China’s growth ‘clearly positive’ for world, spillover ‘particularly strong’ in nations with closer trade ties: IMF official

IMF Photo: VCG

The roaring comeback of the world's second-largest economy could contribute greatly to global growth in 2023 driven by a strong consumption rebound, said a senior official with the International Monetary Fund (IMF), noting that the impact of China's growth will be "clearly positive", and "particularly strong" in nations and areas where China has closer trade ties.

The remarks come as China has just experienced an upbeat, lively opening in the Year of Rabbit after a short shock of Omicron infections - workers again crowded train stations, tourists are packing for outbound visits, manufacturers are busy operating and hiring, and entrepreneurs are rushing abroad to snap up orders - all presented an early picture of things getting better sooner than expected.

Observers noted that a strong boost in the beginning of the year is backed by Chinese central authorities' top-down design over the past three years, which struck a stable balance between epidemic control and economic development. Now, after the optimization of the COVID strategy, the central government has given clear and unswerving support to the nation's economic work, paving the way for a full rebound.

On Friday, Chinese Premier Li Keqiang presided over a plenary meeting of the State Council to discuss the draft version of the Government Work Report for the year, which he is set to deliver during the two sessions in March, China's most important annual political gatherings. China is also expected to release its annual GDP target at that time.

Li said during the meeting that as the package of policies and measures to stabilize the economy continue to bring benefits and with the implementation of optimized and adjusted epidemic prevention and control measures, the current economic operation is picking up, and he urged efforts to consolidate and expand the recovery trend of economic operation.

Amid the earlier-than-anticipated recovery, the IMF raised its forecast for China's economic growth in 2023 to 5.2 percent a few days ago, up 0.8 percentage points from its projection in October, driven by a rebound in private consumption.

"The estimated 5.2 percent growth in China will contribute one fourth of global growth this year. The impact on growth elsewhere is clearly positive," Thomas Helbling, deputy director in the IMF's Asia Pacific Department, told the Global Times during a virtual press briefing on Friday.

The institution also provided a rough estimate of an average spillover - for every percentage point higher growth in China, there is a spillover effect to the rest of the world that comes to about 0.3 percentage points.

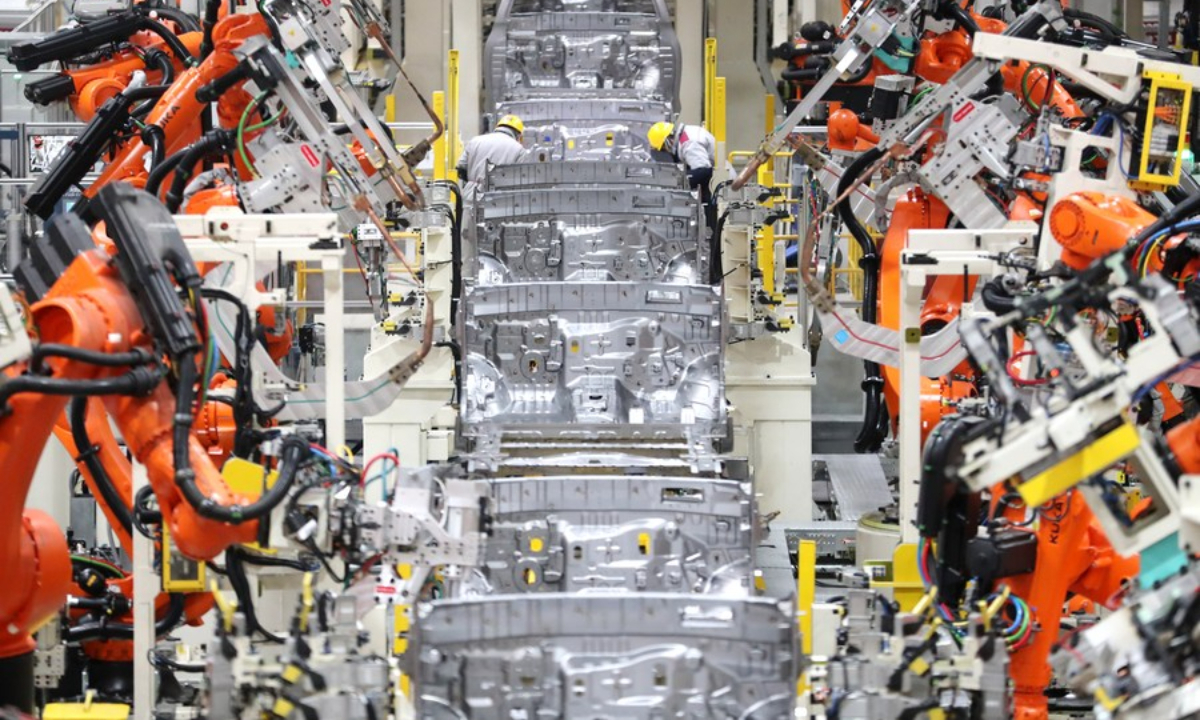

Robots conduct welding work at the workshop of an automobile manufacturing factory in Qingdao, east China's Shandong Province, Jan 14, 2023. Photo:Xinhua

Stronger spillovers

"Now, looking at the spillover in the near term in 2023, we should point out that the rebound is consumption driven. That is different from earlier rebounds after growth downturns in China, which were more investment driven," the official continued.

