US chip ban to spur China's tech breakthroughs: experts

Companies call for stability, reliability to avoid disturbances in global industry

Production of semiconductor chip File photo: VCG

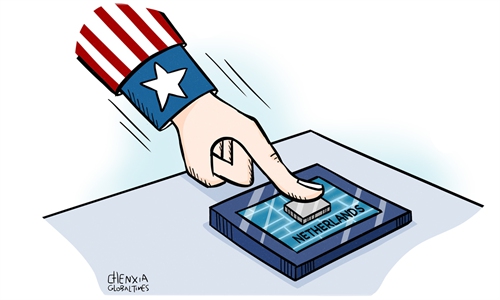

The US has reportedly secured a deal with the Netherlands and Japan on chip export controls against China, using stepped-up pressure on its allies. However, experts said that the latest US move and more potential containment won't beat down China, as Chinese semiconductor firms are making all efforts to achieve breakthroughs in core technologies for self-reliance.The US has reached an agreement with the Netherlands and Japan to restrict exports of some advanced chipmaking machinery to China, including advanced lithography tools, Bloomberg reported on Saturday, citing sources.

The deal would extend some export controls the US adopted in October 2022 to companies in the two countries, including ASML Holding NV, Nikon Corp and Tokyo Electron Ltd, according to the report. The actual implementation of those restrictions could take months as the two countries finalize legal arrangements, it said.

Despite mounting US pressure on export curbs, Netherland's leading lithography firm ASML said these measures would not have a material effect on the company's announced expectations for 2023.

"Our business in China is predominantly directed at mature nodes," ASML said in a statement sent to the Global Times on Saturday. "Meanwhile, ASML's business activities globally will continue. What we need now is stability and reliability in our industry to avoid further disturbances in the global semiconductor industry," it said.

ASML will continue to engage with the authorities to inform them about the potential impact of any proposed rule in order to assess the impact on the global semiconductor supply chain, the company said.

Nikon and Tokyo Electron didn't reply on Saturday.

The Biden administration has repeatedly claimed steps for its so-called chip alliance over the past year, but little progress had been made. In terms of the deal with the Netherlands and Japan, no details have yet been announced.

The latest US moves are unlikely to have any significant additional long-term impact on the Chinese semiconductor industry, which has withstood the US' multi-year unilateral crackdowns, Ma Jihua, a veteran telecom analyst, told the Global Times on Saturday.

Given their massive revenue from the Chinese market, the Netherlands and Japan as well as their companies like ASML are unlikely to comply with the US' order to curb sales of chip machinery to China, Ma said.

The global semiconductor industrial chain is one that embodies broad collaboration and global division of labor, and China is already the world's largest semiconductor consumption market. According to data from industry body SEMI, sales of semiconductor equipment in the Chinese mainland reached $29.62 billion in 2021, accounting for almost 29 percent of the global market. In the second quarter of 2022, the sales in the Chinese mainland recorded $6.56 billion and that of the global market totaled 26.43 $billion, data from China's National Development and Reform Commission (NDRC) showed.

However, the US is pushing forward "tech decoupling" with China at a speed faster than many anticipated, and it's aiming to draw all allies to join its tech war against China. In this regard, experts said China should continue to improve its own tech capabilities to deal with the possible deterioration arising from the US' containment.

"The US' continuous moves send a sober warning to Chinese semiconductor makers that the US won't stop its chip war against China. It's time for domestic firms to concentrate their resources and efforts to seek technological breakthroughs," Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Saturday.

"There is no mystery to lithography tools. Shanghai Micro Electronics Equipment (Group) Co has developed a machine with limited capital investment and already has market demand. I believe we will definitely make tech breakthroughs with nationwide resources," Xiang said.

"It won't take years for China to independently develop lithography tools," he said. The US' push toward tech decoupling has greatly boosted the application of domestically made chips by Chinese smart device manufacturers, which incentivizes local chip firms to make technological improvements. Meanwhile, China has been ramping up efforts in nurturing chip talent.

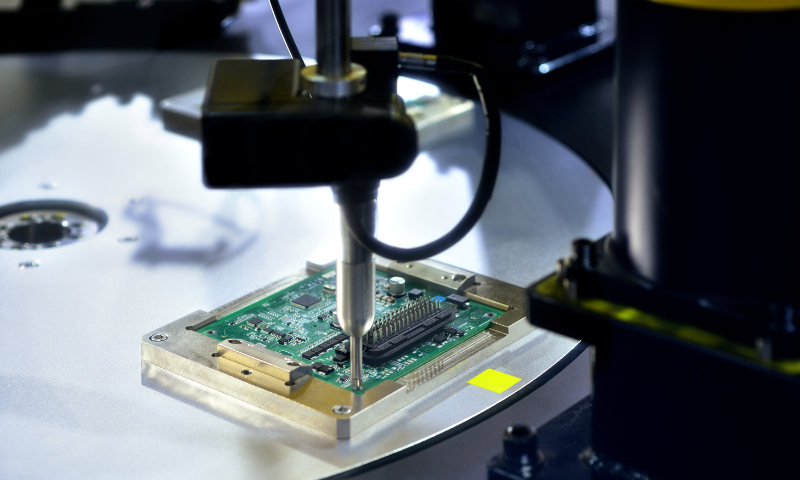

China's semiconductor sector has been developing fast despite the US pressure, especially in terms of the mass production of 28-nanometer chips. Ma said domestic semiconductor firms have been able to independently produce the widely used 28-nm chips and are ramping up efforts to make breakthroughs in advanced 14-nm chips.

Chinese tech giants are constantly making breakthroughs in chip technology.

Take Huawei as an example. Its goal has been very clear, which is to address the existing chip supply problems by increasing input in research and development based on the actual conditions of the domestic chip sector.