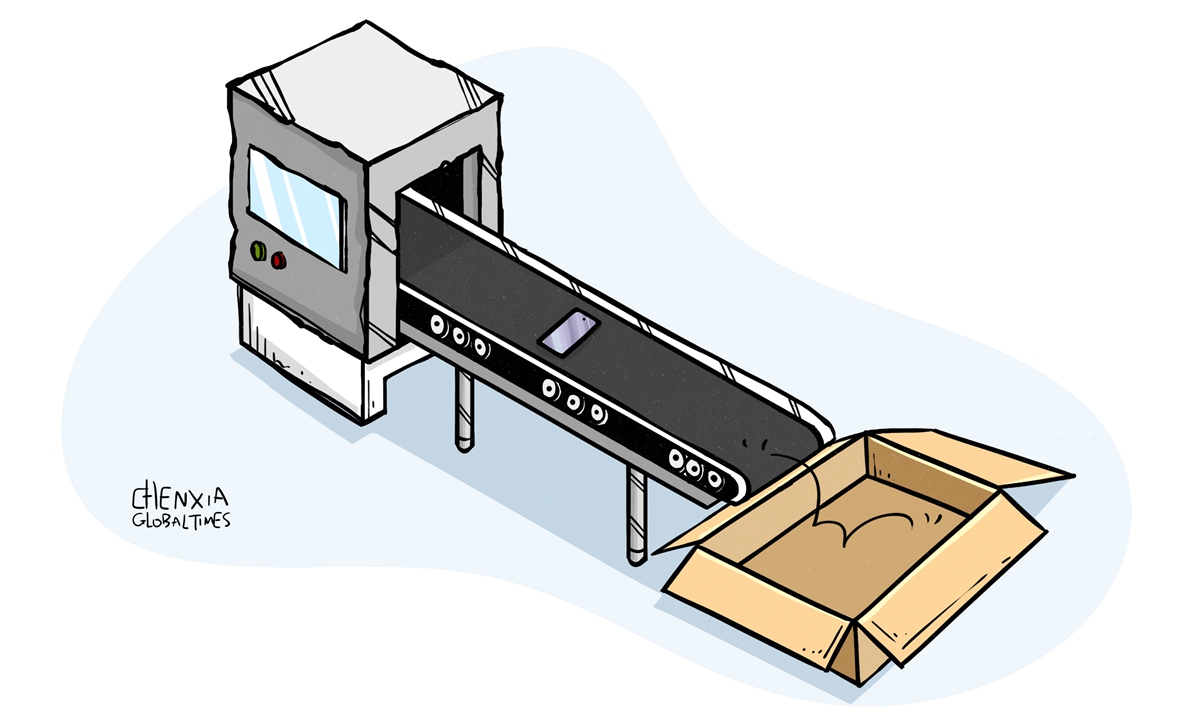

Illustration: Chen Xia/Global Times

Apple Inc has once again found itself in the media spotlight, as they reported that the US tech giant shipped up to $2.5 billion worth of iPhones from India from April to December in 2022, which nearly doubles the previous year's amount. Some claim that Apple's enthusiasm for "Make in India" could be a shot-in-the-arm for India's manufacturing, as Indian factories aspire to grab a piece of the economic pie provided by the California-based tech giant.Tata Group has been in talks for months with Apple's supplier Wistron Corp and is looking to seal the purchase of its assembly factory near Bangalore by the end of March, Bloomberg reported, citing a top executive at the conglomerate's software services arm and saying that the deal would give a boost to India's ambitions to become an electronics manufacturing hub in the world.

With accelerated investment in sectors like electronics, telecom and the like, Indian manufacturing sector has indeed grown at a rapid pace, however, it is premature and overly optimistic to think that relying on star companies such as Apple can help make India's manufacturing ambitions a reality, especially at time when the California-based company is reportedly cutting back on production of iPhones, due to softening demand all over the world.

Some media reports said that Apple backed off plans to increase production of its new iPhones after an anticipated surge in demand failed to materialize. Besides, the tech giant is reportedly considering an iPhone 15 price reduction, which will likely apply to the base model as well as the Plus model. Now, investors are increasingly alerted by the risks of a shrinking market facing Apple, which caused a massive plunge in the tech giant's market cap from $3 trillion to $2 trillion over the past few months.

An updated forecast for the worldwide smartphone market from International Data Corporation (IDC) is showing a more prolonged recovery than previously expected. Shipments of smartphones are estimated to decline 9.1 percent in 2022, and IDC reduce its 2023 smartphone shipment forecast by 70 million units, given the ongoing difficult macroeconomic environment and its negative impact on demand.

The outlook for the global smartphone industry in 2023 is uncertain and tenuous. It seems the California-based tech company faces severe challenges in securing its position in the fiercely competitive marketplace.

If Apple moved to cut its iPhone production due to softening market demand, there is perhaps only limited opportunity for India to attract investment from the California-based tech giant and its suppliers to upgrade its manufacturing industry.

What's more, China remains a massive lucrative market for many US tech companies including Apple. It is almost impossible that the iPhone maker and its supply chain will totally shift their investment focus away from China to India, as the tech giant tries its best to win more Chinese consumers.

Apple, to some extent, can be taken as the epitome of the decline in competitiveness of some Western companies. In contrast, Asian brands are on the rise. They have gained growing market share in not only Asia, but also in the US, Europe and elsewhere.

Asian countries are now the fastest growing economies in the world. Asia - home to more than half the world's population and a fast-growing middle class - represents a 10-trillion-dollar market opportunity.

India has a huge potential in the manufacturing sector, but if the country wants to make its manufacturing ambitions a reality to become a manufacturing hub of the world, it shouldn't focus simply on attracting Western companies, but needs to pay more attention to make itself an attractive investment destination for companies from other Asian countries, including China.

Chinese companies have garnered a bigger market share in 13 high-technology products and services in the world, from electric vehicles to smartphones, Nikkei research shows, underscoring China's outsized presence in the global market. To put it simple, it is hard for India to become another manufacturing hub of the world, if the country tries to shut its door to Chinese manufacturing giants.

India's decision to pull out of the Regional Comprehensive Economic Partnership has reduced its attractiveness for many Asian manufacturing companies. To strengthen industrial cooperation with Asian countries, including China, will benefit the development of India's manufacturing sector.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn