Strengthened China-Saudi ties raise prospects for use of yuan in oil settlement

China-Saudi move helps hedge against uncertainties, weakens US dollar hegemony

An oil drilling rig operates on an artificial causeway island at the Manifa offshore oilfield, operated by Saudi Aramco, in Manifa, Saudi Arabia File photo: VCG

A discussion of shift to use Chinese yuan in China-Saudi oil settlement is increasingly rising recently amid an ongoing visit of Chinese President Xi Jinping to the country - the trip marks epoch-making milestone in China-Arab relations and also raises hopes for more deepened energy ties for years to come.

The shift is deemed as necessary by observers from both countries in light of the "increasing weaponization of the dollar dominated financial system," they said, hoping the move to inject certainty to bilateral trade and dent the US dollar's hegemony of the global petroleum market.

More frequent use of each other's currency is also highlighted in the agenda of the Chinese government. In a report titled "China-Arab Cooperation in the New Era," which the Chinese Foreign Ministry released on December 3, China said it will strengthen monetary cooperation with central banks of Arab countries, and discuss expanding cross-border local currency settlement and swap arrangements.

The report also highlighted a "mutually beneficial and friendly long-term China-Arab strategic energy partnership," vowing to jointly build a China-Arab energy cooperation pattern featuring oil and gas, nuclear energy, as well as clean energy.

In the signed article published Thursday by President Xi on the Saudi newspaper Al Riyadh, he said that China will further synergize its Belt and Road Initiative and Saudi Arabia's Vision 2030, deepen and substantiate practical cooperation in all areas, and increase the convergence of interests and people-to-people connectivity between the two countries, according to the Xinhua News Agency.

Xi arrived in Saudi Arabia on Wednesday to attend the first China-Arab States Summit and the China-Gulf Cooperation Council Summit, and pay a state visit to the country at the invitation of King Salman bin Abdulaziz Al Saud of Saudi Arabia.

Saudi Arabia will remain a trusted and reliable energy partner for China, said Saudi Energy Minister Prince Abdulaziz bin Salman on Wednesday, according to the Saudi Press Agency (SPA).

He noted that cooperation between China, the world's biggest energy consumer, and Saudi Arabia, the world's top oil exporter, had helped maintain global oil market stability, SPA reported.

Experts have expected that Xi’s visit is likely to boost bilateral cooperation in energy apart from other areas.

