Issues in globalization need to be addressed in the spirit of mutual assistance, not through protectionism and US demonizing China: Nobel laureate Angus Deaton

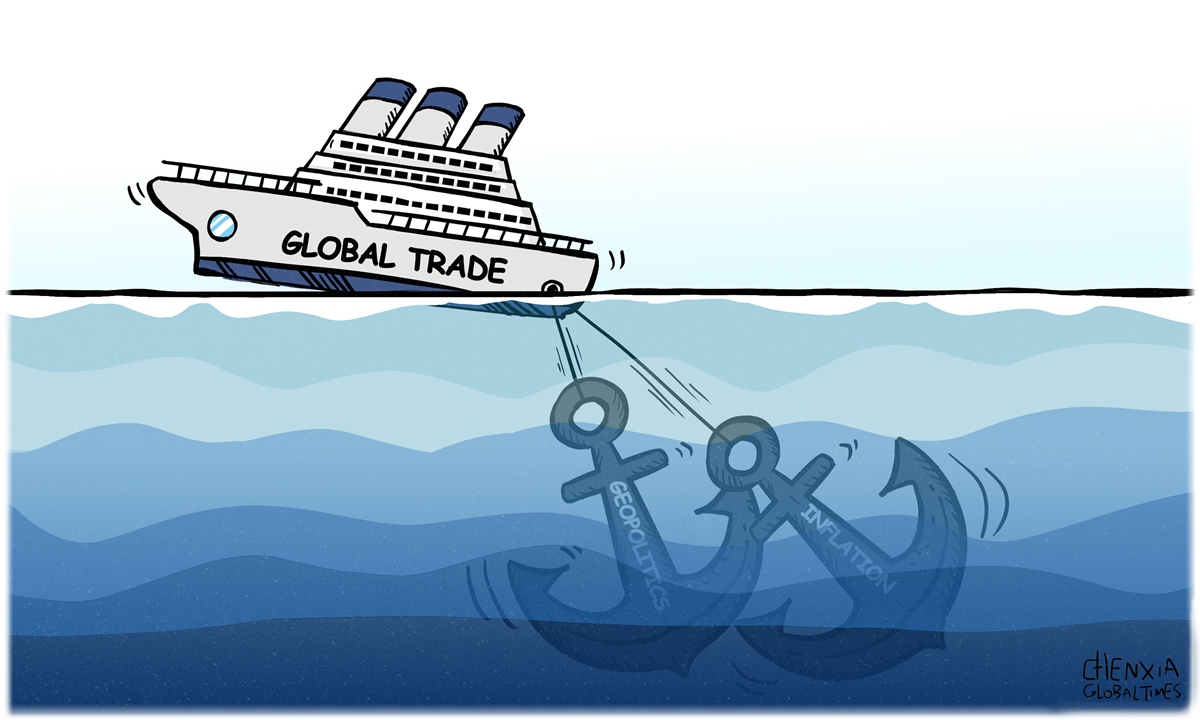

Illustration: Chen Xia/Global Times

Nobel Prize winner, Princeton University professor, Sir Angus Deaton Photo: Courtesy of Angus Deaton

GT: Over the past three decades, China's economy has made great strides in poverty reduction. Now China's economic development is striving toward the goal of high-quality development. How do you view the advantages and challenges related to this new path?Deaton: This is a key issue for policymakers in China. As has been the case elsewhere, in accounting for progress, quantity has become less important and quality more important. China has been incredibly successful in the quantity phase, and for an extraordinary long time. But improving quality remains a challenge. This is one of the areas where collaboration with other countries can help to bring "learning by doing," and where there is a real payoff to reductions in the currently tense international relations. Foreign firms need to feel able to work in China.

GT: Official statistics show that the contribution of final consumption to China's GDP growth in 2022 were 1 percent. Chinese household saving rates remain at a high level, can China expect consumption to make greater contribution to economic growth in coming years?

Deaton: That would certainly be desirable, and I think that policymakers in China have had that goal for some years now. I think the longer-term prospects for consumption growth are good, and will be helped by the relaxation of the one-child policy - provided people in fact choose to have more children - and also by the falling number of workers relative to elderly and young dependents. People will have to spend more relative to what they earn.

GT: Sharp, long-lasting slowdown is expected to hit developing countries hard in 2023, according to World Bank. How to prevent more people in developing countries from falling back into poverty?

Deaton: I am sure the World Bank has thought very carefully about its projections, but there remains a great deal of uncertainty. I remember at the beginning of the pandemic in 2020, there was much concern about what would happen in developing countries, and how they would be devastated by the pandemic risking previous poverty reductions. Yet it didn't happen, largely because - with some exceptions - the death toll from COVID-19 was low in many poor countries. Note also that the Bank's poverty estimates rely on surveys that are available with considerable lags, so that the current projections are based on links with GDP, links that are likely to have been modified by the pandemic and its aftermath. Of course, uncertainty is not the same as knowing that poverty reduction will be on a good path. But I am hopeful.

GT: Many advanced economies, especially the US, are facing the risk of stagflation. Now the sudden failure of the Silicon Valley Bank (SVB) and the Signature Bank has caused more concerns. Will the crisis continue to expand within banking systems across Western countries? How countries should jointly guard against financial risks and maintain global economic stability?

Deaton: Everything we know about contagion in banking tells us that we can't predict it! I think the authorities in both the US and Europe have done very well so far, which doesn't mean that it is all over. Western bankers and regulators are going to have to learn from this episode, and perhaps bankers will learn, once again, that things can go badly wrong. China has many more tools to handle its banks than do Western policymakers, so Chinese banks are unlikely to be a threat to global economic stability.

GT: What's next for globalization? Has globalization stopped? How should countries jointly tackle rising protectionism?

Deaton: Globalization has slowed, but not stopped. There are many different measures, and they give a range of results. Protectionism is an understandable response to the fact that so many people have been hurt by the changes that globalization has brought, but it is not a good response. Much better would be the development of better automatic stabilizers - safety nets - particularly in the US where they are weak. Regional policy might well help too.

GT: What's your take on the root cause of the economic problems between China and the US and problems that emerge in the process of globalization? How do you view the US response to these problems? In face of global economic gloom, how should China and the US - the two largest economies in the world - overcome obstacles encountered in economic and trade cooperation?

Deaton: There are many causes of the economic problems between China and the US, though I agree that internal US problems are important. And globalization has benefited many Americans, but it also did not help many more. The answer here is for everyone to recognize that there is a problem, and that cooperation and understanding are required to deal with it. And not for the US to demonize China and to make the world a much more dangerous place. China also needs to be aware of the domestic stresses in the US and other rich countries. In an ideal world, US-China discussions would be held in a spirit of mutual assistance, as in how can we help?

GT: How do you view the rhetoric of economic and technology decoupling as well as protectionism advocated by some US policymakers and its likely impact on the global economy?

Deaton: Technology is a somewhat different issue, and I think the real issues there are to do with data gathering in general, and not with China in particular. Once again, it is unfortunate that so many American policymakers have made China a scapegoat here, instead of dealing with the threats that come from data gathering by big tech in the US. That said, and has been recognized at least since Adam Smith, there are genuine national security issues at stake here.