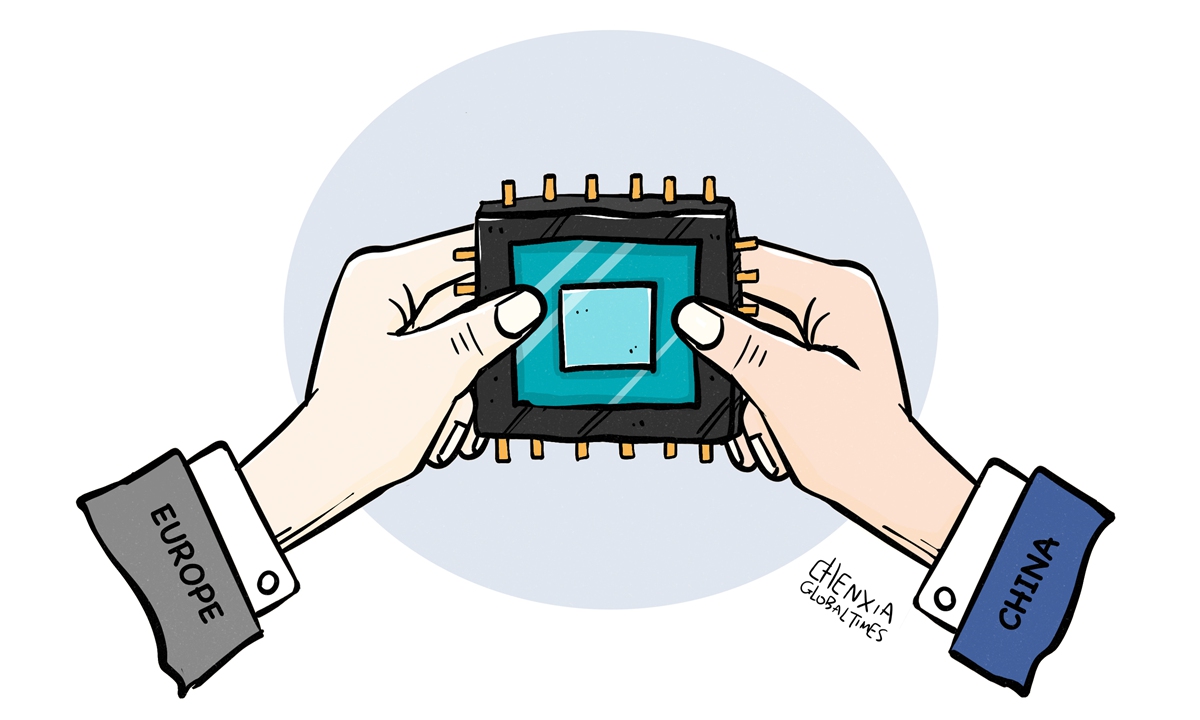

Illustration: Chen Xia/Global Times

The European Chips Act is likely to get the green light from EU countries and lawmakers on April 18, Reuters reported on Wednesday. As a frontrunner in some cutting-edge technologies, applications and researches, the EU's move in reinforcing its capabilities in semiconductor manufacturing is understandable. Yet, if the bloc wants to transform itself into a magnet for investment from first-class chipmakers such as TSMC, Samsung and Intel to revitalize its chip industry, only high subsidies may not be enough. Market is perhaps a far more important factor.

In 2022, US President Joe Biden signed into law the CHIPS and Science Act, which provides $52.7 billion for US semiconductor research, development, manufacturing and workforce development. Many believe the CHIPS Act will place the EU at a disadvantage in terms of attracting semiconductor-related investment.

The EU's attempt to narrow its subsidy gap with the US may help attract semiconductor investment, especially after European countries realize that the US could sacrifice any of its allies to serve the US' own national interests. Still, it should be pointed out that simply relying on subsidies is not enough. History has proved that no country can revitalize its economy and address its structural economic problems such as manufacturing hollowing-out simply through government subsidies and preferential policies.

The European Chips Act proposed by the European Commission in February 2022 has been widely seen as the EU's response to the challenges in global semiconductor industries. The act came at a time when global semiconductors shortages forced factory closures in a wide range of sectors from cars to healthcare devices. Now, after a year has passed, the situation has changed. Chip shortages have turned into a glut in many sectors. Some analysts believe the semiconductor surplus that emerged in the second half of last year is not expected to ease until at least the fourth quarter of this year.

Today the share of the EU in global production capacity is about 10 percent. By adopting the Chips Act, the EU aims to increase this share to 20 percent. One question worth considering is how to absorb newly-added capacity. The glory of some European electronics giants like Nokia and Ericsson seems to have faded compared with competitors in the US and Asia. Partly due to shrinking demand from Europe's electronics industry, some European chipmakers have shifted manufacturing out and focus mainly on the semiconductor consumption market in the Asia-Pacific region.

As semiconductors become a new US tool of geopolitical competition, it's understandable that the EU is trying to reinforce its capabilities in chip manufacturing, but an increase in production capacity means the EU should further strengthen, not reduce, its connection with the semiconductor consumption market in the Asia-Pacific.

China is the world's largest semiconductor consumption market because of the size of its domestic electronics market and its status as production base for global electronics giants. At a time when European policymakers are aiming to promote semiconductor chip manufacturing, it is crystal clear they should strengthen economic and trade cooperation with China, because European semiconductor makers need China's chip consumption market.

Nevertheless, as the US' ill-intentioned chip war against China escalates, Washington is striving to convince and rope in Europe to its side, because the latter has been seen by US politicians as an ally that can be sacrificed for the US' own national interests. For instance, the Netherlands is under US pressure to block its tech champion from selling chipmaking machines to China.

Chinese representatives at the WTO on Tuesday urged the multilateral trade organization to scrutinize US-led technology export restrictions. The representatives asked whether the widely reported export control agreement among the US, Japan and the Netherlands reportedly aimed at curbing China's ability to make advanced chips exists. "Relevant players may have realized that the agreement adamantly violates WTO rules," Chinese representatives said, according to CCTV.

The US' ill-intentioned chip war is a dangerous game, in which Washington will not hesitate to hijack the global semiconductor manufacturing sector as cannon fodder. If European semiconductor makers are isolated from their consumption market, the European Chips Act will become a waste paper. China and European countries have complementarities and potential for cooperation in boosting the development of their semiconductor industries. The EU should not be hijacked by US politicians' selfish policies.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn