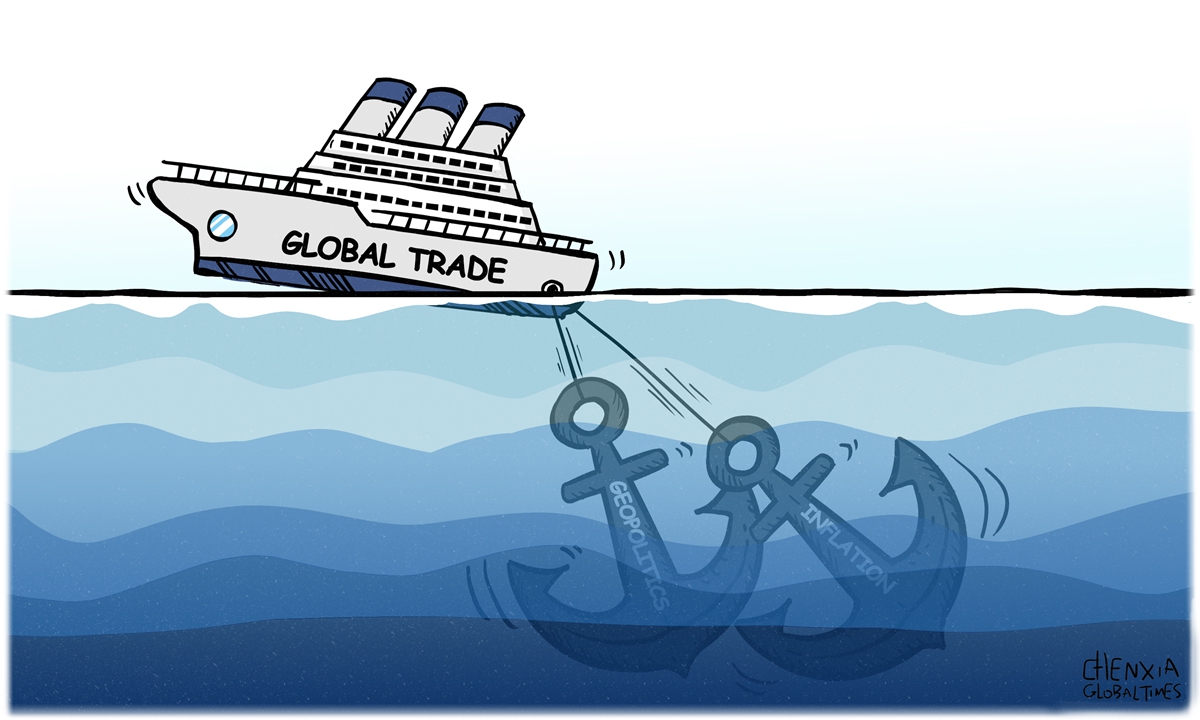

Illustration: Chen Xia/Global Times

Global trade is expected to remain largely subdued this year, the World Trade Organization(WTO) said in a recent report, as persistent inflation, muted economic growth prospects and other geopolitical headwinds continue to weigh on the world's major economies and curb their demand for imported goods and services. Uncertainties are associated with the shifting monetary policy in advanced economies and the unpredictable nature of the Ukraine crisis.Inflation has become the single most potent factor inhibiting household consumption and nation-to-nation trade as elevated prices eat into average consumer's buying power and negatively impact manufacturing activity. With mostly stagnating disposable household incomes and dwindling post-pandemic handouts by governments, international market demand for manufactured goods will be flat throughout 2023.

WTO economists predict global merchandise trade will grow by merely 1 percent in 2023, down sharply from last year's 3.5-percent expansion. After a resilient performance in the first half of 2022, global trade deteriorated in the second half of last year due to softening demand worldwide. Currently, an oversupply of merchandises is estimated to continue this year, as containers keep stacking up at sea ports and ocean shipping rates have kept dropping to low levels unseen since early 2020.

China's timely lifting of strict epidemic restrictions in December, and its re-energizing economy and rising consumer demand point to a growing Chinese appetite for overseas goods and services - a positive factor that can proportionately offset the shrinking demand from Europe and North America where high consumer prices are baked in. Japan is also witnessing an inflation rate of more than 4 percent now, according to latest official data.

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) price index, the Federal Reserve's preferred gauge of price hikes, edged higher to 4.7 percent in January, much higher than market analysts' forecast of 4.3 percent. The hot inflation report led to another sell-off on Wall Street on Friday. As a hawkish US central bank is set to raise interest rates to even higher levels in 2023, the odds of a hard landing of the world's largest economy are increasing. A slump in the US and Europe will significantly curb world trade.

In addition to deeply trenched inflation, geopolitical skirmish and economic and technology clash between the world's major powers will hold back progress of global commerce in 2023 and beyond.

The grinding military conflict in Ukraine has now entered its second year, which shows little signs of a let-up or coming to a ceasefire as the US and its NATO allies look set to continue sending billions of dollars of lethal weapons to the battlefields. US President Joe Biden personally visited Kiev to trumpet the war effort. Moscow said that it cannot afford to lose the fighting or Russia will be "torn into pieces" by the West. By all metrics, the conflict and its complications will have profound negative impact on trade in Europe and the world.

Russia has faced the most sweeping economic and financial sanctions imposed by the West, and its trade with Europe and G-7 countries has been largely cut off. The US' intent is to fundamentally weaken Russia through the sanctions. To inflict deep hurt on Russia, the US went to the extreme. According to Pulitzer Prize-winning reporter Seymour Hersh, who is noted for exposing the My Lai massacre and its cover-up during the Vietnam War, the White House ordered the notorious CIA to detonate and destroy the Nord Stream pipelines in the Baltic so that natural gas trade between EU countries and Russia could be terminated.

US secretary of state Anthony Blinken said that halting Nord Stream is a "tremendous opportunity to one and for all remove the dependence on Russian energy." No wonder Hersh wrote in one of his essays: "The war I know about is not the war you're reading about." The mainstream US media outlets have described Russia as a "pariah state" during the past 12 months, despite the fact that the NATO is encroaching to the doorstep of Russia, severely endangering its national security.

And, the global trade is disrupted by the US government's nefarious suppression of China's economy just because the latter's growth rates have outpaced the US for a number of years. As economists complain, the largest commercial and technology conflict in modern history, the US-China tariffs war and tech decoupling, launched by Donald Trump almost five years ago and being intensified by Biden, will undoubtedly sabotage global trade.

Although there is growing evidence that the heightened tariffs have inflicted considerable pain on US consumers and manufacturers, significantly contributing to its elevated inflation, the shortsighted anti-China politicians in Washington are stuck to its strategy of containing China. Did the US' trade war generate the desired leverage over China? The answer is no, as China's trade with ASEAN countries, with RCEP partners, and with all its neighbors, including Russia and India, have blossomed. China's export growth is estimated to tick up by 7-10 percent this year.

In a nutshell, the prospects for global trade in 2023 are bleak, as energy prices have skyrocketed, inflation has become more broad-based, and the US is sending more weapons and money to fuel the Ukraine war, while it finds itself further entrenched in unilateralism and protectionism - eventually obscuring itself and rattling the world.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn