China’s ‘Big Fund II’ makes intensive investments, as country aims to overcome US chip ban

An employee of Semiconductor Manufacturing International Corp works at the company's factory in Beijing. Photo: Xinhua

The second phase of the National Integrated Circuit Industry Investment Fund Co, also known as "Big Fund II", has invested heavily in China's semiconductor manufacturing, equipment and related materials to deal with the US government' containment and suppression.Chinese leading photoelectric new material producer Jiangsu Nata Opto-electronic Material Co recently announced that the "Big Fund II" had become an important shareholder of its subsidiary in Ningbo, East China's Zhejiang Province.

Leading high-tech new materials producer Crystal Clear Electronic Material Co said that it will receive an investment of 160 million yuan ($23.23 million) from the fund.

Projects like Crystal Clear Electronic Material will be the first batch of investments since Zhang Xin took the leadership of the state-backed chip investment fund in early March, and shows that the "Big Fund II" is restarting a new round of investment.

The "Big Fund II" was established in 2019 by the Ministry of Finance, China Development Bank and other parties, and is one of the most important government guidance funds that support the microchips sector. Armed with a total of 200 billion yuan in capital, the fund has backed more than 20 projects, the Securities Times reported.

The "Big Fund II" was suspended for some time in 2022 amid an anti-corruption campaign in China's chip industry. In February, the Big Fund became a shareholder of domestic leading memory chipmaker Yangtze Memory Technologies Co, committing investment of approximately 12.9 billion yuan.

In January, China's contract chipmaker Hua Hong Semiconductor said the company, the "Big Fund II" and another entity will invest $6.7 billion in a 12-inch wafer fab in Wuxi city, East China's Jiangsu Province.

"Compared with the first phase that focused on chip manufacturing, the Big Fund II seems to have increased investment in the upstream, including equipment and materials, so as to break bottlenecks as soon as possible and supply domestic demand," Fu Liang, an independent tech analyst, told the Global Times.

Meanwhile, the fund may also step up investment in applications such as 5G, artificial intelligence and smart cars in tandem with the country's emerging industry development strategy, according to Fu.

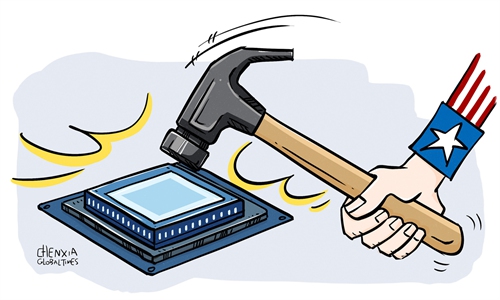

The move comes as China is speeding up efforts to achieve greater self-reliance in science and technology, as the US escalates its containment and encirclement of its imagined enemy.

While pressuring the Netherlands and Japan to curb chip exports to China, the US aims to further exclude China from the global chip industrial and supply chain by limiting the production expansion of globally leading chipmakers such as South Korea's Samsung and SK Hynix.

On March 21, the US Commerce Department unveiled "national security guardrails" of its CHIPS and Science Act, which restrict chipmakers that obtain US government funding from expanding output by 5 percent for advanced chips and 10 percent for older technology in China.

The US' hegemonic behavior will not shake China's resolution for tech self-reliance, but only damage the US' own chip research and development and manufacturing capability inhibiting its allies, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times.

"If chipmakers from South Korea and other countries and regions - under US pressure - cut themselves out of the world's largest chip market, they would get into a blind alley," Xiang said.

On March 24, Samsung Electronics Executive Chairman Lee Jae-yong visited a semiconductor components factory in Tianjin, operated by Samsung Electro-Mechanics and checked the multilayer ceramic capacitors production line, Yonhap News Agency reported.

While global chipmakers are on alert for mounting US pressure, Chinese domestic chip firms have been gradually filling the void left by the US' bad-faith ban.

On Tuesday, chipmaker Semiconductor Manufacturing International (SMIC) reported its strongest annual performance in history last year, with revenue up 39 percent year-on-year to 49.5 billion yuan, while profit was up 13 percent to reach 12.1 billion yuan.

The company said that its development of multiple platforms and projects are proceeding as planned. In 2022, the R&D of 28-nanometer high-voltage display driver integrated circuit technology platform, the first-phase development of a 55-nm BCD platform, a 90-nm BCD technology platform and a 0.11-um silicon-based OLED technology platform were completed and its products entered small batch trial production, according to a filing with the Hong Kong Stock Exchange.

In addition, Huawei Technologies has made breakthroughs in electronic design automation tools for chips produced at and above 14-nm technology, domestic news outlet Yicai reported on March 24.

"China has been accumulating technology in all aspects of semiconductor manufacturing. With the influx of more capital and talent, the country will successively make key technological breakthroughs during the coming years," Fu said.