US investment curbs unlikely to disturb China's high-tech growth: experts

Nation remains a hot destination for global capital

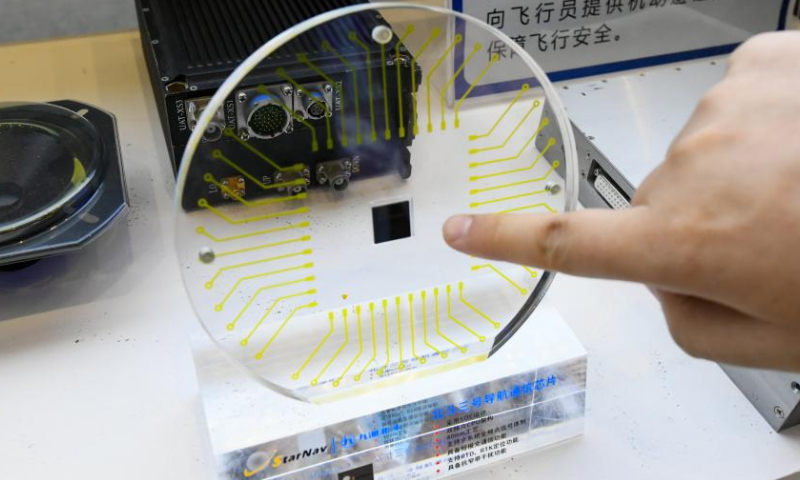

A communication chip of China's BeiDou-3 Navigation Satellite System is on display at the 10th China (Mianyang) Science and Technology City International High-Tech Expo in Mianyang, southwest China's Sichuan Province, Nov. 16, 2022. Photo: Xinhua

The Biden administration is reportedly weighing plans to restrict US investment in China's high-tech sector, which may be one of the least effective ways to contain the sector's growth. Chinese developers face no shortage of capital and the nation remains a hot place for global investors, Chinese experts said on Sunday.

The US is reportedly preparing a new "decoupling" push against China's high-tech industries by setting up barriers for American investors to pour money into China's high-tech industries.

The new program is expected to cover private-equity and venture-capital investments in advanced semiconductors, quantum computing and some forms of artificial intelligence, the Wall Street Journal reported on Friday, citing people familiar with the matter.

It is not a "surprising" move for Washington to extend its hostility against China's high-tech development into financial areas, but clearly it is not going to be an effective way, Ma Jihua, a veteran industry analyst, told the Global Times on Sunday.

Restricting investment takes a relatively long time to produce the desired results for Washington, Ma said, and there will be a series of unpredictable events along the way.

As the latest potential move, industry experts said that it may have some impact on the financing of certain projects in the short term, but it will be quite limited.

China's high-tech developers are no longer facing a massive shortage of capital, and there are a lot of alternative investors from both China and overseas, experts said, noting that it will be a huge loss for Wall Street if it misses the growth opportunities in the colossal Chinese market.

US investors have been continuously showing their interest in China, from stock markets to manufacturing. A recent survey conducted by the American Chamber of Commerce in China revealed that many US companies still find the market an attractive investment destination.

The wealth of opportunities presented by China's 1.4 billion consumers continues to attract member companies, the Chamber said, revealing that about 74 percent of the firms surveyed said that they are not considering relocating manufacturing or sourcing outside of China.

A report jointly released by the WSJ and US research firm Rhodium Group in 2021 showed that US venture capital firms, chip-industry giants and other private investors participated in 58 deals in China's semiconductor industry from 2017 through 2020, more than double the number from the prior four years.

The semiconductor industry is a representative sector of Washington's vicious crackdown on China's high-tech development. Yet, China has remained the largest chip market for years and Chinese producers are gaining market share all over the world, in spite of repeated assaults from the US.

Moreover, China has remained one of the top choices for foreign direct investment (FDI) in recent years. FDI in the Chinese mainland, in actual use, expanded 6.3 percent year-on-year to 1.23 trillion yuan ($178 billion) in 2022, according to data from the Ministry of Commerce (MOFCOM).

Of the total, high-tech industries attracted 445 billion yuan, surging 28.3 percent. Major investors such as South Korea, Germany, the UK and Japan all registered substantial growth of investment in China.

It is hard for global capital to find another market with as much potential as China during the post-COVID era, experts said.

Commenting on a previous report about the potential investment restriction of the Biden administration on some Chinese technology companies, Shu Jueting, a MOFCOM spokesperson, said on February 16 that the US government's intervention in companies' normal business decisions through administrative approaches undermines market rules and the international economic and trade orders, and harms the interests of companies and investors. It goes against the interests of China and the US, as well as the whole world, Shu said.

"The US could not give up its hegemonic attitude and refuse to accept the reality of the development of other countries," Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times.

Such power play and trade protectionism are definitely harmful to global scientific and technological progress, Dong said.

Taking the semiconductor industry for instance, any act of tearing apart the global industrial system will cause immeasurable harm to the life and development of people all over the world, since it is a global industry, which has long been highly dependent on the global division of labor and cooperation, the China Semiconductor Industry Association said recently.

Openness and cooperation is the best way to create value and promote global progress, the association said.