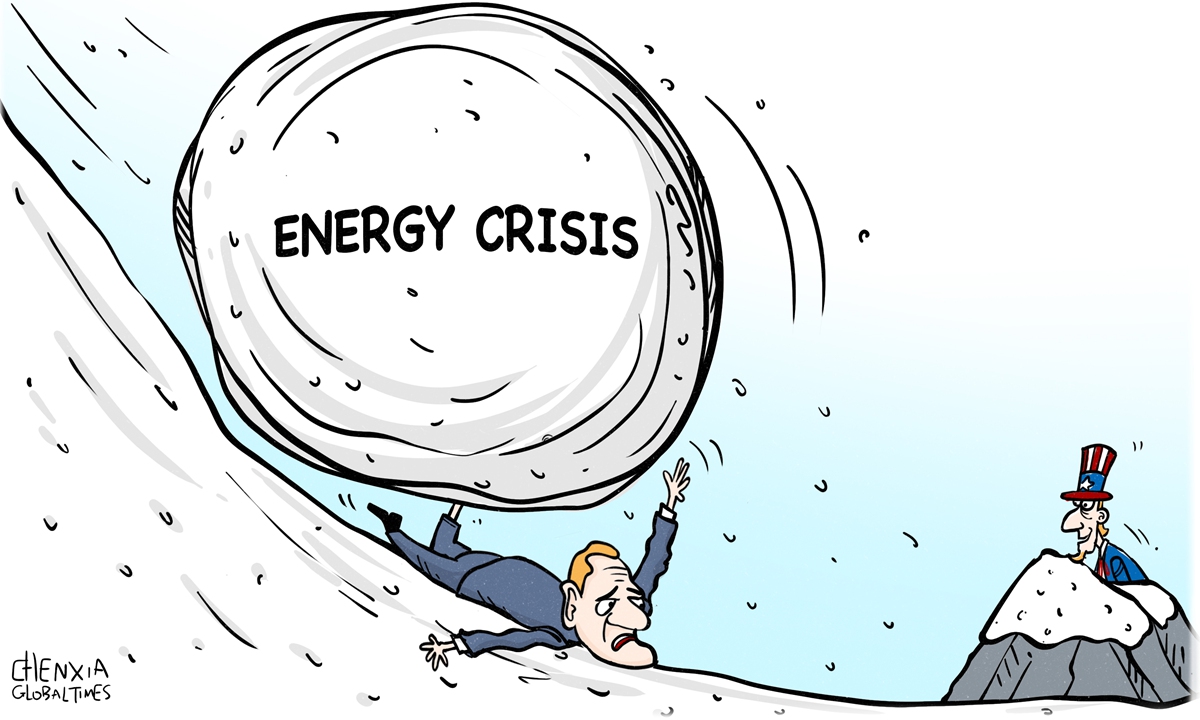

Illustration: Chen Xia/GT

Moscow has voiced opposition against a price cap on Russian oil and said European countries championing the price cap could face a suspension of oil supplies, local media reported over the weekend.

The Kremlin's uncompromising stance came on the heels of a Friday announcement by the Group of Seven (G7) nations and Australia to join the EU in setting a $60 a barrel cap on Russian seaborne crude oil.

The price ceiling is indicative of Europe's plans to maneuver the non-market practice into propaganda to show its political correctness, experts said, arguing against the West's hype around the cap supposedly serving as a stabilizer to global energy supplies with discounted Russian oil.

A bruising scenario in the wake of the price cap could be a possible hike in oil prices that eventually boomerangs on the EU and adds to the bloc's economic sufferings, they noted.

Oil wrestling

Russia has barely given any ground on the price gap, although the orchestrated move is blatantly targeting Russia's finances.

On Friday, the G7 and Australia as current members of the Price Cap Coalition agreed on the price limit in line with a unanimous decision by EU member states, according to the announcement. The price cap is scheduled to enter into force on Monday or very soon thereafter.

Russia will definitely give resolute countermeasures at the diplomatic level as Russia does not want to lose the pricing power of energy exports, and pricing power is one of the core contents of economic sovereignty, Zhang Hong, an associate research fellow at the Institute of Russian, Eastern European & Central Asian Studies of the Chinese Academy of Social Sciences (CASS), told the Global Times on Sunday.

