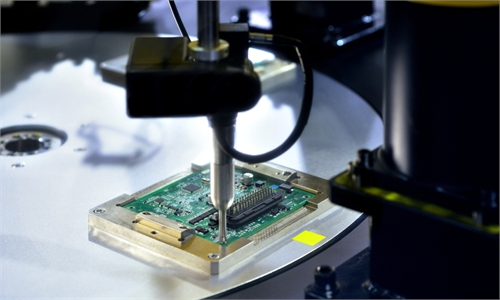

Chip Photo:VCG

Amid the US' hegemonic meddling in the global supply chain, the EU on Tuesday announced a 43 billion euro ($47 billion) provisional deal for its semiconductor industry, aiming to strengthen its chips sector and secure its resilience.

Industry analysts said on Wednesday that many countries and regions have realized the significance to enhance their own development as no one want to see the US alone dominating the global semiconductor industry.

The Chips Act is expected to create the conditions for the development of an industrial base that can double the EU's global market share in semiconductors from 10 percent to at least 20 percent by 2030, European Council said in a statement.

"This agreement is of utmost importance for the green and digital transition while securing the EU's resilience in turbulent times," Ebba Busch, Swedish Minister for Energy, Business and Industry, said in the statement.

It is expected to mobilize 43 billion euro in public and private investments, with 3.3 billion euro coming from the EU budget.

"With only 3.3 billion euro coming from the EU budget, it remains to be seen how much marginal effect it can generate and whether it can mobilize enough capital in the end," Fu Liang, an independent tech analyst, told the Global Times on Wednesday.

Experts noted that, like the US' Chips and Science Act, mobilizing private capital is not easy, as it is primarily driven by market rules.

The EU's market share has dropped sharply in recent years due to the rapid growth of Asia's chips sector and the US' increasing efforts to exert control over the industrial chain, Fu said.

In the 1990s, the EU had more than 40 percent of the global chip market, but that share has now fallen to about 10 percent, according to media reports.

Not only the EU, many countries and regions have rolled out measures to enhance the development of their semiconductor industries. It reflects that the global players have attached greater importance to the chips area which is the foundation for the future competition, Fu noted.

"The EU eagerly trying to catch up in the area also shows that it wants strategic autonomy instead of simply following the US steps," Fu said.

He further pointed out that no one wants to see the US controlling the entire industrial chain. "Instead of a one-pole model dominated by the US, global players, including the US allies, want to see a multi-pole development pattern," Fu said.

Upholding an "American first" principle, the US has been trying to maneuver the global chip supply chain which was one of the most globalized industry around the world. Not only has it tried to decouple from China, but it has also pressured other countries to align with its stance and reduce investments in China, the world's largest semiconductor market, experts noted.

However, the drawbacks of decoupling from China have become increasingly evident. Some governments have openly opposed the idea, and companies understand that losing the Chinese market could lead to severe crises and affect their future competitiveness in the international market, experts said.

Chinese companies have been forced to enhance their self-reliance, but at the same time, they never intended to avoid cooperation with global frontrunners, Fu said, stressing that "it is more of a competition and cooperation relationship under which different parties could compete and growth together."