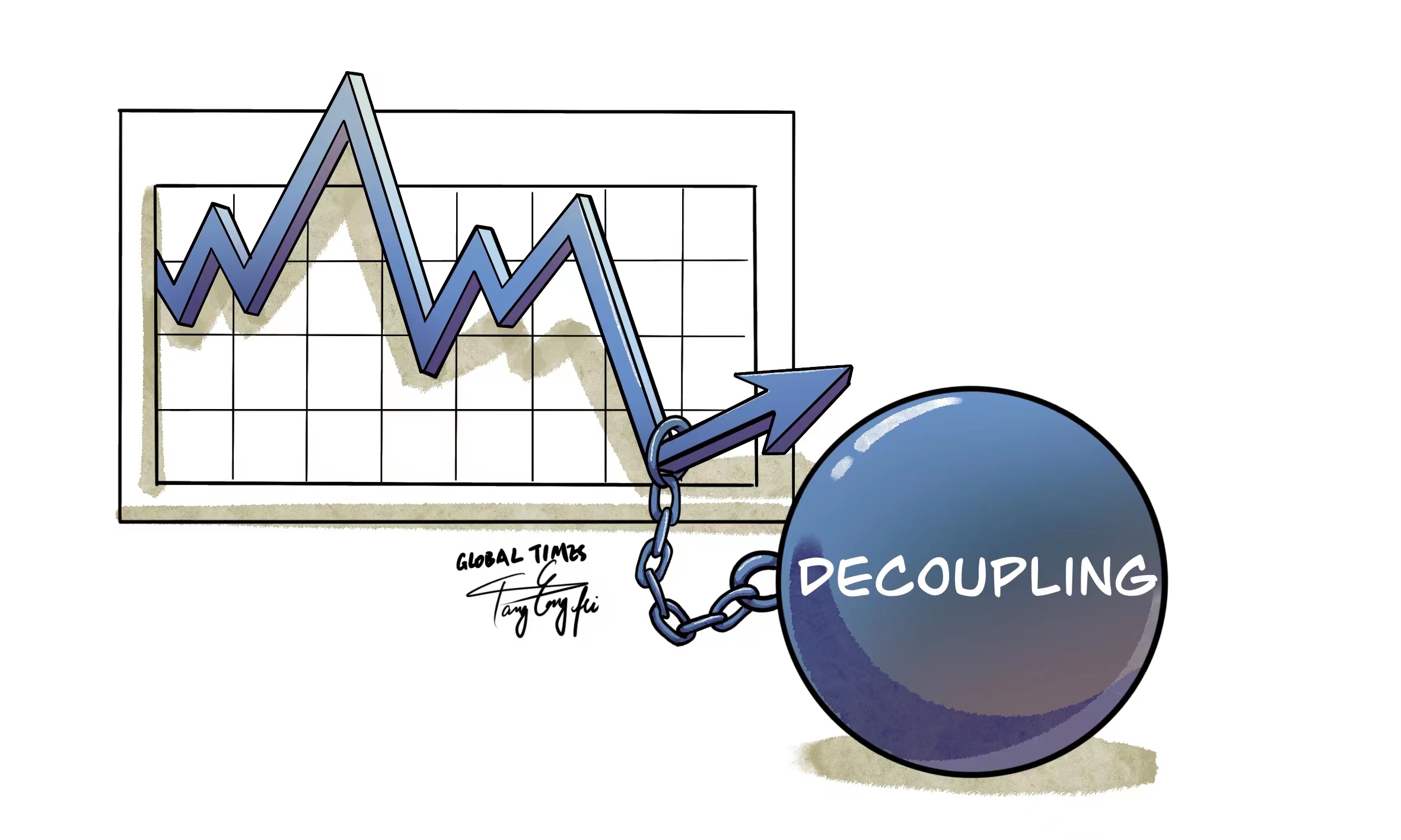

Illustration: Tang Tengfei/Global Times

Washington has sent a confusing stream of mixed messages over the last few weeks in response to growing market concerns over a US "decoupling" from the Chinese economy. Such mixed messages deserve attention, especially at time when the US is facing serious economic headwinds.US Commerce Secretary Gina Raimondo said the US isn't seeking to sever economic ties with China, although are taking steps to protect US' technological and military prowess, according to the Associated Press. Meanwhile, US Treasury Secretary Janet Yellen said on Wednesday that businesses reviewing their supply chains should be mindful of the geopolitical risks surrounding Chinese practices that "have raised US national security concerns." Yellen's remarks added to market concerns about rising US protectionism and "decoupling" from the Chinese economy.

As US partisanship becomes increasingly fierce, ideological divisions are magnified, analysts share a common view that confronting China has become one of the few remaining consensus points among different political interest groups in the US, and whichever of them dominates the nation's mainstream politics, their tough policy tone will resonate in economic relations with China. However, we have observed that even in terms of "being tough on China," there are still differences in the attitudes of various parts within US political ecology. What's more, the difference has been magnified as the US economy teeters on brink of recession, which also put pressure on US policymakers.

While some in Washington may still think "decoupling from China" rhetoric sells well in the political circle, inserting such a zero-sum mentality in its foreign policy would only underscore the uncertainties and the lack of resolve in revitalizing US manufacturing exports. Despite the US rhetoric of "decoupling" from China, more American entrepreneurs have realized the importance of the Chinese economy in the global industrial and supply chains. Against this backdrop, some US politicians make some perfunctory remarks about "not seeking decoupling from China" to appease the market and accumulate political capital for their future career.

Although the US economy reported 2.9 percent growth from July through September, after a two-consecutive-quarter contraction, the US Federal Reserve is still warning about greater economic uncertainty amid inflation and higher interest rates. As of the end of November, the US economic activity was "about flat or up slightly," and businesses express greater uncertainty and increased pessimism for the US economy, according to the Fed's Beige Book released on Wednesday.

Against the backdrop of the US' economic gloom, the debate of whether the US ought to "decouple" from China has become increasingly heated among US policymakers and pundits. At present, the US government continues to take a tough stance on the issue of "decoupling," which is opposed by more and more people in the US business community.

It comes as no surprise that some US politicians try to appease the market by saying the US isn't seeking to sever economic ties with China. These contradictions between their political rhetoric and practice suggested that some in Washington feel unconfident in the front of US business community's demand to cooperate, not "decouple" from China.

Despite the US trade war and technological suppression, China has been committed promoting its own industrial development and independent technological innovation. For core technology fields related to national economic security, such as semiconductors, China has made progress in spite of reckless suppression from the US.

For instance, shortly after the US announced chip export restrictions in October, China's largest chipmaker Semiconductor Manufacturing International Corporation (SMIC) saw revenue of $1.907 billion in Q3, an increase of 0.2 percent from Q2 and up 34.7 percent year-on-year. The Chinese semiconductor giant expressed its confidence in the company's medium-to long-term development against the US crackdown on China's chip sector and amid weak demand in the consumer market.

It is understandable that some US politicians may soften their tone to appease the market at time when the US is facing serious economic headwinds, but China will follow its own speed and rhythm in economic development and modernizing the nation's strategic industries. The "decoupling from China" rhetoric will ultimately hurt long-term US industry leadership.

The author is a reporter with the Global Times. bizopinino@globaltimes.com.cn