chief operating officer of Starbucks China told jiemian.com.

Industry insiders said that more potential for county-level markets or markets in third- and fourth-tier cities will be unleashed.

The domestic coffee consumption can't solely rely on first- and second-tier cities, which have less than 300 million people, Zhang Yi, CEO of iiMedia Research Institute, told the Global Times on Monday.

Official data showed that as of the end of 2021, China has a total of 1,866 counties and county-level cities, with a total population of around 250 million.

Zhang noted that the consumer power of these markets can't be neglected, while the old-dated myth that consumers from smaller cities or townships can't afford products from brands like Starbucks has changed, as businesses have sensed the major purchasing strength and advantage from them as consumers may be more willing to spend money than those in first-tier cities due to a relatively lower living cost and smaller pressure for work.

Meanwhile, sales of NEVs in third- and fourth-tier cities along with rural areas have been booming from the first half of the year. Retailers such as BYD have been increasing their sales network construction, which currently laid 830 outlets in third-tier and smaller cities, accounting for 50 percent of its entire number of outlets, chinatimes.net.cn reported in November.

Home appliances from big ticket items to small gadgets like cell phones have also enjoyed a strengthening consumer market since the start of this year.

For instance, during the just passed annual double 11 shopping festival, the orders for cell phones from third- and fourth-tier cities increased significantly on e-commerce platform Pinduoudo, per another report from chinatimes.net.cn.

Meanwhile, yicai.com reported in October that major home appliance sellers ramped up promotion with improved logistics and after-sale services, aiming to further boost the consumption in third- and fourth-tier cities.

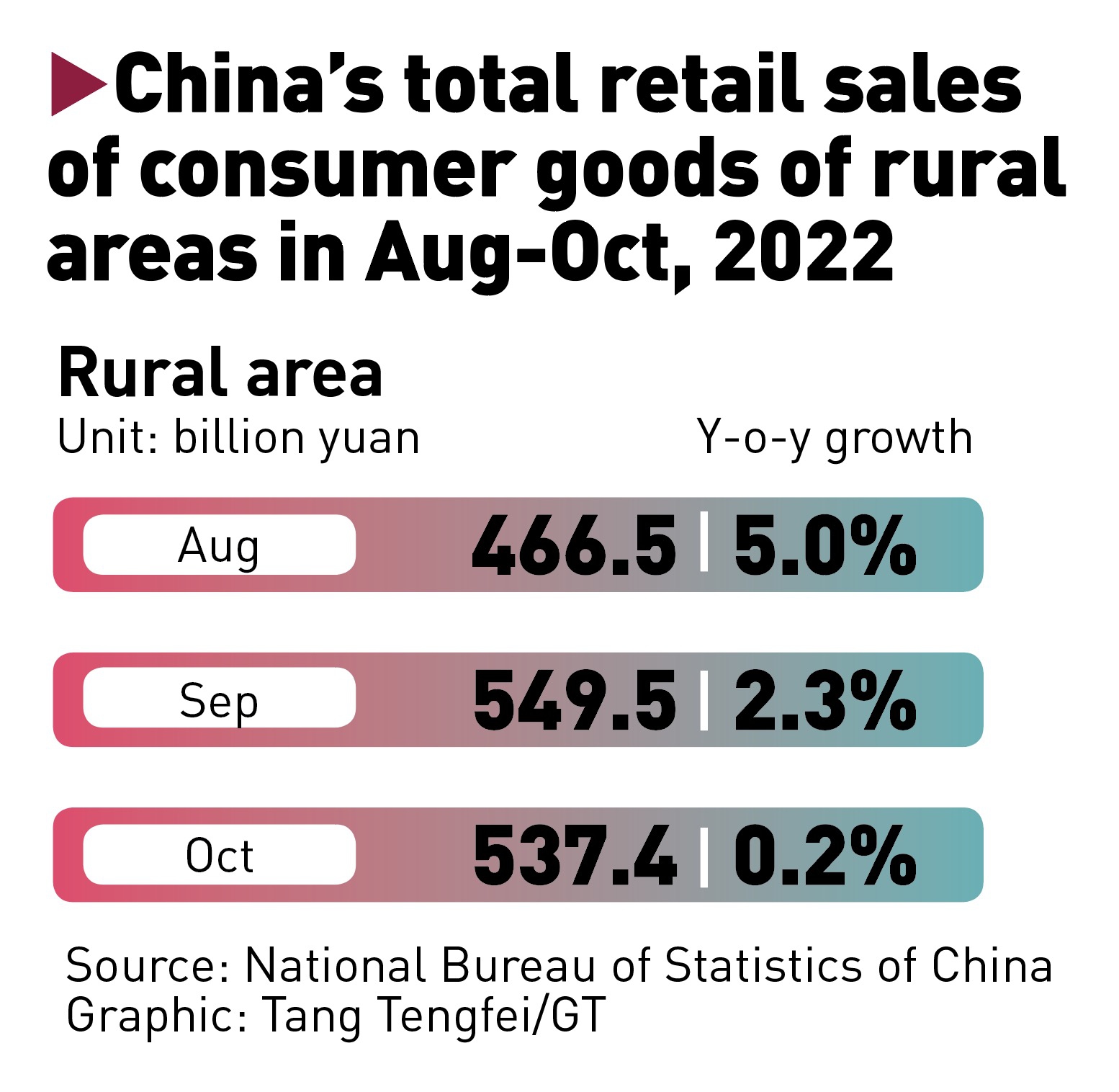

In 2021, China's retail sales of consumer goods in urban areas reached 38.16 trillion yuan, a year-on-year increase of 12.5 percent, while the retail sales of consumer goods in rural areas accumulated 5.93 trillion yuan, a growth of 12.1 percent compared with the previous year, data from the General Administration of Customs showed.

Graphic: Tang Tengfei/GT

Appealing expansion option

Third- and fourth-tier cities have been showcasing their purchasing power and capacity, and have become a major destination for businesses ranging from daily necessities, luxury items to international hotels.

According to a report published by PWC, China's double-circulation strategy plays as an indispensable role for boosting domestic consumption especially for consumption in third- and fourth-tier cities.

Analysts noted that China's double-circulation strategy along with the bundle of various policies targeting to promote domestic consumption by the State Council, the nation's cabinet, and local governments have strengthened the consumption power in third- and fourth-tier cities.

China has been working on balancing out the regional development, which is a major focus of the double-circulation strategy, leading more resources and factors of production being distributed in third- and fourth-tier cities and boosted local consumption, while encouraged enterprises to develop in the regions, Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Tuesday.

Dong added the double-circulation strategy and targeted measures to stabilize the economy have also helped boost consumer confidence especially during the COVID-19 epidemic.

Luxury brands such as Coach said earlier in October that it will open around 30 new stores with a penetration goal set to reach more third- and fourth-tier cities, China Business Herald reported, citing Yann Bozec, the CEO of Coach China. Bozec noted the strong market potential for consumers in third- and fourth-tier cities, adding that reaching into that market can help the brand further expand.