Global chipmakers face mounting challenges in 2023 amid persistent US export controls on China: expert

Firms bet on China’s strong rebound as challenges persist

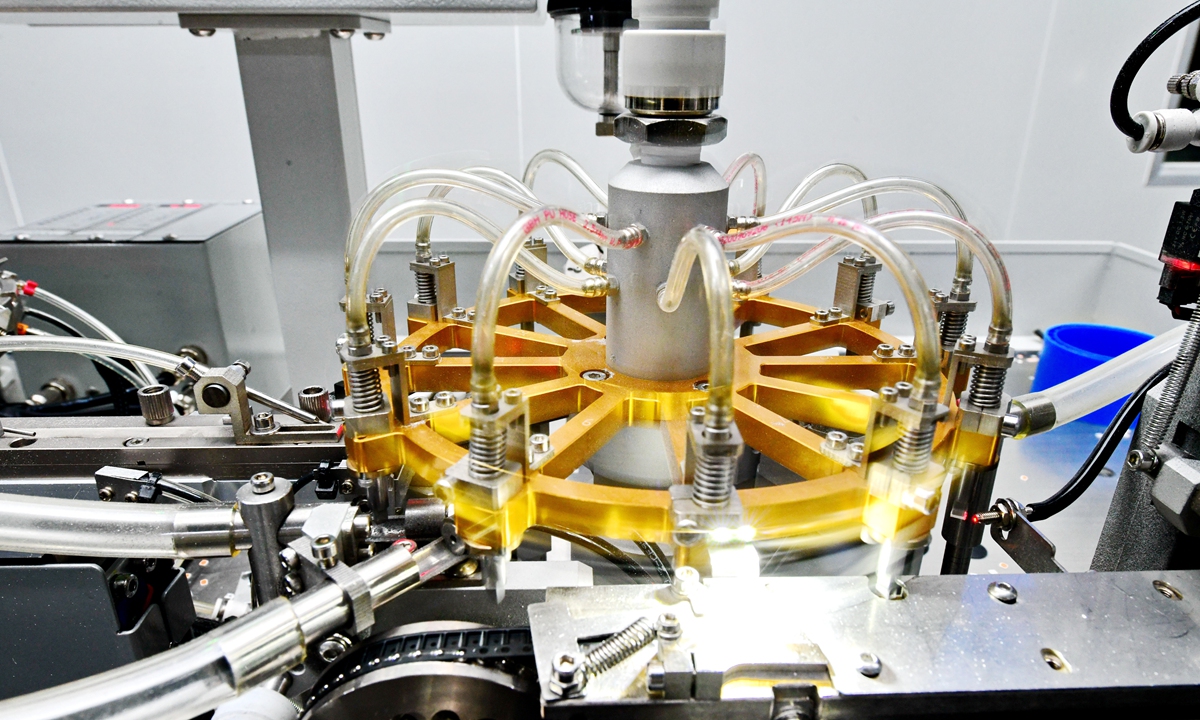

Manufacturing equipment of semiconductor products Photo: VCG

Leading global semiconductor companies have reported extended revenue declines, sending a sober warning to the strategic industry about the fallout of sweeping US chip export curbs on China. Experts said on Tuesday that Washington's relentless political interference will continue to disrupt the sector, while China's strong rebound will give a ray of hope for the world.

US-based Applied Materials, which makes materials for the production of semiconductors and other items, said its revenue between February and April 2023 would fall $6-6.8 billion. This would mean a drop of up to 4 percent year-on-year - or possibly an increase of 9 percent, Nikkei Asia reported on Tuesday.

Profit in Samsung's chip segment tumbled more than 90 percent year-on-year to 270 billion won ($220 million) in final quarter last year, according to the company's results.

SK Hynix posted a loss for the first time in 10 years in the fourth quarter of 2022, according to a press release that the company sent to the Global Times. Revenue stood at 7.699 trillion won ($6.3 billion), while the net loss was 3.524 trillion won.

Industry analysts said these figures reflect a severe supply and demand imbalance and disorder in the industry amid sweeping US restrictions on chip exports to China, global economic gloom and historic inflation in many economies.

"After facing a shortage of chips in the first half of 2022, producers stockpiled enough chips for sales of up to six months for fear of disrupted supply chains amid a US push for 'tech decoupling' from China. "Fu Liang, an independent tech analyst, told the Global Times on Tuesday.

"Due to increasingly weak electronics demand as economic stress dented consumer spending, many semiconductor giants posted historic revenue drops last year," Fu added.

Global smart phone shipments fell 12 percent year-on-year in 2022 to fewer than 1.2 billion, data released by Canalys showed.

The year "2023 will be a tough year. Recent macroeconomic trends indicate a growing risk of global recession," said Amber Liu, an analyst at Canalys.

"Many foreign semiconductor firms have bet on China's strong economic rebound to drive market demand. However, many of them dare not invest much in new production capacity due to a lack of confidence amid rising uncertainties brought about by the US' political intervention," Ma Jihua, a veteran industry analyst and close follower of China's chip industry, told the Global Times on Tuesday.

The World Semiconductor Trade Statistics forecast in November 2022 that the global market will decline by 4.1 percent to $557 billion in 2023, driven by the memory segment. The category is projected to fall to $112 billion in 2023, dropping by 17 percent compared with the previous year.

Vanguard International Semiconductor Corp, an integrated circuit foundry service provider based in the island of Taiwan, said on Tuesday that its capacity utilization is estimated to drop by 10 percent year-on-year in the first quarter of 2023, as clients have adjusted inventory due to sluggish market demand.

Referring to sharp inventory adjustment, geopolitical tensions, inflation and other factors, the company said its capital expenditure would drop by about 48 percent to around NT$10 billion ($329 million), according to media reports.

China is a major chip market, and foreign governments and companies should take the message from these disappointing financial results and consider whether to cooperate with the US in containing China if they do not want to lose the massive market, Fu said.

Experts urged the US to abandon the illusion of maintaining its chip hegemony by using political coercion to split the global semiconductor industry.

This is tantamount to suffocating the sustainable development of global chip industry, and will eventually be abandoned by the market.

In sign of full confidence in China's demand this year, ASML CEO Peter Wennink said China accounted for around 15 percent of sales in 2022 and will be at a "similar" amount this year, despite US chip export restrictions, CNBC reported.