A 'logical' shift

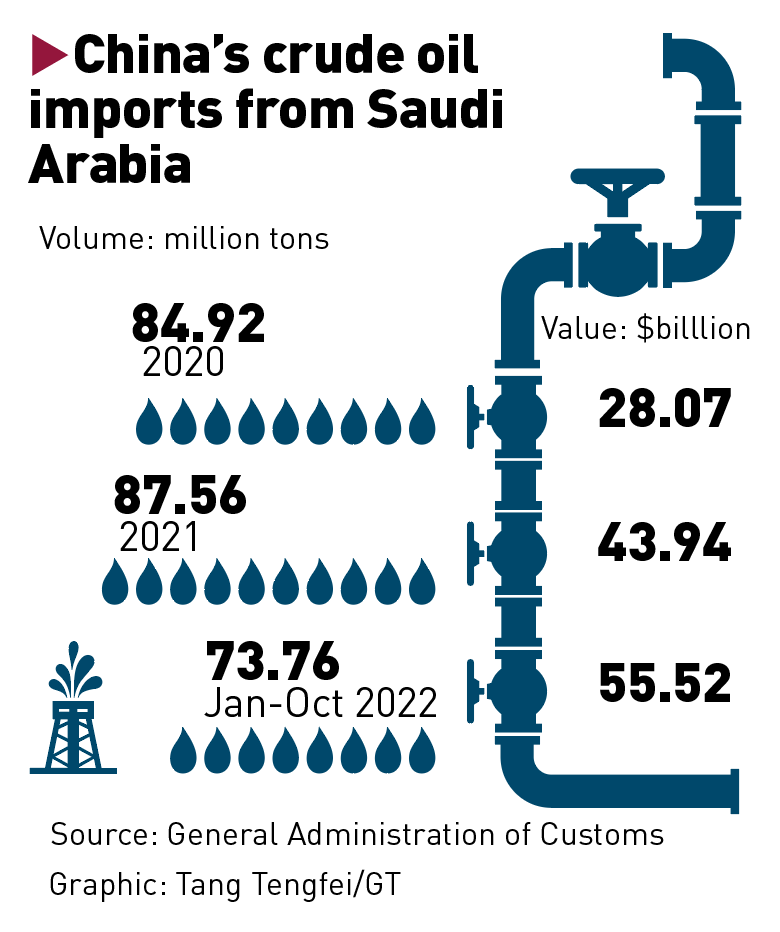

China is Saudi Arabia's largest trading partner, with bilateral trade worth $87.3 billion in 2021. Moreover, Saudi Arabia is China's top oil supplier, making up 18 percent of China's total crude oil purchases, with imports totaling 73.76 million tons in the first 10 months of 2022, worth $55.52 billion, according to data from Chinese customs.

China’s crude oil imports from Saudi Arabia Graphic: GT

"Therefore, using the Chinese yuan to settle a portion or all of their trade, whether it be oil-related or not, is only logical and normal, especially in light of the increasing weaponization of the dollar dominated financial system," Ebrahim Hashem, a United Arab Emirates strategist and former adviser to the chairman of the Abu Dhabi Executive Office, an authority responsible for Abu Dhabi's long-term strategies, told the Global Times on Thursday.

"Settling their trade in their local currencies, especially in the Chinese yuan, will further cushion their trade against possible politicization of the international financial system," Hashem said.

The talks over yuan-priced oil contracts have been going on for years, but this year witnessed signs of acceleration.

According to a report from Wall Street Journal in March, Saudi Arabia is "in active talks" with Beijing to price some of its oil sales to China in yuan, citing people familiar with the matter.

The Saudis are also considering including yuan-denominated futures contracts, known as the petroyuan, in the pricing model of Saudi Arabian Oil Co, known as Aramco, the report said.

"If those active talks between Riyadh and Beijing succeed in pricing some of Saudi Arabia's oil sales to China in yuan, then it is a step that would reduce the dominance of the dollar in the global oil market," Nadia Helmy, an expert in Chinese political affairs and professor of political science, Beni Suef University, Egypt, told the Global Times on Wednesday.

"I believe that allowing oil payments to be made in yuan may pave the way for the creation of a (parallel system for international payments) in which the Chinese yuan will have the same importance and strength as the US dollar," the expert said.

Making gradual progress

"But this is a long-term process and a major shift that cannot be achieved overnight, because oil has been denominated in dollars for so many years, and the hegemony of the dollar cannot be easily dented," a representative from a Chinese company in Saudi Arabia told the Global Times on Wednesday.

According to the Wall Street Journal report, the majority of global oil sales, roughly 80 percent are transacted in dollars, and the Saudis have traded oil exclusively in dollars since 1974, in a deal with the Nixon administration that included security guarantees for the country.

"Nevertheless, if it is not just about oil, there may be many other trades and cooperation between us and Saudi Arabia, we can gradually start with easy things, even small-scale cooperation, try to expand the use of yuan in bilateral settlement," the representative, who asked to remain anonymous, said.

One of the latest progresses has already been made in China's Yiwu, the hometown to small commodities in East China's Zhejiang Province. On Tuesday, a local company received cross-border payment in yuan from Saudi Arabian customers through "Yiwu Pay," marking a progress in the use of yuan in bilateral trade, according to a report from the Securities Times, a Chinese financial newspaper.

"One thing for sure is that we can see that the expansion in use of yuan in global trade is now becoming a trend, not only in Saudi Arabia, but also in neighboring countries and other parts of the world," the representative said.

The yuan now has gained a 2.13 percent of the market share in global payments by value as of October, behind the Japanese yen at 2.95 percent, the British pound at 7.85 percent, the euro at 34.43 percent and the US dollar at 42.05 percent, according to Swift.