Beijing CBD Photo: VCG

China's economy has got off to a strong start in 2023, with the January PMI bouncing back to expansion territory reaching 50.1from merely 47 in December, shrugging off the pandemic-induced slump in 2022 and sending a confident signal that the world's second largest economy is rapidly regaining pace and will jumpstart the development of China's Asian neighbors and close trade and economic partners in the world.

The naysayers in the US who play down China's economic prospects, question the resilience of Chinese economy and Beijing's competence in governance and economic management must feel very disappointed, particularly as the US is facing the double whammy of higher consumer prices and the Federal Reserve's monetary tightening resolve, which may send the US economy into a painful recession this year.

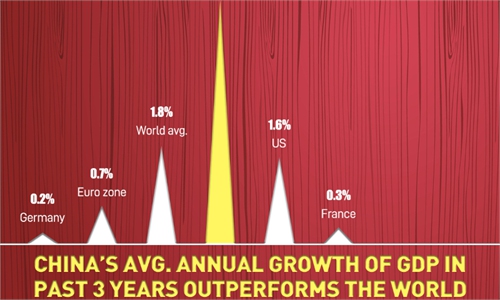

The majority of global investment banks and world institutions portend that China is poised to achieve annualized economic growth of 5-6 percent in 2023 and 2024, which will make China's GDP to reach approximately $20 trillion in 2024. Despite the US government' reckless decoupling attempt aimed at containing China's economic growth, the gravity of the global economy is now moving from the east of Pacific to the west of the ocean.

The speedy recovery of China will have considerable implications for the world, lifting the boat of those countries sitting together and economically integrated with China. Nearly all China's neighbors will benefit greatly, the ASEAN economies in particular.

China's prompt move to drop COVID restrictions and reopen its borders is re-energizing the global market of industrial materials too. Since the beginning of January, prices for copper, aluminum and zinc have all had their best start to a year in 11 years, rallying by an average of 13 percent, according to data provided by the London Metal Exchange. Tin, which is largely used to make electronics, has soared 30 percent, its sharpest rise in 32 years.

Fixed-asset investment and domestic consumption will be the two leading driving forces propelling growth this year. Chinese Premier Li Keqiang on Saturday presided the first post-holiday executive meeting of the State Council, calling for intensified efforts to "expedite consumption recovery" and keep investment and foreign trade basically stable, according to an official readout.

Domestic consumption was significantly up during the seven-day Spring Festival holidays that ended on Friday - thanks to the government's grand reopening which saw coronavirus infections quickly peaked throughout the country in early January. National tourism revenues surged by more than 33 percent during the seven days from last year to reach 375.8 billion yuan, new data showed.

One crucial task facing the government in its bid to gear up domestic consumption is ensuring workers feel confident in their future incomes. So, it is necessary for the government and corporate employers to work together to raise the salary levels of Chinese workers across the board.

Immediately after the Spring Festival holidays, all provinces, municipalities and autonomous regions in the country moved to roll up their sleeves to pursue higher local GDP growth rates in 2023, with the coastal powerhouses including Jiangsu, Guangdong, Shandong, Zhejiang and Fujian provinces as well as Shanghai vowing to achieve annual 5-6 percent economic growths. South China's Hainan Province, the largest free trade zone in the country, aims to attain nine percent GDP growth this year.

Some provincial-level governments have announced incentive measures, including fostering high-quality development and optimizing local business environment to inspire faster development in 2023 and spur quick recovery from the impact of the pandemic. The actions will give a strong boost to the overall economic growth. Last year, the country saw one of the slowest years of economic growth of 3 percent since 2008 when the US subprime loans meltdown caused the global financial crisis.

An action plan consisting of 10 implementation lines was released by the Shanghai municipal government. According to the plan, three tasks, boosting confidence, expanding market demand, and seeking stable growth, are imperative, with China's largest industrial city aiming to achieve above five percent GDP growth this year.

Meanwhile, the government needs to strengthen coordination of fiscal and monetary policies and help ease economic burdens on pandemic-hit broad service sectors and medium and small-size private enterprises.

At the same time, China has intensified infrastructure build-up and urban housing construction to help drive economic revival. The strong start of infrastructure projects is more of continuing the momentum that has picked up pace since the fourth quarter last year. The National Development and Reform Commission, the top economic planner of China, said it approved a total of 109 fixed-asset investment projects in late 2022. The projects, with a combined investment value of 1.48 trillion yuan, cover rail and road transportation, new energies exploration, urban development and water conservancy. To sum it up, China is now "firing on all cylinders" to lift its economic growth rates in the coming years.