High-end manufacturing companies on the rise

Tech coercion by Washington will only make China stronger: expert

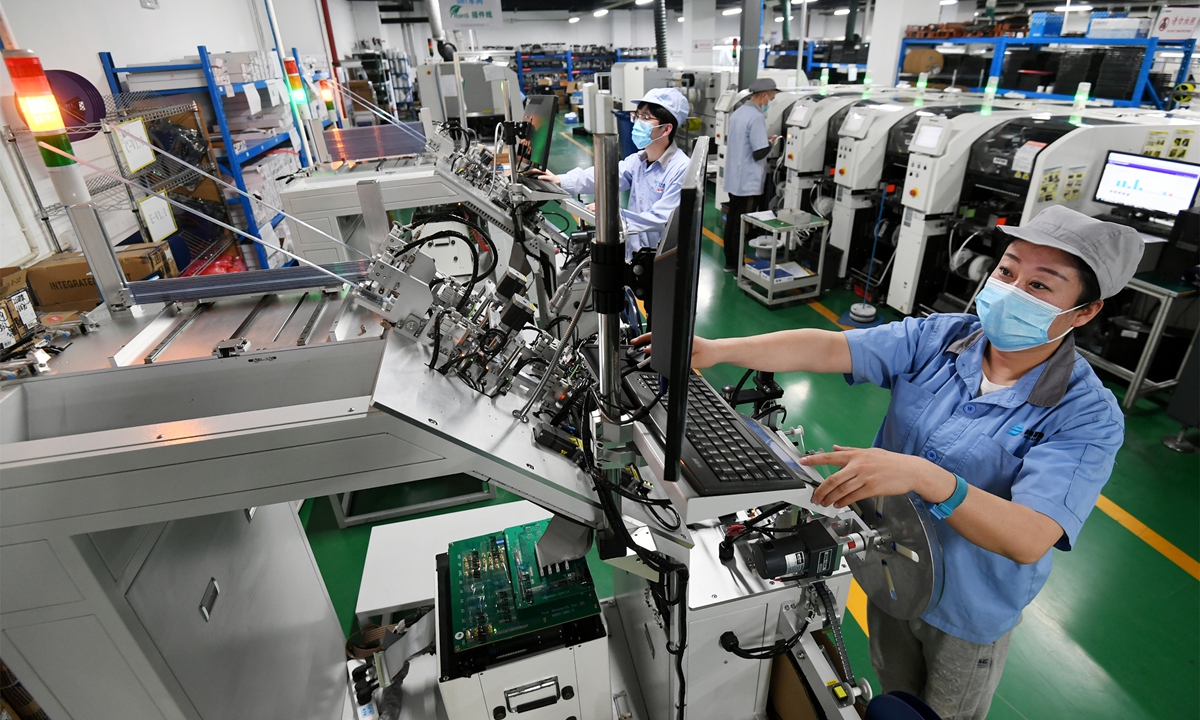

A worker checks a chip at Jade Bird Fire Co in Zhangjiakou, North China's Hebei Province, on March 27, 2022. Jade Bird makes firefighting products. Its self-developed Zhuhuan chip, which integrates fire detection capability, communication technology and integrated circuit technology, is widely used in China. Photo: VCG

China's publicly traded high-end manufacturing companies withstood the US trade war and tech coercion to achieve a compound revenue growth rate of 12 percent from 2017 to 2021, and their profits began to surge in 2020, according to data contained in a white paper published by the China Association for Public Companies.

This is a vivid reflection of the rapid development of China's high-end manufacturing sector ranging from ships to aircraft making in the past several years, despite challenges like the coronavirus pandemic and relentless assault by the US government, as China ramps up its manufacturing power.

There were 2,121 high-end manufacturing listed companies as of December 10, accounting for 65 percent of all listed manufacturing companies and up 69.7 percent from the end of 2017.

Those companies each with market capitalization of more than 10 billion yuan ($1.44 billion) surged from 338 at the end of 2017 to 664 companies by the time the white paper was released. The market value of semiconductor, power equipment and new-energy companies witnessed the strongest growth.

The white paper showed that China's high-end manufacturing companies are strengthening quickly. Their revenues rose from 7.47 trillion yuan in 2017 to 11.79 trillion yuan in 2021.

However, the companies' profitability fell in 2018 due to the trade war and other factors, but profitability started to improve in 2020, with a growth rate of about 46 percent recorded for that year.

"China's manufacturing supply chains, represented by high-end manufacturing, have become one of the comparative advantages of China's comprehensive economy," Chen Jia, an independent international strategy analyst, told the Global Times on Monday.

There's been much news in recent years of the manufacturing companies' achievements. For example, China delivered its first C919 passenger aircraft, which is expected to go into commercial use in early 2023.

In June, China delivered the world's largest container ship, the first of its kind made by the country, according to media reports.

Tian Yun, a veteran economist, said that the momentum of China's industrial upgrading is very obvious. Despite challenges like the pandemic and the US trade war, the growth rate of high-tech companies' profits has exceeded market expectations.

On the one hand, the situation reflects China's earlier strategic planning and policy push, such as in the area of new-energy development. On the other hand, the growth of made-in-China replacement products has exceeded expectations despite Washington's push for industrial "decoupling", especially in the field of semiconductor chips, said Tian.

Experts said that it will be a matter of time before China breaks through Washington's technology coercion.

According to Tian, high-end chips, especially those below 14 nanometers, are still China's biggest technological shortcoming, and it will need the participation of multiple departments and enterprises to constantly beef up their efforts.

The US government has launched a series of measures to stop China's chip industry from progressing, such as by adding more of China's tech companies onto its "black list" and restrict exports to China.

Chen said that the Biden administration's chips coercion is a product of anti-globalization, aimed at cutting supply chains arbitrarily.

"The policy would cause mutual harm and could not be sustained for a long time," he said, adding that with China's increasing research input in advanced manufacturing, it is certain that China will achieve complete domestic replacements for all high-tech products including chips.