Illustration: Chen Xia/Global Times

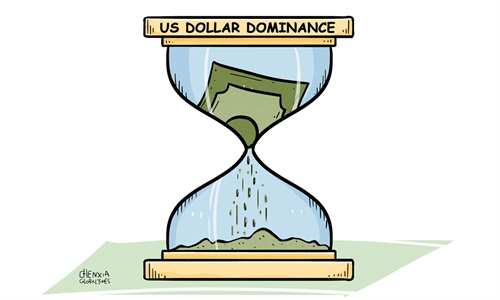

Bangladesh and Russia have agreed to use the Chinese yuan to settle payment for a nuclear plant Moscow is building in the South Asian country, a Bangladesh official said on Monday, according to Reuters. The two countries have chosen to use the Chinse currency for settlement in a project that does not involve China. This marks another milestone in the yuan's internationalization.Bangladesh and Russia agreed to use the yuan to settle payment also adds new evidence to the rising de-dollarization trend. It's an indisputable fact that an increasing number of major economies, both developed and developing ones, are striving to ditch the US dollar through innovating cross-border payment and settlement mechanisms, signing bilateral currency agreements, and promoting the diversification of currencies.

The Russia-Bangladesh pact to settle payments in yuan will be conducted through China's Cross-Border Interbank Payment System (CIPS), according to media reports. As the yuan's internationalization keeps gaining pace in recent years, more and more countries are accepting yuan payments through this system.

The yuan-centered payment network, which was launched by the Chinese central bank, the People's Bank of China, in October 2015, has been rapidly gaining popularity along the expediting yuan internationalization, with 79 direct participants and 1,287 indirect participants, covering 109 countries and regions around the world, as of the end of February.

While announcing its joining in CIPS in March, Brazilian bank Banco BOCOM BBM said that its aim is to reduce the costs of commercial transactions. NBD-Bank, a Russian bank for small and medium-sized businesses joined CIPS earlier this month, said that the move helps to improve quality of its services by reducing the processing time for yuan payments. Choosing to use the Chinese yuan - the currency of the second-largest economy and top trading partner of more than 120 countries - to settle payment through CIPS, other countries are also clearly in consideration of economic efficiency, rather than geopolitics.

Against the backdrop of an accelerating de-dollarization wave, many Western media outlets have portrayed the CIPS as a yuan-driven alternative to the dollar-dominated SWIFT system. It must be pointed out that this is misleading. The CIPS system is introduced to satisfy the inherent demand for cross-border payments amid yuan internationalization process. It is not designed to target any other currency or any other system.

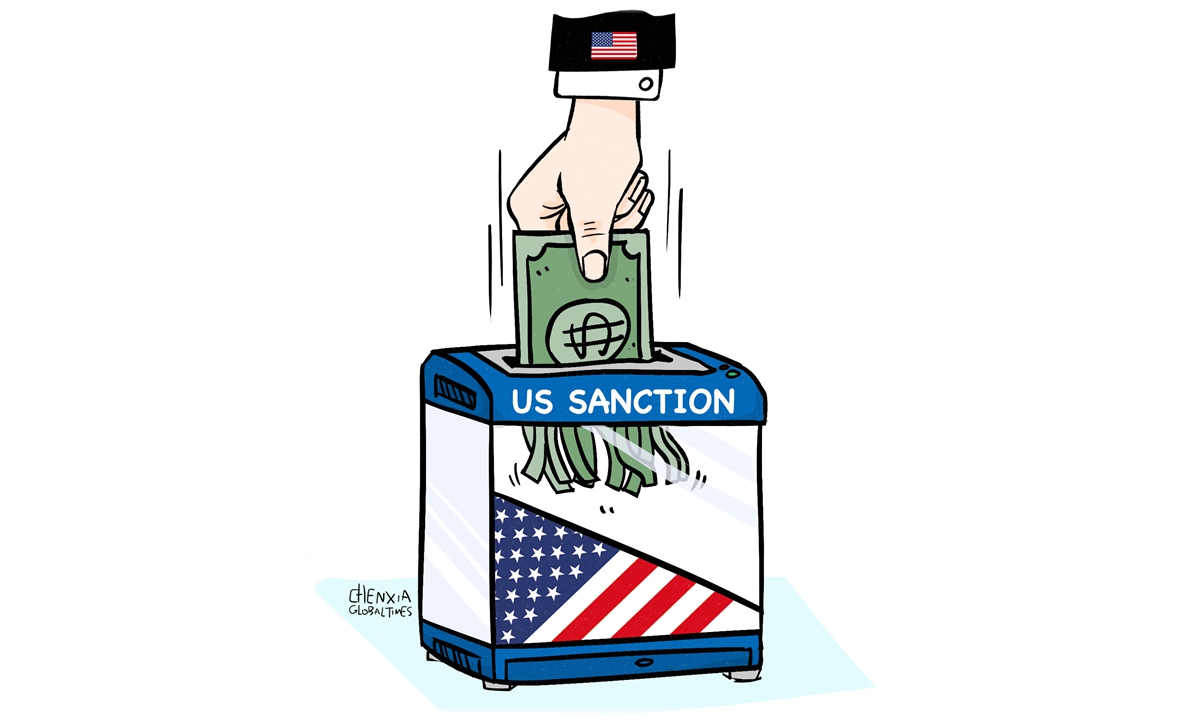

Evidently, de-dollarization is the self-inflicted result of the US' own actions. For a long time, the irresponsible monetary policy of the US and Washington's reckless sanctions backed by the hegemony of the US dollar have severely impacted the economies of many countries in the world. The choice of these countries to bypass the US dollar in international trade and economic cooperation is just to avoid the risks brought by the hegemony of the US dollar.

Even US Treasury Secretary Janet Yellen has admitted that US financial sanctions are endangering the dominant status of the dollar. As the US continues to impose sanctions on other countries at will, targeted nations are seeking alternatives, which over time could "undermine the hegemony of the dollar," Yellen was quoted as saying by US media outlet CNN.

The association between the self-inflicted de-dollarization and yuan internationalization is typical zero-sum thinking. In face of the US sanctions and irresponsible monetary policies, other countries' choice to bypass dollar settlement with other currencies should be respected. More importantly, the legitimate development of the yuan's internationalization should be respected.

The dollar hegemony has benefited the US at the expense of other countries for far too long. It is time for the US to reflect on its irresponsible policies and practices, and its abuse of the dollar hegemony, as well as the Cold War mentality, rather than further attempting to discredit the yuan's internationalization and other countries independent choices.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn