Share of yuan in Russia's FX market hits record amid worldwide de-dollarization push

Chinese yuan Photo:VCG

The Chinese yuan's share in Russia's foreign exchange transactions hit a new high in March amid the accelerating push by countries and regions to seek a more diversified international monetary system. The yuan is expected to see continuous growth as an international currency, Chinese experts said on Tuesday.

The proportion of the yuan/ruble currency pair reached 39 percent in on-exchange trading, whereas that of the US dollar/ruble pair fell to a multi-year low of 34 percent, the Russian central bank said on Monday.

A Russian bank that focuses on small and medium-sized businesses, NBD-Bank, has joined the Cross-border Interbank Payment System, which specializes in yuan-denominated cross-border payment clearing, Russian media reported on Friday.

"As China and Russia see an enhanced strategic partnership of coordination and closer economic and trade ties, the growing share of the yuan in Russia's foreign exchange market is within expectations," Sun Huijun, an expert focusing on international strategic studies, told the Global Times on Tuesday.

Bilateral trade hit a record of $190 billion in 2022, surging 29.3 percent year-on-year. Chinese experts said that besides growing trade in energy, China's exports of mechanical and electrical products to Russia are expected to increase along with the recovery of the Russian economy.

Against this backdrop, it is expected that the yuan's share in bilateral trade settlements will continue to increase, they said.

With Washington weaponizing the US dollar and the SWIFT international payments system, normal international trade and settlements have been severely affected. Countries and regions have realized the need to seek a diversified international monetary system, instead of heavily depending on the greenback, Sun said.

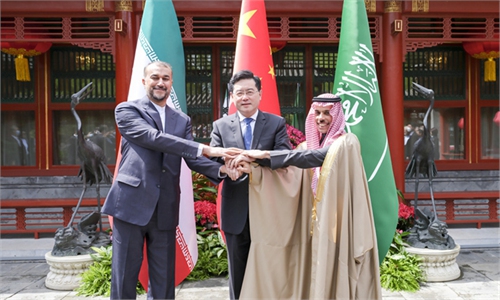

On March 28, Chinese national oil company CNOOC and France's TotalEnergies completed China's first yuan-denominated liquefied natural gas trade. China and Brazil reached a deal to trade in their own currencies, and the yuan has recently passed the euro to become the second most important currency in Brazil's foreign reserves, according to media reports.

Finance ministers and central bank governors of members of the Association of Southeast Asian Nations held a meeting in Indonesia on March 28, with the top item on the agenda being a discussion of how to reduce dependence on the US dollar, euro, Japanese yen and UK pound and move to settlements in local currencies.

Many countries are seeking a more diversified international monetary system, Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Tuesday.

Though the US dollar will remain the world's "dominant currency," its significance and "world position" will gradually go downhill, Xi said.

By contrast, amid the push to de-dollarize, the Chinese yuan is expected to see faster growth among non-dollar major currencies, Xi said, noting that the yuan's current global share doesn't match the country's colossal economy or its role as the world's largest trading country.

China's cross-border receipts and payments settled in yuan totaled 42 trillion yuan ($6.1 trillion) in 2022, an increase of 3.4 times from 2017. This figure accounted for nearly half of the country's total cross-border receipts and payments, Pan Gongsheng, a deputy governor of the People's Bank of China, the country's central bank, said at a press conference in March.

The yuan's weighting is now in third place in the IMF's Special Drawing Rights basket. More than 80 countries and regions around the world are using the yuan as a reserve currency, making it the fifth major reserve currency in the world, Pan said.