"We are assessing the situation. Certain preparations for such a cap were made. We won't accept the price cap and we will inform you how the work will be organized once the assessment is over," Russia news agency TASS reported on Saturday, citing Kremlin Spokesman Dmitry Peskov.

Also on Saturday, Russian Permanent Representative to International Organizations in Vienna Mikhail Ulyanov wrote on Telegram that "Moscow has already made it clear that it will not supply oil to those countries who support an anti-market price cap."

"Starting from this year, Europe will live without Russian oil," he claimed, according to TASS.

Interestingly, a photo reportedly published by Russian Security Council Deputy Chairman Dmitry Medvedev is circulating on social media on Telegram channels, sarcastically warning Europe of the price cap's chilly implications, media reports said.

The meme is taken from Stanley Kubrik's landmark horror movie The Shining features the frozen protagonist, and is accompanied by an ironic sentence that suggests the decision on the Russia oil price cap has finally been made.

Capping crude oil prices is part of the sanctions aimed at cutting Russia's energy revenues in order to make Russia's economy and its current military operations unsustainable, experts said.

The impact of the price limit on direct oil trade between Russia and the EU is almost negligible. This is because the direct trade between the two sides has almost been suspended, and the West mainly aimed at affecting Russia's oil exports and price negotiations with third parties, Zhang said.

Reckoning the move as an attempt to showcase the West's political correctness, the expert stressed that if the price further drops to the $30 previously requested by some countries in the region, then Russia may cut production, which will lead to a rise in global crude oil prices.

Bruising repercussions

Even under the current price limit, what the deal might ultimately end up is believed to be far from, if not entirely contrary to, its desired role as a stabilizer to global energy markets already feeling the pinch of sanctions on Russian oil, observers said.

"The price cap will encourage the flow of discounted Russian oil onto global markets and is designed to help protect consumers and businesses from global supply disruptions," US Treasury Secretary Janet Yellen said in a statement Friday released following the price cap announcement.

The fundamental purpose of the price cap is to limit Russia's ability to export oil and thus its access to energy export revenues. However, there is a premise that Russia can only rely on European energy markets, Cui Heng, an assistant research fellow from the Center for Russian Studies of East China Normal University, told the Global Times on Monday.

Europe is likely to suffer far more than Russia as the latter can search for alternative markets outside Europe, the expert noted, adding that this would add to Europe's already high inflation.

Europe is already divided over energy, and several countries have sought exemptions from bans on importing Russia's oil. All in all, the price cap is undoubtedly a lose-lose situation for both Russia and Europe, and the de-Europeanization of Russia's energy exports is also a certainty, Cui remarked.

Russia, albeit under pressure of the deal's fallout on its economy, is unlikely to give in to the mandate discounted price in the foreseeable future, Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Sunday.

Factoring into the lack of pipeline infrastructure to channel crude oil, Russia might find it difficult to identify purchasers out of the price limit's jurisdictions yet sufficiently accessible to Russian crude oil, Lin continued, noting that Europe is facing a similar dilemma.

Without readily available oil transportation conduits, the EU would be challenged to increase oil imports from the US and other sources, he added, estimating that the continent is almost destined to be crippled by a surge in oil prices in the short term.

The global oil price will likely top $100 amid the price limit, TASS reported in a separate report on Saturday, citing Kirill Melnikov, head of the Russian Energy Development Center.

"The cap level is irrelevant by itself, because Russian companies will not sell oil under it anyway. Accordingly, supplies of Russian oil via European shipping and insurance companies will be interrupted, which may reduce Russia's export by 1-1.5 million barrels per day in December and January. This will likely lead to a price hike above $100 per barrel," he said.

While an expected oil price hike would inevitably add to woes over a worsening inflation landscape across the globe, the EU that's being haunted by record price levels in decades will bear the most brunt, analysts said.

In the words of Lin, instead of envisioning a soothing impact on energy prices, the continent should ready itself for even costlier energy bills and consequently an unbearable drag on its economy amid US' continued cycle of rate hikes.

At the same time, experts also predicted another possibility: the OPEC+ alliance led by Saudi Arabia and Russia might reach a consensus on moderate production cuts to maintain the stability of international oil prices.

Such positivity will directly make the West's price limit agreement to not have the desired effect, it'll just be a diplomatic propaganda, Zhang at CASS remarked.