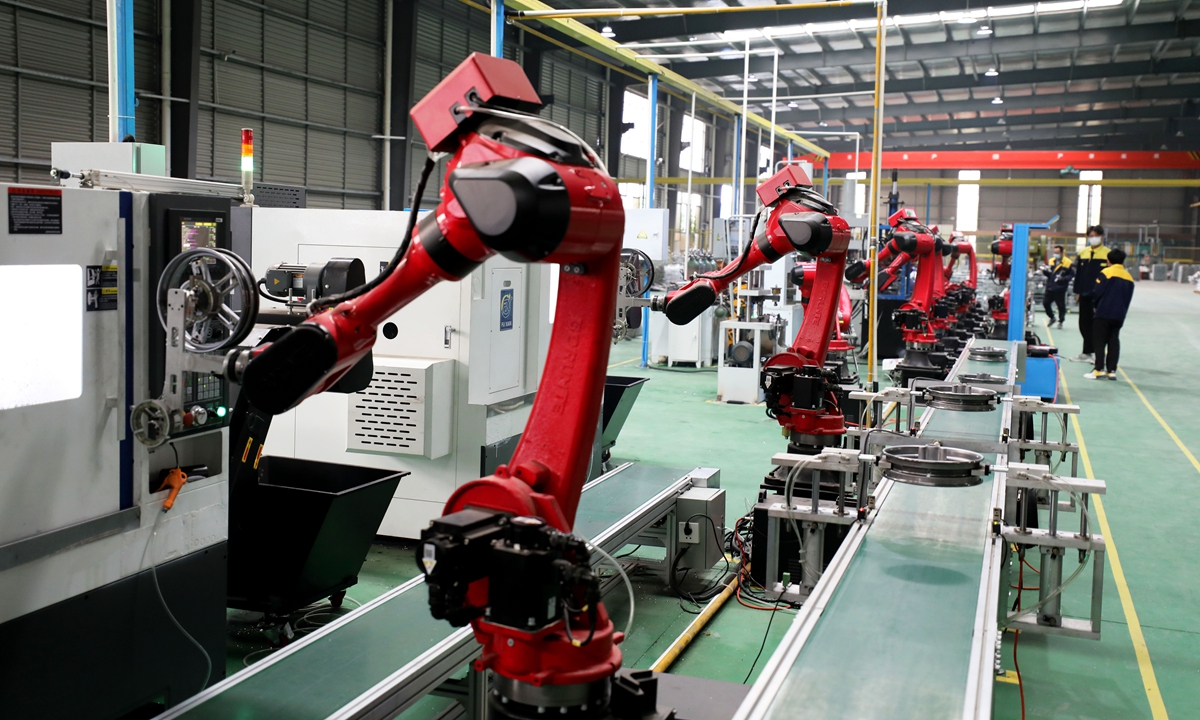

Robotic arms install vehicle and motorcycle wheel parts at an automotive parts assembly factory in a local industrial park in Huaibei city, East China's Anhui Province, on April 22, 2023. Photo: VCG

More than 80 percent of A-share companies listed on the Shenzhen and Shanghai stock exchanges made profits in the first quarter of 2023, thanks to expansion in domestic demand as well as science and technological advances amid China's digital transformation.

As of Wednesday, 1,786 listed firms reported their first-quarter results, with 1,477 achieving a profit. Their aggregate net profits rose 3.37 percent year-on-year to 283.52 billion yuan ($41 billion), local newspaper Yicai reported on Wednesday. Of them, 1,031 reported year-on-year growth in profit while 755 reported lower profit on a yearly basis.

Led by China's rapid digital transformation and accelerated spending following the adjustment of COVID-19 measures, companies in various sectors including services, electrical equipment, agriculture, and food and beverages posted better performances in the first three months.

Shenzhen-listed Feilong Auto Components Co said its first-quarter profit rose as much as 703 percent to about 70 million yuan in the first quarter. The company attributed its success to the fast development of the new-energy vehicle (NEV) industry in China, which drove a rapid revenue increase in thermal management components.

Beijing Yanjing Brewery Co, one of the largest breweries in China, said first-quarter profits reached 64.56 million yuan, surging by 74 times year-on-year.

"China's economy is rebounding fast. Both consumption and industrial output has recovered, with consumption in March exceeding broad market expectations. The consumption sector is expected to see another peak during the May Day holidays, which will serve as another opportunity to drive up consumption-associated companies," Yang Delong, former chief economist at Shenzhen-based First Seafront Fund Management Co, told the Global Times on Wednesday.

He expressed confidence in the A-share market this year, noting that the country's economic transformation will benefit consumption, NEVs, and the broad technology sector.

To strive for high-quality economic growth, China has made remarkable progress in digitalization. The country has implemented the national cyber development strategy and national big data strategy, promoted deep integration of the internet, big data and artificial intelligence, and facilitated digital industrialization, the Xinhua News Agency reported.

In the first quarter this year, big companies that focus on China's major development strategies had a leadership role. For instance, driven by cloud computing and big data services, Beijing-based China Unicom's revenues reached 97.22 billion yuan, up 9.2 percent year-on-year, the fastest in nearly a decade. Its profit jumped 11.6 percent to 2.3 billion yuan, the best first-quarter profit since it was listed in 2002, according to the company's Q1 financial results.

TCL Zhonghuan Semiconductor Co, a subsidiary of TCL that focuses on semiconductors and new energy development, estimated that its first-quarter profit ranged between 2.2-2.4 billion yuan, an increase of about 68-83 percent year-on-year.

Global Times