Japan shooting itself in the foot by caving to US pressure on containing China: expert

An engineer analyzes chips at a chip factory in Nantong, East China's Jiangsu Province in February. Photo: VCG

Japan's willingness to blindly follow the US as its pawn in technology containment toward China may cost it dearly, Chinese experts said on Friday.

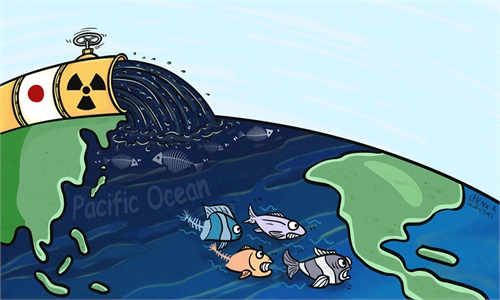

Japan's government on Friday said it plans to restrict exports of some 23 types of semiconductor manufacturing equipment. The move is seen to be the country aligning itself with the US technology curbs on China.

Chinese Foreign Ministry spokesperson Mao Ning said on Friday that politicizing trade, economic and technology issues, making them a tool and a weapon of the US, and destabilizing the global industrial and supply chains will benefit no one.

Japan will impose export controls on six categories of equipment used in chip manufacturing, according to Ministry of Economy, Trade and Industry. Equipment from cleaning, deposition, lithography and etching are affected and on the surface, it did not specify China as the target of those measures, noting equipment makers will need to seek export permission for all regions.

The ministry said that the goal of the export restrictions, to come into force in July, was to stop advanced technology being used for military purposes.

It is expected that major Japanese players in the field, including Nikon Corp, Tokyo Electron Ltd, Screen Holdings Co Ltd and Advantest Corp will be affected by the new rules.

Kyodo News reported on Friday that although Japan and the Netherlands did not specify China and are more lenient in exports control measures, these moves will surely meet with strong opposition from China.

Ma Jihua, a veteran tech analyst, told the Global Times that the latest Japanese move aims to put some of its discriminatory practices into writing but there is also a hype aimed at discouraging Chinese firms.

A web of containment set up by the US aimed at curbing China has already been shown to have a lot of loopholes and become increasing expensive to implement, Ma said.

The Chinese technology sector has withstood the US' technology stranglehold for six years, and homegrown solutions are expected to appear in a few more years, noted Ma.

"The Netherlands and Japan, pressed into service for the US, are also halfhearted, calculating their own best interests and are unlikely to act in lock step, further eroding the effectiveness of the US tech containment," Ma said.

Japan's move follows announcement by the Netherlands government on plans to restrict chipmaking equipment exports earlier in March. The move were also seen as being in alignment to US technology containment with the US in October imposing restrictions on chipmaking tool exports to China.

ASML CEO Peter Wennink visited China this week and met with China's Minister of Commerce Wang Wentao, on which occasion Wang said he hopes ASML will jointly safeguard supply chain stability of the global semiconductor industry.

China has repeatedly accused the US of orchestrating a "tech hegemony" and urged the Netherlands not to follow export control measures put forward by certain countries.

Chinese experts claimed that if Japan chooses to be a US' pawn, its companies will lose a big chunk of revenue and have to slash research and development investment. The curb will erode the long-term competitiveness of these companies and cost Japan dearly, they noted.

The spread of US' unilateralism is hurting the global economy and although Japanese companies have been affected by trade frictions between China and the US, most Japanese companies do not want to "decouple" from China, Tadashi Izawa, president of Japan-China Economic Association, said at the 2023 China Development Forum on March 25.

Amid a push for technology self-reliance and faster domestic replacements to break through the US' containment and encirclement, the second phase of the National Integrated Circuit Industry Investment Fund Co, also known as the "Big Fund II," has invested heavily in China's semiconductor manufacturing, equipment and related materials and other key links, with a notable increase in the upstream, so as to break bottlenecks as soon as possible and fuel domestic demand.

A CEO of China's telecommunication giant Huawei, under years of US crackdown, confirmed on Friday that the company is now able to design chip produced at or above 14-nanometer technology with homegrown electronic design automation (EDA) tools it develops.

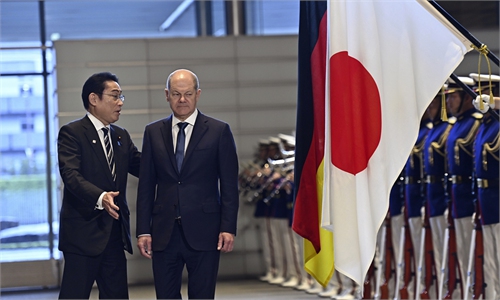

Japan's Minister for Foreign Affairs Yoshimasa Hayashi will visit China over the weekend, Foreign Ministry spokesperson Mao Ning announced on Friday.