The boost will be driven by the rebound in services, especially in intensive services, including travel and tourism both domestically and internationally, Helbling said. "So what we would expect is that the spillovers in the near term will be strong, particularly where there are strong trade linkages in tourism with many of the Asian neighbors including Thailand or the Philippines. Of course, the larger these linkages, the bigger will be the impact."

China's services activity in January expanded for the first time in five months as spending and travel received a boost from the optimization of COVID-19 measures, while also sending business confidence to near 12-year highs, a private sector survey from Caixin showed on Friday.

Neighboring countries already had a taste of China's boost over the weeklong Spring Festival holidays - outbound travel bookings soared by 640 percent, with Bangkok, Singapore, Kuala Lumpur, Chiangmai, Manila and the resort island of Bali, among others, making the list of the most popular transnational travel destinations among Chinese passengers.

Nevertheless, although China's reopening is set to provide a welcome boost to global growth, offsetting weakness in Europe and a looming recession in the US, some Western media outlets have been hyping so-called inflationary pressure after China's reopening, claiming China's surging demand for raw materials and energy will push up prices of those commodities.

In response, the IMF official said there would be "if any, a limited impact on inflation," adding that prices of commodities have so far been declining since earlier this year and are lower compared to earlier projections. "So we would see more upside, probably limited upside risk inflation from the earlier-than-expected opening in China," said Helbling.

Chinese analysts, while describing the inflation hype as "fear-mongering and slandering," stressed that the Russia-Ukraine conflict prolonged and expanded by the US-led NATO, Western countries' sweeping sanctions against Russia as well as growing unilateralism are the causes of high inflation levels globally.

Rather than citing so-called inflation pressure, China's economic rebound drives imports ranging from cars and luxury products to fresh goods, injecting momentum into global economic recovery, Li Yong, deputy chairman of the Expert Committee of the China Association of International Trade, told the Global Times on Friday.

Moreover, Li said China has strong control of domestic price levels, compared with the high inflation in some Western economies, and China's exports will actually contribute to reducing inflationary pressures around the world.

China has effectively kept its consumer price index (CPI) at a low and steady range in contrast to the inflation seen in other major economies, the National Development and Reform Commission (NDRC) said in January, expressing confidence that the nation can keep prices steady in 2023.

By closely monitoring the prices of grain and energy, and improving the transport and distribution system for commodities, China was able to rein in CPI at a time when runaway inflation was seen around the world, Wan Jinsong, an NDRC official, said at a press conference.

In response to some worries over slow growth in China's real estate sector, Li said the authorities' recent policy measures, including moves to increase further funding for completion of troubled projects and stimulus on the demand side, mean the risk of a real estate crash "would be significantly lower."

Workers are on duty at the construction site of the Huafu mega bridge at the Sichuan-Chongqing section of the Chongqing-Kunming high-speed railway in southwest China's Chongqing Municipality, Nov 28, 2022. Photo:Xinhua

Outside risks

The pace at which China recovers this year will be consequential for the world, which is now pinning hopes on the country's consumer-led rebound to buttress global growth, while China may still have to navigate uncharted waters throughout the year and overcome headwinds, ranging from the coronavirus and geopolitical tensions to interest rate hikes and waning overseas demand.

In its latest economic update, the IMF said the global economy will grow 2.9 percent this year, representing a 0.2 percentage point improvement from its previous forecast in October. However, that number would still mean a fall from an expansion of 3.4 percent in 2022.

For advanced economies, the slowdown will be more pronounced, with a decline from 2.7 percent last year to 1.2 percent and 1.4 percent this year and next. Nine out of 10 advanced economies will likely decelerate.

The World Bank gave a much more gloomy outlook, expecting global growth to slow from 2.9 percent in 2022 to 1.7 percent in 2023, and US GDP is expected to rise just 0.5 percent in 2023, the weakest forecast in three decades.

Prospects for other economies in the world are quite uncertain and not promising - with main factors including interest rate hikes, inflation and energy among others. China's economic growth forecast from 4.4 to 5.2 percent is mainly based on the economic vitality after its reopening after the epidemic, and the rapid rebound of production and consumption, Li said.

Observers are also warning of a more disrupted, protectionist world under the US' stronger push for tech decoupling, and calling for global cooperation in countering a potential global recession.

Helbling has warned of a possible "geoeconomics fragmentation" under the rising tech decoupling push, citing the IMF's regional economic outlook of October 2022, saying that a technological decoupling push could possibly lead to "considerable income or GDP losses" around the world.

"Given these risks, we have emphasized that the main economies should work together to address these challenges from fragmentation and find a solution and avoid fragmentation," Helbling said.