Illustration: Chen Xia/Global Times

Chinese electric vehicle battery giant Contemporary Amperex Technology Co (CATL) is planning to raise at least $5 billion by listing global depositary receipts (GDR) in Switzerland as early as May, Reuters reported on Wednesday.If confirmed, CATL's listing will mark the largest GDR by a Chinese company in Switzerland. The continuing and growing enthusiasm of Chinese companies selling GDR in major European stock markets could serve as an important trend signal that with the rapid rise of commercial value of Chinese companies, it becomes an inevitable trend for them to expand overseas markets with the help of global capital, despite Washington's so-called "decoupling" push.

Indeed, A-share companies could not access the Swiss capital market until after July 2022 when the China-Switzerland Stock Connect was officially launched by the SIX Swiss Exchange and the Chinese mainland stock exchanges in Shanghai and Shenzhen.

Since then, a growing number of Chinese companies have gone public at the Swiss market. Statistics show that nearly 40 A-share companies have completed the GDR listing since 2022, of which 31 chose to list on the Swiss stock exchange. There are also more than 20 A-share companies waiting in line for the securities regulators' approval for a GDR float in Europe.

Moreover, many companies that chose to list in Switzerland are industry leaders in China or even in the world, including China's largest heavy equipment manufacturer Sany Heavy Industry Co, China's largest supplier of carbon products Fangda Carbon New material Co, among others.

Switzerland's ability to attract the IPOs by a growing number of high-profile Chinese companies is the evidence reflecting the financial strength of the Swiss stock exchange, which suits the need of Chinese companies for access to overseas financing. The Zurich-based bourse is one of the largest stock exchanges in Europe, with two-thirds of Europe's blue-chip companies listed there.

More importantly, it may be the signals about closer financial cooperation between China and Switzerland, as well as the Swiss exchange's stable listing rules and market-oriented regulatory system that is the biggest attraction for Chinese companies.

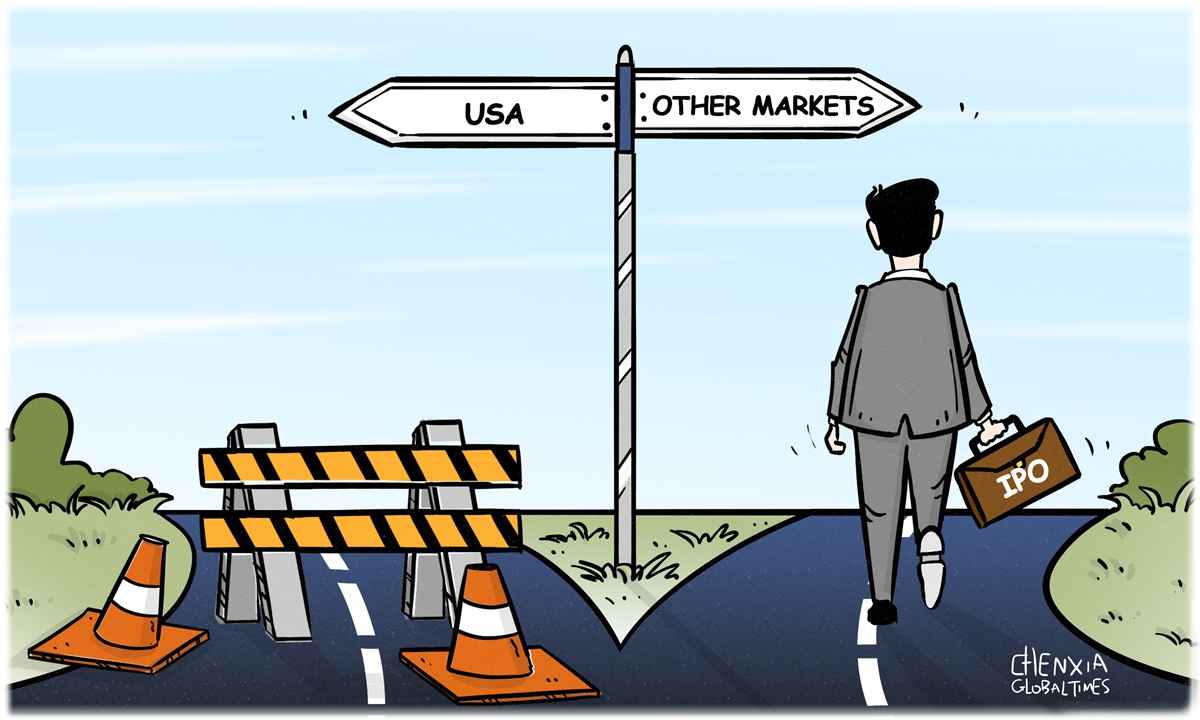

If anything, this is in sharp contrast to the difficulties faced by some US-listed Chinese companies in recent years.

It is no secret that there have been long-standing disputes between Beijing and Washington on the audit oversight of Chinese companies listed at US exchanges. Since the US Holding Foreign Companies Accountable Act (HFCAA) was signed into law at the end of 2020, some have politicized the capital market regulation and used the law to crack down on US-listed Chinese companies with the so-called "delisting timetable," which has greatly affected their share prices and even forced some to delist.

The US pursuit of a financial "decoupling" between the two countries is aimed at ostracizing China and denying Chinese companies' access to global capital, but it turns out that its politicization of capital market rules has turned out to accelerate financial cooperation between China and Europe, undermining its own position in the global financial market.

The year 2022 marked the first time that Europe overtook US as the top region for IPOs for Chinese firms. Five Chinese companies have raised more than $2.1 billion on stock exchanges in Zurich and London last year, according to data from Dealogic. By comparison, only eight Chinese companies went public in the US during the same period, raising $230 million in total, plunging 98.2 percent year-on-year.

Fundamentally speaking, US crackdown on Chinese companies is bound to backfire on its own financial hegemony in the long run. This is because the development of Chinese companies is just unstoppable, and for them to go to the world will be an inevitable trend during the process. With the increasing presence of Chinese companies in the global economy, the global financial market will see consequent changes as a result of the overseas listings of Chinese companies. The absence of the US in such major change will only end up endangering its financial strength.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn