Illustration: Tang Tengfei/Global Times

The turmoil in the US banking system, caused by the sudden collapse of Silicon Valley Bank and Signature Bank, showed some signs of subsiding over the weekend, but the tumult, coupled with future market uncertainty pertaining to the Federal Reserve's interest rates policy and still elevated inflation there, will continue to dent the confidence of US depositors and cast a thickening cloud over the country.Although US President Joe Biden and Treasury Secretary Janet Yellen both said the US' banking system was "sound," the run on bank deposits which brought down Silicon Valley Bank and Signature Bank did not abate, indicating depositors' largely fragile confidence in the system.

Prodded by the regulators, a group of 11 large banks in the US reached a deal to collectively inject $30 billion to prop up the precarious First Republic Bank, another medium-size lender caught in the financial turmoil. Four of the country's biggest banks, JPMorgan Chase, Bank of America, Citigroup and Wells Fargo, agreed to contribute $5 billion each. Nevertheless, investors' jitters remain as they continued to dump shares of First Republic Bank, which dived a whopping 32.8 percent on Friday.

Now, coming after a turbulent and miserable 2022, an increasing number of market watchers believe 2023 is going to be another unpredictable year for Wall Street and the world's largest economy. Despite 14 years having passed after the 2008 financial debacle, the US financial system has not improved, and still is blighted by perplexing loopholes. Regulation and oversight of US banks and other financial institutions remain problematic. It is still too early to claim whether there will be other US market players follow the heels of the above trio and shut down this year.

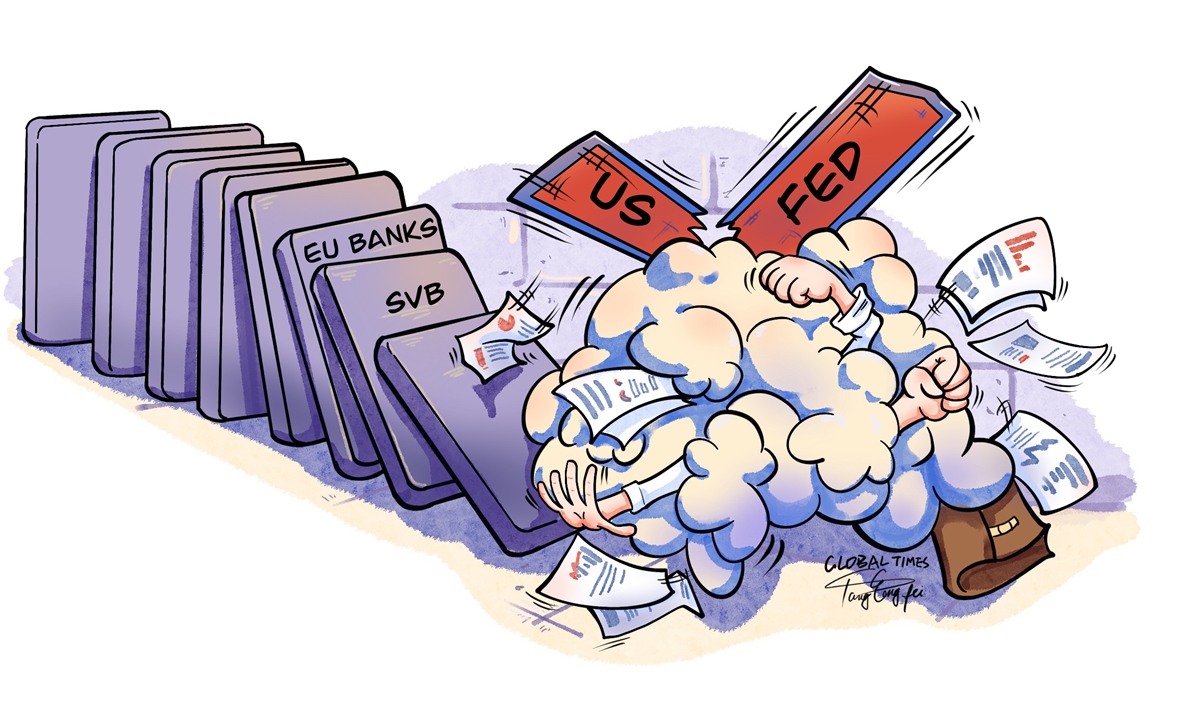

To make matters worse, the contagion of fallen US banks seems to be spreading to Europe, where the banking giant Credit Suisse received an emergency $54 billion lifeline liquidity injection from Switzerland's central bank last week in order to survive. Investors' nervousness is unlikely to disappear over the coming weeks as the pundits are warning this could just be the beginning of a domino collapse.

And, there could be more hidden risks still undetected and lurking within the system, particularly after an unusually fast increase in interest rates by the US Fed and other Western central banks in the past year. For instance, the European Central Bank moved to raise the eurozone' benchmark rates by another half a point on Thursday, which is feared to induce a serious economic distress and sharply increase banks' financial burden. The Fed is also likely to raise federal funds rate by 25 basis points in March, which will put further pressure on the US economy and its financial system.

There is another weighty uncertainty hanging over the US. If one thinks the market chaos when two midsize banks capsize is bad, wait till what happens if the Republicans-controlled US Congress obstructs the Biden administration's motion to raise the federal government debt ceiling and cause the country to default. Just imagine what the run on banks will be like when the default on the US' debt-repayment obligations happens. Throngs of people will swarm to the banks withdrawing their deposits, which will cause another financial tsunami in the world.

The recent financial market turbulence has dumbfounded global investors who used to think the US economy under the steward of Biden and his fellow Democrats as "more thoughtful and resilient" than managed by his predecessor Donald Trump and the Republicans. But the ongoing turmoil seems to suggest the opposite.

During the recent market ructions, the US mainstream media has put the blame squarely on Trump and Republicans, alleging if they had not compromised on strict banking regulation that were put in place in Barrack Obama's tenure, the US wouldn't have the current banking crisis. These media outlets accuse the Republican mantra of financial deregulation is a threat to the stability of the US economy. Some are asking that all US banks must be subject to stress testing at regulated intervals, and bank executives should be subject to claw-back of their huge remunerations if their banks melt down and need to be bailed out by US taxpayers.

US policymakers have sought to contain systemic financial risks by backstopping lenders teetering on the edge, and although those efforts have helped ease investor concerns to some extent so far, the market anxiety is not fully resolved yet. US households are jittery as people are trying to figure out which other banks might be susceptible to similar troubles. And, there could be more bad news to come, bending US policymakers' hands.

The Fed will be sitting on tenterhooks as the officials balk at continuing its monetary tightening policy to rein in consumer price rises. The tumult in US financial markets are set against the concerning cross-current of a brewing banking crisis while the damaging inflationary pressures stubbornly persist. If the US central bank keeps aggressively pushing interest rates higher, the stress on US lenders, private equity funds, real estate developers and other institutions will only increase.

After all, the blame for current plight should go straightly to the US government and the Fed for they have chosen to neglect one basic economic rule - that fiscal and monetary prudence is always needed. Biden's signature $1.7 trillion pandemic rescue splurge and the Fed's money-printing orgy caused the inflation which ultimately led to the mess of the troubled banks. In a nutshell, to believe that the US financial system solely based on blind greed will work smoothly is unrealistic, and will backfire, causing more turmoil and loss.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn