NEV industry calls for subsidy continuation for Chinese consumers

Industry calls for subsidy continuation for Chinese consumers

An NEV charging station in Taiyuan, North China's Shanxi Province Photo: VCG

China's new-energy vehicle (NEV) sector, securing the world's top ranking in terms of output and sales for eighth consecutive year in 2022, has been put under the media spotlight in the world, which will continue to be a strong driving force in China's quest for green development.

Industry executives and experts shared their insights on the NEV sector's future growth ahead of the annual two sessions, focusing on how to boost sales and improve core technologies in an increasingly competitive environment.

"NEV users in China now have better consumption experiences thanks to continuous market expansion and advancements in technology as well as a reduction in costs," Li Shufu, a member of the 14th National Committee of the Chinese People's Political Consultative Conference (CPPCC), said on Saturday.

The recycling capacity of China's NEV industry has also improved significantly, he said.

"The whole industry is built around the green, environmentally friendly, energy-saving, and sustainable course," Li, who's also the founder and chairman of Chinese automaker Zhejiang Geely Holding Group, told reporters at the Great Hall of the People in Beijing on Saturday.

For instance, the recycling rates of nickel and lithium, key elements in batteries used by electric vehicles, have exceeded 95 percent in China, Li said.

As home to the world's largest NEV market, China has accumulated obvious advantages in some technology segments like electric battery, led by battery titan Contemporary Amperex Technology (CATL) which now boasts a global market share of more than 37 percent last year.

Feng Xingya, a deputy to the 14th National People's Congress (NPC), also general manager of the state-owned automaker Guangzhou Automobile Group (GAC), said ahead of the two sessions that the usage of domestically-manufactured auto chips should be enhanced.

"The overall shortage in the chip industry has eased over the last two years with the support of national and local governments, but the localization rate of automotive chips with high computing power and stability remains low. The development structure of the chip industrial chain is unbalanced," Feng said.

He proposed to accelerate the guidance of industrial transformation at the policy level, by promoting research, development, and application of high-end chips. Meanwhile, supportive measures for auto-use chips should come in an all-rounded way such as improving the application guarantee mechanism, and incorporating technical specifications and testing standards for the sector.

An NEV charges at a charging station.Photo: VCG

Green subsidies

As the government incentives for NEVs came to a close on the last day of 2022, industry observers worried that there could be slower EV sales in the coming months after the subsidy policy phase-out.

Feng of GAC proposed a continuation of the government's subsidy policy which was launched in 2009, yet it should transform into a demand-side strategy, meaning preferential subsidies should go directly to consumers instead of automakers.

Some experts suggest that the removal of government incentives is a necessary move for the industry's long-term and sustainable development. To fill the vacuum, more supportive measures should be put in place as auto consumption is one of the major areas helping expand domestic consumption.

"In 2022, the country issued a series of policies for the NEV sector, and the effect was obvious. This year, it is necessary to continue to introduce new policies to stimulate the consumption potential of the auto market and help stabilize the economic market," Cui Dongshu, secretary general of the China Passenger Car Association, told the Global Times.

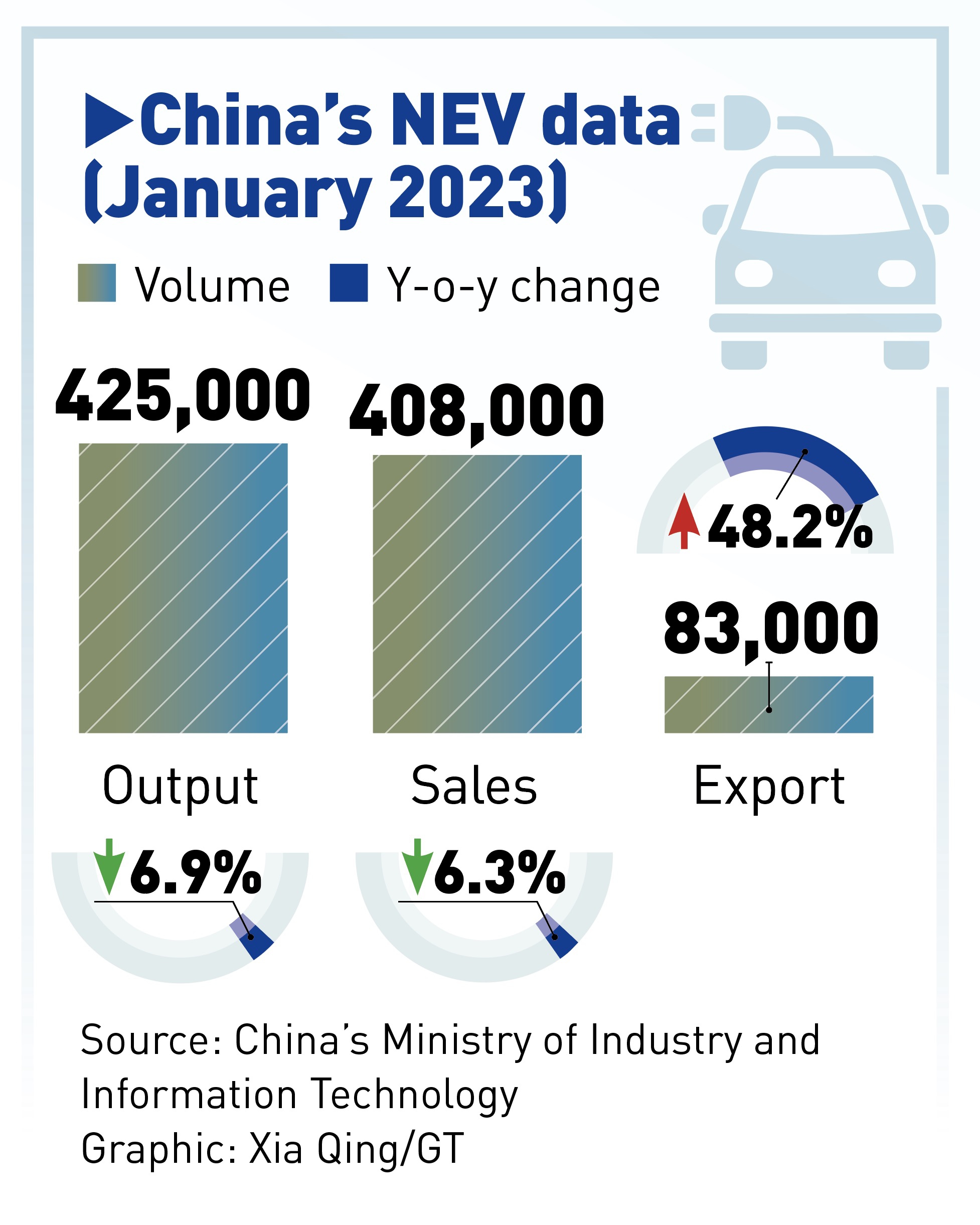

The latest data from the China Association of Automobile Manufacturers (CAAM) said that in January, sales of electric vehicles and plug-in hybrids decreased by 6.3 percent to 408,000 units from last year, ending a 30-month growth streak.

Analysts projected that January would be the lowest point throughout the year, and that sales growth would remain positive in 2023. The CAAM forecasts that China's NEV sales in 2023 will reach 9 million units, up by 35 percent year-on-year.

Graphic: Xia Qing/GT

Hydrogen fuel cells

Apart from electric vehicles and plug-in hybrids, the two widely used NEV types in China, the third model - fuel cell vehicles that use hydrogen as an energy source or other fuels to cleanly and efficiently produce electricity - is also seeking to leave a bigger footprint in the world's largest NEV market.

"Under the guidance of the national policies, the hydrogen energy industry, especially the hydrogen fuel cell vehicle manufacturing, has attained rapid development, and has achieved significant improvements in both industrial scale and cost-effectiveness, and the industry is about to enter the fast track of development," said Zhang Tianren, a deputy to the NPC, who is also chairman of Tianneng Power.

Zhang proposed that only by fully expanding the scope of demonstration applications of hydrogen fuel cells, enriching application scenarios, and improving infrastructure and regulations, can the country achieve scale advantages in the fuel cell vehicle sector.

In 2022, production of hydrogen fuel cell vehicles in China stood at 3,626 units, up by 105.4 percent year-on-year, and sales went up by 112.8 percent to 3,367 units, according to CAAM.