Illustration: Chen Xia/Global Times

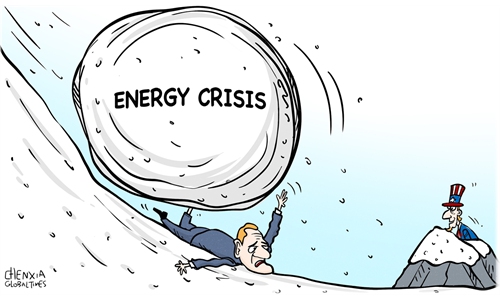

Global oil prices have started to slide, after plateauing for a couple of months following the outbreak of the Russia-Ukraine military conflict in February, and the prices have nearly halved now from their peak as this year rapidly draws to an end. International demand for fuel in 2023 is expected to be flat as the world economy reels from anemic growth and the irritating COVID-19 pandemic drags on into 2023.Total oil consumption may return to pre-pandemic levels in the second half of 2023, but uncertainty remains.

The US Federal Reserve's persistent push for lower inflation by aggressively heightening interest rates will curtail oil consumption too, as the stronger dollar puts additional downward pressure on oil, natural gas, iron ore and other commodities prices.

Also, the international community's intensifying efforts to combat climate change by controlling combustion-engine vehicles' carbon dioxide emissions mean more widespread electrification of road transportation, which will also restrict market demand for oil.

Oil prices are likely to remain at an average of $80-$100 per barrel next year, barring any abrupt geopolitical upheavals or inflammatory escalation of the Russia-Ukraine military conflict.

Stable oil prices are also conditional on the policy orientation of the world's major crude producers. It is hoped that OPEC+, which includes the 13-member Saudi Arabia-led Organization of the Petroleum Exporting Countries, and 11 other non-OPEC members including Russia, won't move to drastically reduce production. In October, OPEC+ announced a 2-million-barrels-per-day oil reduction that is to last through 2023 to prevent a slumping price from triggering a complete free-fall.

The global economy and oil markets are largely remaining in the doldrums caused by COVID-19. Many international organizations, including the World Bank and International Monetary Fund, have lowered their global economic growth forecast for 2023 to around 2.7 percent on account of the global central banks' monetary policy tightening measures. As a result, oil's pre-eminence as the premium land, air and marine transport fuel has declined. The unprecedented collapse in worldwide personnel mobility in the fallout of the pandemic has led to significantly slashed oil demand in the world.

Naturally, oil prices have declined by some 45 percent from March highs in the aftermath of the Ukraine crisis. Now many consumers wonder as to whether the crude oil prices have bottomed, and if not, how much lower the prices could go. There is one definite answer that OPEC+ will always move to support oil prices by cutting production whenever necessary, or the powerful oil producers' alliance could just choose to be vocally hawkish in talking about wanting higher prices.

To place more economic pressure on Moscow, the US-led Group of Seven, or G7, moved one week ago to impose the so-called $60-per-barrel "cap" on Russia crude export, which Kremlin spokesperson Dmitry Peskov has said Russia "will not accept" and is considering effective ways to respond.

The coercive price "cap" set by G7 governments has the purpose to limit Moscow's revenues from selling its huge oil deposit. Nevertheless, the reckless G7 move has the potential to disturb global oil market stability, if Moscow decides to upend and cut off all crude export to those countries. Earlier, Moscow has said it will not do business with any country that tries to apply the price "cap" on Russian crude.

Oil futures, including Brent and West Texas Intermediate (WTI), booked a significant loss of approximately nine percent last week, as fears of the global economic recession continue to be amplified by interest rate hikes by the European Central Bank, the US Federal Reserve, and other central banks.

As the world's largest oil importing country, China's ongoing efforts to significantly loosen domestic COVID restrictions, exemplified by the central government's 10 new anti-virus measures announced on Wednesday, will likely ramp up the country's prospective oil demand. During the past three years, strict anti-COVID controls on inter-provincial mobility have led to dwindling oil demand, which is also among the reasons for selling pressure on crude market in the world.

Some analysts predict that China, in the coming several months, may experience a demand decline of one million barrels of oil per day, before the dust settles and the anti-COVID situation stabilizes in the country. Once community-wide immunity is developed, and hospitalizations of seniors with conditions begin to trend down, China will greet a full-bloomed economic recovery, and its oil consumption will surge.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn