BOJ’s surprising tweak to YCC policy could have wider impact on global stock market: analysts

Haruhiko Kuroda, governor of the Bank of Japan (BOJ), takes a question during a news conference at the central bank’s headquarters in Tokyo on Tuesday. The BOJ kept monetary policy steady and took a more upbeat view of the economy, reinforcing market expectations that it could begin tightening monetary policy, including raising interest rates, Reuters reported. Photo: CFP

The Bank of Japan’s surprising tweak to its bond yield curve control (YCC) policy somewhat has sent a signal that the country may fine tune its existing ultra-loose monetary policy in the near future, some industryobservers interpreted, while others opined that it is only a regular move to maintain the stability of yen’s exchange rate.

But all analysts warned the decision could be consequential to global stock market, in particular the Asian market which has taken a dive on Tuesday as Japan has long been viewed as a bellwether for the Asia-pacific market.

The BOJ decided on Tuesday to allow the 10-year bond yield to move 50 basis points either side of its 0 percent target, the range of which is wider than the previous 25 basis points band. The announcement also came earlier than investors’ expectation, who predicted that no major change on YCC would be made until new BOJ leadership step up in the spring next year.

According to a Financial Times report on Tuesday, BoJ governor Haruhiko Kuroda denied that the latest adjustment amounted to a tightening of monetary policy, stressing that the central bank would not scrap its yield target.

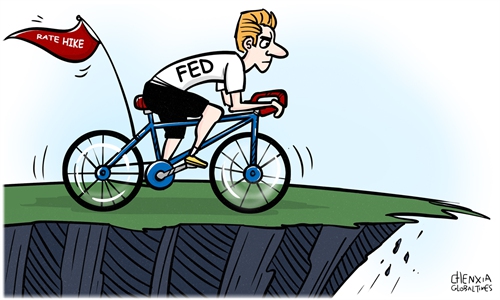

“This measure is not a rate hike,” Kuroda said, noting that the change aims to enhance the sustainability of monetary policy framework and does not signal the end of YCC or an exit strategy.

“It is a clear signal that Japan may withdraw from its ultra loose monetary policy, and once they followed up with more adjustments, it will make China one of the last few major economies in the world that could still shore up the economy with monetary policy stimulus,” an industry observer surnamed Li told the Global Times on Tuesday, noting that it indicates that China will become subject to a more “complicated” external environment.

Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, however, noted that a change on YCC policy does not equate to a departure from Japan’s previous monetary policy.

“The main objective is to keep yen’s exchange rate, but there are multiple options to achieve the target in addition to tightening liquidity. For example, Japan is a net creditor country, it could sell US bonds and other countries’ bonds to mitigate the downward pressure on yen due to a stronger dollar,” Dong told the Global Times on Tuesday. But he warned that despite a minor influence on global exchange rate and bond market, the change will send shockwaves across the stock market, although Chinese market will be relatively immune to such short-term fluctuation.

Following the BOJ’s decision on Tuesday, the yen surged and Asian shares plunged sharply. The Nikkei benchmark index slumped 2.46 percent on Tuesday’s closing, while the MSCI's broadest index of Asia-Pacific excluding Japan fell over 1 percent.

Global Times