Photo taken on Jan 25, 2022 shows the US Federal Reserve in Washington, DC, the US. Photo:Xinhua

Inflationary pressure in the US edged down in November, as measured by the official Consumer Price Index. The Bureau of Labor Statistics reported on Tuesday that CPI rose 7.1 percent in the month, down considerably from 7.7 percent in October. In June, the US inflation numbers peaked at 9.1 percent, the highest level since early 1980s.The cost of used cars, furniture, airline fares and hotel rooms all dropped in November. From October to November, core prices rose 0.2 percent, recording the mildest increase since August 2021. The latest figures provided the strongest evidence to date that US prices rises are steadily slowing down from the price acceleration that first struck the country about 18 months ago.

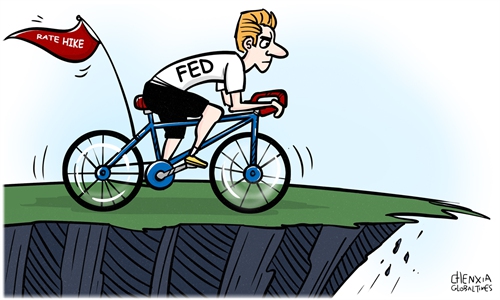

On Wednesday, the US Federal Reserve officials will convene the last FOMC monetary policy meeting for this year, and investors worldwide are expected the American central bank will raise the US federal funds rates by a half-point. Fed officials are likely to debate on the coming path of how to set the benchmark interest rates in the spring of 2023, which has a close correlation to the Fed's propensity to steer the US from a hard landing or avoiding a deep recession.

The CPI measures what average consumers pay for goods and services and its consecutive decline in the past two months should give the US monetary policymakers some relief in making an easier decision this time. A 50-basis-point raise on Thursday, widely anticipated by market analysts, would put the Federal Reserve's key short-term interest rates in a range of 4.25 to 4.5 percent, which will be the highest in 15 years.

Investors will be poring over remarks by Fed Chairman Jerome Powell at a press conference scheduled on Thursday after the FOMC meeting, for clues on the US' next trajectory of monetary policy. Barring any abrupt mishaps such as the global oil prices surging back to $140 a barrel, the FOMC will likely ramp up the key interest rates by a quarter-point in February 2023, which could be the last rate hike in the Fed's current rate hike cycle.

Since the beginning of 2022, the Fed has raised the federal funds rates by 0.75 percentage points four consecutive times, unprecedented in its history, as the world's largest economy is roiled by highly elevated inflation, caused by the US government's splurge on pandemic-bailout fiscal spending.

The two administrations of Donald Trump and Joe Biden have spent more than $5.2 trillion since the pandemic caught hold of the country, largely through selling federal government treasury debts and other securities. The Federal Reserve also contributed to the runaway inflation by slashing its interest rates to de-facto zero in early 2020 in the fallout of the pandemic then.

American economists are seriously concerned now if the Fed moves to continue to raise interest rates to more than 5 percent next year, the US economy will probably slip into a recessionary cycle, as the central bank's too aggressive rate hikes will make it more expensive to borrow to buy cars, homes, big ticket commodities and services, and curtail Americans' credit card spending, which will reduce US domestic consumption -- the major engine of the US economy.

As to whether the US can escape its traditional boom-and-bust cycle this time depends on the Federal Reserve's coming choice of monetary policy. Though the inflation seems to have come off the boil, prices for grocery and services remain two stubbornly troubled segments. Grocery prices surged 0.5 percent in November from October and are up a whopping 12 percent year-on-year. Those price spikes have left many American families struggling to afford food and other daily necessities. Also, prices for energy spiked 13.1 percent year-on-year.

Earlier, Powell said he was tracking price trends in three separate categories to best understand the likely path of the US inflation: Goods, housing and services. He stated that his biggest concern has been with prices of services which he said are likely to remain persistently high.

Also, service sector enterprises tend to pass on some of their elevated labor costs to their customers by charging more, thereby perpetuating inflation. The core change in services rose 0.4 percent in November, according to the US Bureau of Labor Statistics. Prices for many service segments kept rising in November. Dental care jumped 1.1 percent in November from October, and restaurant prices rose by 0.5 percent. The so-called US core inflation, which excludes volatile food and energy costs and which the Federal Reserve tracks closely, remained at 6 percent for November, compared with a year earlier.

US President Joe Biden on Tuesday called the latest inflation data "welcome news for families across the country". However, considering the still elevated prices of food, energy and core services, it is premature to claim that the country has won its fight against inflation.

According to Chinese economists, the largely disrupted US industrial supply chain hasn't fully recovered to its pre-pandemic levels, and the Biden administration's lingering trade war and highly coercive technology contest with China means the US' supply chain woes aren't to abate in a short period of time.

In a nutshell, the softer November CPI reading may underline expectations the US central bank will move to slow down its action pace of interest rates hikes, but the Fed officials can hardly rest assured from now on, boasting they have successfully controlled US inflation. The country will have to do more, say drastically scale down trade and investment protectionism and stop forming small economic circles, in order to bring its inflation back to lower than three percent.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn