Photo: Global Times

US investors including the investment arms of Intel Corp and Qualcomm Inc in Chinese artificial intelligence (AI) companies accounted for roughly 17 percent of the investments into Chinese AI companies from 2015 to 2021, according to a report released by CSET, a tech policy group at Georgetown University, Reuters reported.

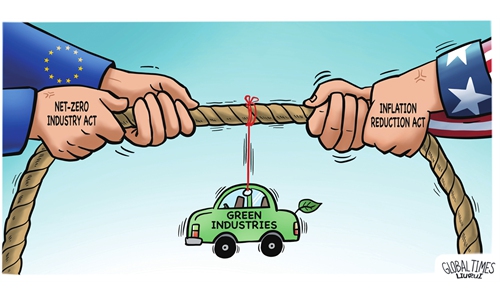

At a time when the Biden administration is reportedly preparing an executive order to restrict US investors' investment in China's key technology industries, US investors' growing favor for China's AI sector reflects their confidence in the Chinese economy and optimistic expectations in China's high-tech progress. The US government's "decoupling" approach is undesirable and unrealistic.

The Washington's political interference is becoming the biggest threat to disrupting normal economic and trade exchanges between China and the US and harming the interests of US businesses. If such arbitrary investment restrictions that go against the market rules were implemented, US investors investing in China will bear the brunt.

There already are severe shocks from the US' "decoupling" moves against China in various sectors, and more and more US businesses and scholars have been urging the US government to stop moving further on the wrong track that inflicts more damages.

When US President Joe Biden took the office in January 2021, the US business community issued stern warnings about "decoupling" from China. If the US and China were to fully "decouple," American businesses would be significantly impacted. If US companies reduce their cumulative foreign direct investment (FDI) in China by 50 percent, they will lose $25 billion in capital gains per year, the US Chamber of Commerce warned at the time.

But the Biden administration keeps the Trump-era tariffs in place, and even intensifies crackdown on Chinese technology companies.

In stark contrast to the US' "decoupling," China will continue to open up and welcome more foreign investors to share the result of its economic growth. It is expected that FDI in China will accelerate growth this year along with a strong economic rebound.

For US investors, the Chinese market, especially the promising high-tech industries such as AI, has become a must, rather than just an option. In the case of AI, according to the CSET report, by the end of 2021, China already has more than 1,600 AI companies, making it the second largest market in the world.

With the US economy slowing and a possible recession on the horizon, China represents opportunity and profits source for US investors. More importantly, as China further increases investment in scientific research and supports the high-tech field, new advantages will emerge to attract foreign investment. As China's position in the global supply chain is getting more important, more foreign companies have set up their research and development centers in China.

Some politicians in Washington are using the so-called national security as an excuse to artificially set up obstacles for American investors to enter the Chinese market. Their disruptions cannot change trends of the market. If American investors have to reduce their investment in China due to government restrictions, they can only hand over the opportunity to competitors from other countries.

The US government should jump out of the outdated zero-sum game thinking and stop interfering in normal economic and trade cooperation with geopolitical calculations. "Decoupling" cannot curb China's scientific and technological progress and economic development. Instead, it will only make the US lag behind in technological competition.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn