Biden’s bullish view of US economy “false”, laying bare its downward pressure: analysts

Elevated inflation, disrupted supply chains to impede growth: analysts

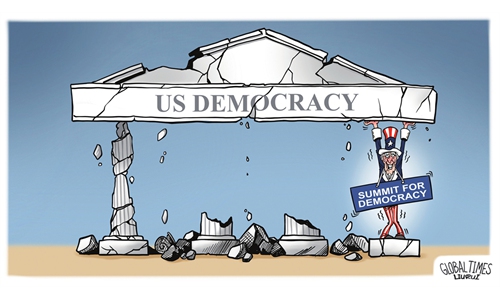

US economy Illustration: Chen Xia/Global Times

US President Joe Biden has been peddling bullish views of the US economy, which he claimed could grow “faster than the Chinese economy this year”, the first time since 1976. But some Chinese observers pointed out that his rhetoric is false, based on the manipulation of “nominal GDP”, which has been largely driven up by runaway US inflation.

A deeper examination of real US GDP growth shows that the gap between Chinese and US economic expansion will likely reach more than 1 percentage points this year, with the US facing multiple downward pressure including elevated prices, supply chain problems, widening income gaps and a looming recession.

Biden’s “fabrication”of US economic data also laid bare Washington’s lack of strategic confidence in its perceived competition with China, which – in contrast to the US’ lackluster economy – is on a firm recovery trajectory and is set to play an increasing role in the global economy, analysts said.

Biden said in a Twitter post on Monday that “independent experts have even projected that the US economy could grow faster than China’s economy this year. That hasn’t happened since 1976.”

Biden did not identify the source of the projection. It is not clear which rate of economic growth he referred to. The comment was also made at a time when a delegation of senior American officials on Asia-Pacific affairs was on a visit to China.

The number Biden cited is out of line with the broad estimates and is “groundless”, He Weiwen, an executive council member of the China Society for World Trade Organization Studies, told the Global Times on Monday.

Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, told the Global Times on Monday that the “economic growth” Biden talked about could be “nominal GDP growth” rather than “real GDP growth” – a widely used statistical indictor that mirrors the general health of an economy.

Analysts said nominal GDP does not reflect the factual status of the US economy, as it needs to be adjusted for inflation.

He said that US nominal GDP growth is sure to surpass that of China because of its high inflation. However, this is precisely the problem facing the US economy.

“So taking out the US’ elevated prices, it is evident that China’s real GDP growth would be significantly higher than that of the US this year,” Gao noted.

The conclusion also adds to a flurry of objective economic predictions by global financial institutions.According to an IMF report in October, the gap between economic growth in China and the US is likely to reach 1.6 percentage points in 2022, and the gap could widen to 3.4 percentage points next year. The estimates by other financial institutions such as the World Bank also point to a gap of more than 1 percentage points this year.

Biden’s bragging about the US economy also showed that the US is not confident in its competition with China, He said.

“Biden is giving himself a pep talk and bolstering his political base by saying the US economy isn't so bad. It is aimed at fooling the American people and public opinion polls have shown poor approval for Biden's economic performance,” He said.

Observers said that the US “is shooting on its own feet,” bearing the dire consequences of its policy, which is driven by a zero-sum mindset and the “America First” policy.

The results of this policy are palpable everywhere, from its irresponsible excessive money printing during the pandemic era, and global supply chain disruption due to unilateral sanctions for geopolitical gains, to its relentless crackdown on Chinese exports, which jointly led to runaway inflation and a looming recession in both the US and the world.

Also, “the US has prioritized its development and political goals at the expense of sacrificing other countries’ interests, dragging down the global recovery,” Gao noted.

The IMF report forecast that that global economic growth will slow from 3.2 percent this year to 2.7 percent next year. The global deceleration will be broad-based, and countries accounting for about one-third of the global economy are estimated to have a two-quarter contraction in real GDP this year or next.

Against global headwinds, analysts voiced confidence that the Chinese economy will continue expanding on a firm track as the country further optimizes its COVID-19 response.

“China will continue acting as the ballast anchoring global economic growth next year,” Gao said.

In early December, investment bank Morgan Stanley upgraded its view of the future performance of Chinese equities to “overweight” from “equal-weight,” citing multiple positive developments in the economy.