Transfer of a few factories will not alter China’s core place in global supply chain

Illustration: Chen Xia/GT

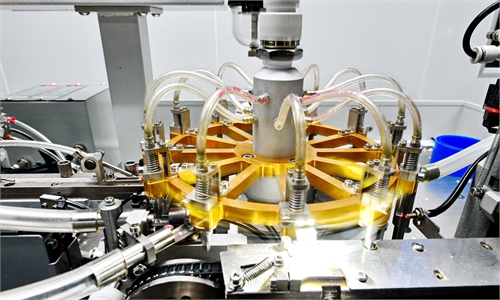

The US' curbs on China's access to advanced technology are "killing its viability as a manufacturing base for exports," the Financial Times wrote on Tuesday in a report entitled "China no longer viable as world's factory." Japanese chip component maker Kyocera has been relocating its manufacturing facilities out of China due to rising labor costs and the US' export controls, according to the report.The headline is clearly too alarmist as the transfer of manufacturing of a few companies is not going to be significant enough to really alter China's core place in the global supply chain. China will continue to move forward in manufacturing upgrade process, whether or not the US' intensifying tech war frustrates businesses in the short term.

Admittedly, the relocation of production of Kyocera is a negative signal for businesses across the world amid the disruptions on industrial chain caused by the US' political interference in normal cooperation. However, as China keeps consolidating its advantages in manufacturing despite US "decoupling" and crackdown, an increasing number of foreign companies are expanding production in China, which supports their sales both in the Chinese market and exporting.

For instance, US new-energy vehicle (NEV) manufacturer Tesla's Shanghai Gigafactory remained its top export hub in 2022. The company delivered 1.31 million vehicles last year, of which the Shanghai plant delivered over 710,000 vehicles, accounting for half of its global delivery. In recent years, although there is no shortage of Western media hype that Apple will transfer production out of China, there are more and more signs that the quality and efficiency of the company's factories in other countries are difficult to reach the level of Chinese factories.

It should be pointed out that what determines the prospects of China's manufacturing sector is by no means the undesirable "chip war" and "tech decoupling" from the US, but whether China can properly cope with its own issues emerging in the process of manufacturing upgrading that is moving forward in line with the laws of the market and industrial development.

China's manufacturing enjoys multiple advantages that will not easily be replaced by other countries in short term. First, China has the largest market in the world. For the vast majority of foreign companies, setting up production in China can help them save costs and better explore the potential of the Chinese market.

Second, China has the world's most complete industrial chain and the most developed transportation and logistics system, which directly determines that it is the most reasonable choice for enterprises to build their production base in China.

Third, China's education and training system provides enterprises with competitive labor resources, which are difficult for enterprises to find in other countries with low labor costs.

Faced with the negative signal sent by the production transfer of some foreign companies like Kyocera under pressure of the US, China needs not be too concerned. In fact, China is already taking action to further expand opening-up and improve the business environment to promote the overall upgrading of the manufacturing industry. The sharp increase in external challenges and uncertainties is pushing China to consider the next key direction to allocate resources and increase investment so as to offset the negative impacts.

China has been redoubling its efforts to upgrade the country from a manufacturer of quantity to one of quality. China's industrial structure is constantly being optimized, and China's position in the global value chain is also rising.

As China increasingly supports innovation and intellectual property protection, the research and development (R&D) investment of foreign-invested industrial enterprises above designated size in China has increased by 91.5 percent in the past ten years. In 2022, multinationals set up 60 new regional headquarters in Shanghai and 25 foreign-invested R&D centers were founded in Shanghai. By the end of 2022, Shanghai hosted regional headquarters for 891 multinationals and 531 foreign-funded R&D centers.

China's manufacturing resilience has withstood the test of the epidemic and US "decoupling." As more and more foreign companies increase investment in innovation, China's manufacturing sector will further upgrade and consolidate its advantages. China's transformation from a world factory to an innovation-driven manufacturing hub will further help maintain the stability of the global industrial chain and supply chain, and hedge against the disruption and damage caused by US political interference.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn