Illustration: Global Times

US inflation measured by the consumer price index rose 6.5 percent in December 2022, down from 7.1 percent growth in November. It immediately drew investors' attention as capital markets surged from Wall Street to Europe and Asia last week. However, as uncertainties persist with the US Federal Reserve and the global geopolitical struggle, more market volatility may lie ahead.The meaningful drop in the headline US inflation should reassure investors that there won't be any more hectic hiking of interest rates by the Fed in 2023, and the Fed's policy tightening cycle will probably come to an end in the second half of 2023, which would boost equities trading all over the world.

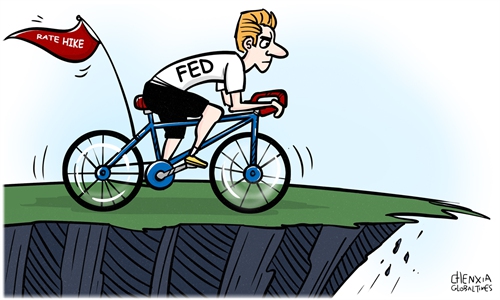

The US central bank raised rates by a cumulative 425 basis points in 2022, including four consecutive 75 basis points raises, which is unprecedented in its history. The aggressive monetary tightening has dampened US economic activity, with most economists predicting a severe economic slowdown or a small-magnitude recession in 2023.

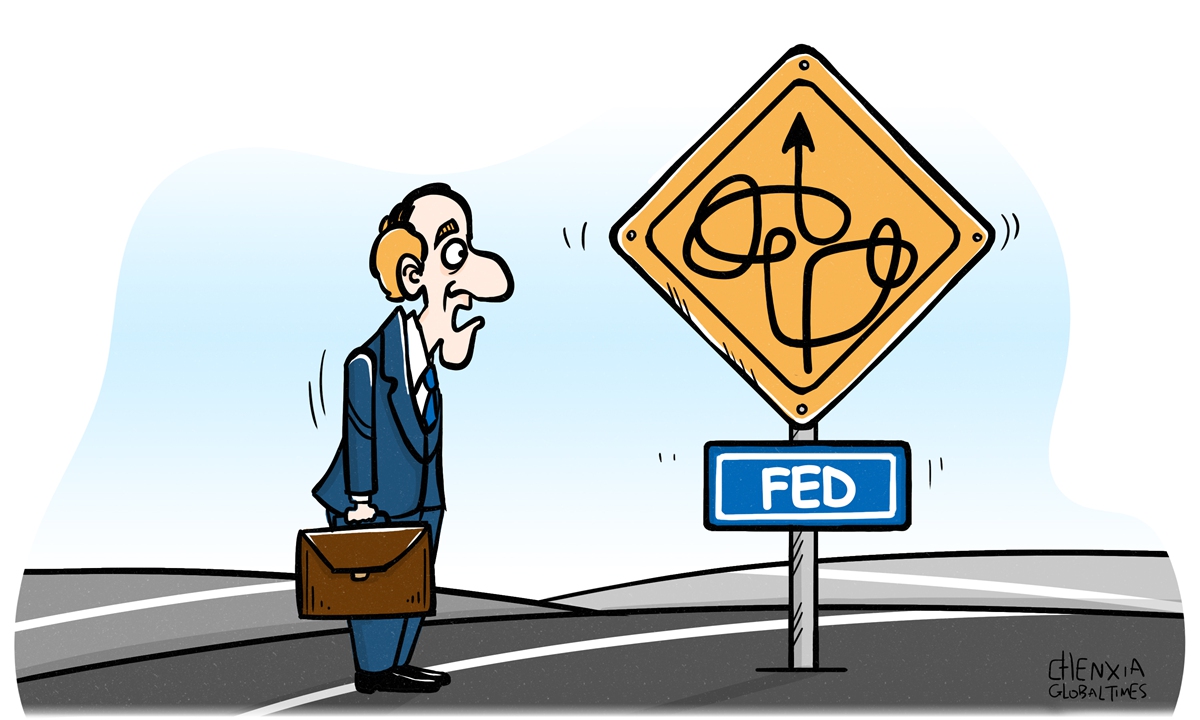

The paradox before the Fed policymakers is that they don't know how high and how long they should continue to raise the rates that will be just appropriate to rein in elevated inflation, but not too restrictive to cause a deep recession in the US. Since December, the pace at which the Fed has increased borrowing costs has been scaled back. By all metrics, it is a tough job for any central bank to avoid overdoing it with higher-than-needed interest rates and put an economy on ice.

Still, some Fed officials continue to strike a hawkish tone, vowing they won't pivot away from curbing high prices and bring inflation down to the desirable 2 percent set the by US central bank. The bets that Wall Street will embrace a massive surge in equity prices may not materialize. Investors need to take a grain of caution before gambling all-in.

Federal Reserve chairman Jerome Powell and other Fed officials have stressed that they need to see clear signals that inflation has truly eased before calling a pause to policy tightening. It is likely for the Fed to raise rates by a quarter of a percentage point at its next policy meeting scheduled from January 31 to February 1. Ultimately, the benchmark policy rate is likely to end up at a range of 5-5.25 percent, most analysts predict.

"Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time," Powell said in a recent policy address. "Restoring price stability when inflation is high requires measures that are not popular in the short term, as we raise interest rates to slow the economy."

It seems that the Fed this time is rather serious in curbing inflation, which briefly reached 9.1 percent in June 2022. US policymakers were broadly scoffed and ridiculed in 2021 for insisting inflation was only "transitory" despite market warnings that price rises would keep spiraling up and be trenched in the broader US economy, eating into the pocketbooks of ordinary US households.

As it turned out, Fed officials made a significant mistake by ignoring economists' warnings, refusing to raise rates at an earlier time and watching US inflation soar through the roofs. Of course, the Biden administration's staggering fiscal spending since 2021 is one of the major factors leading to the 40-decade inflation in 2022.

Even in December when the CPI retrieved to 6.5 percent, food and housing prices and rents remained a source of pain for US household budgets. The overall food index jumped 10.4 percent year-on-year, with grocery prices rising at an even higher 11.8 percent clip. Some staple grocery items posted eye-popping increases, with dairy products increasing 15.3 percent and eggs jumping by a whopping 59.9 percent year-on-year. The decline in gasoline prices was by far the largest contributor to the monthly drop in overall inflation, which is likely to continue to be volatile in 2023.

It is true that elevated US inflation will be difficult to squelch after taking root in the broader services sector of the US economy, and the Fed will be forced to press ahead with more rate rises in the first half of 2023, until it sees more and clearer evidence of easing labor market conditions. So, bringing down inflation in the US will mean more job losses and declining wages, economists say.

The FOMC minutes from its December meeting wrote that no FOMC members expected rates cut throughout 2023. The members generally observed that maintaining a restrictive policy stance for a sustained period until inflation is clearly on a path toward 2 percent is appropriate. In view of the persistent and unacceptably high level of US inflation, several participants commented that historical experience "cautioned against prematurely loosening monetary policy."

Under these macro settings, in which the Fed remains strongly committed to lowering inflation by restraining economic growth, investors should be prepared to see a period of softer US economic growth and higher unemployment. The perception that the lower CPI reading in December marks "the beginning of the end of monetary tightening" may be false, keeping investors around the world perplexed, scratching their heads in 2023.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn