Illustration: Chen Xia/Global Times

Warren Buffett's Berkshire Hathaway Inc. sold billions of dollars of shares - 86 percent of its holding - in Taiwan Semiconductor Manufacturing Corporation (TSMC) just months after buying-in, the Wall Street Journal reported on Thursday. When the global semiconductor industry now faces a downturn in growth, Buffett's sudden selloff showed that the predicament of TSMC, which was caused by the political interference of the US and the Democratic Progressive Party (DPP) authorities on the Taiwan island, may be worse than many have expected.Alongside Berkshire, investment companies including Tiger Global Management, GQG Partners and Capital Group, BlackRock as well as JPMorgan & Chase were among the biggest sellers of the contract chip maker from the Taiwan island in the fourth quarter of 2022, Reuters reported on Wednesday, citing regulatory filings. News of TSMC out of favor with slew of funds triggered a 5.31-percent drop in TSMC's shares on Wednesday.

TSMC last month said that its revenue could drop as much as 5 percent in the current quarter. Whether TSMC's stock represents a risk or an opportunity, its prospects depend not only on the overall performance of the industry under the macroeconomic cycle, but also on whether the company can successfully avoid the political risks brought about by the US' reckless tech "decoupling" attempt and the political interference of the DPP authorities on the island.

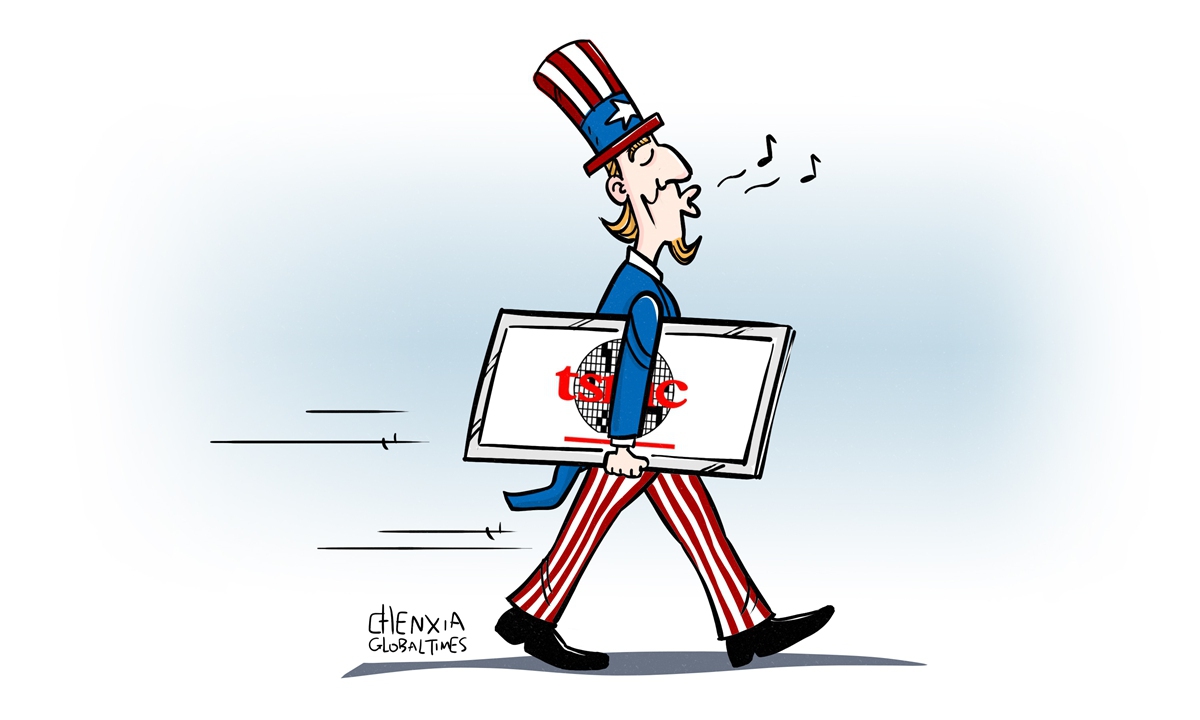

TSMC is being pushed by the US government and the DPP authorities to expand investments to build new factories in the US, as the global chip industry has come under pressure created by weak demand. TSMC recently said that it could cut this year's capital expenditures due to slowing demand. The company said on Tuesday its board approved a capital injection of $3.5 billion into its TSMC Arizona plant, according to media reports.

TSMC has encountered challenges such as slow progress and difficulty in recruiting workers in the US. In addition, the profits of the US' own chip companies are falling sharply, casting a shadow on the TSMC factory construction. For instance, US chipmaker Intel reported revenues of $14 billion in Q4 last year, a year-on-year decrease of 32 percent.

Since the US intensified its containment of the Chinese mainland in the semiconductor sector, Taiwan island's DPP authorities continued to use TSMC as a political tool to curry favor with the US government and for their own political interests. Market analysis has long pointed out that it is totally illogical from an economic point of view for the US and the DPP authorities to force TSMC to build factories in the US, while its own chip manufacturing industry is being hollowed out. This approach will not only harm TSMC, but the chip industrial chain on the island.

In 2022, the global demand for chips dropped sharply, and the US moved to impose restrictions on global chip manufacturers from selling their products to the Chinese mainland market - the world's largest chip market, which consumes about three-quarters of the world's chips.

Sustained US pressure on TSMC came even before the sweeping chip exporting ban in October 2022, resulting in a continuous decline in TSMC's revenue from the Chinese mainland. The Chinese mainland accounted for 10 percent of TSMC's revenues in 2021, down from 17 percent in 2020, Japanese media Nikkei Asia reported.

It is no secret that the US is actively pressing TSMC to move its manufacturing to the US, and the calculation behind the moves is to reduce the US' dependence on Taiwan island's chips and to cut off the island's chip trade with the Chinese mainland. By pushing TSMC to transfer its talent and production capacity to the US, the ultimate beneficiary is the US' semiconductor industry.

The reaction of the capital market is often the most sensitive among interested stakeholders. Buffett and other institutional investors' sell-off in TSMC is an ominous signal for Taiwan's chip industry. The DPP authorities on the island threw the island's chip industry into a political vortex, which will only harm the island's chip sector and local economy.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn