China’s chip industry faces opportunities even amid global glut caused by US disruption

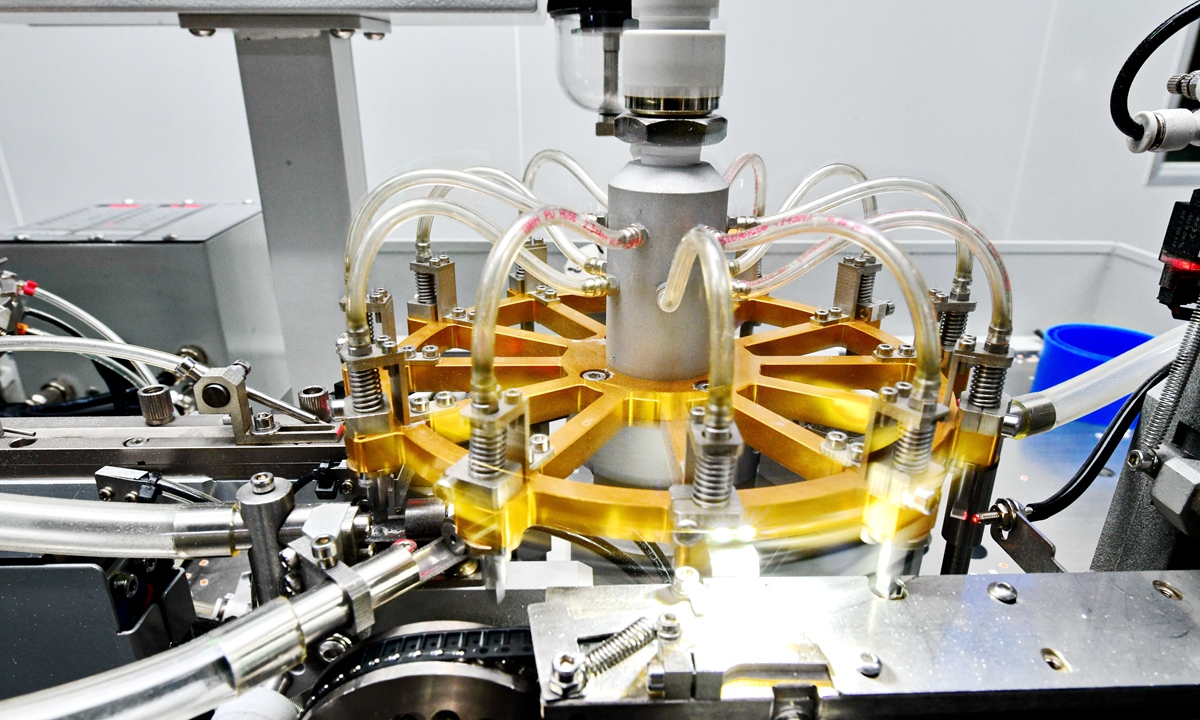

Manufacturing equipment of semiconductor products Photo: VCG

Global semiconductor sales have been slowing down over the past few months amid a lingering glut which is expected to last through 2023. This round of semiconductor sales slowdown is likely to have not reached its bottom yet, as global semiconductor business revenue in February declined 24 percent year-on-year, the second worst drop following the financial crisis in 2008, according to a report by Japanese media outlet Nikkei, citing data from World Semiconductor Trade Statistics Organization.

This is the consequence of the US moves of disrupting the global industrial chains and suppressing China's chip industry. The US has not stopped its practice of attempting to coerce more allies like South Korea with more reckless bullying measures to impose chip exports restrictions to China, which are expected to further disrupt the global chip industry chain, escalating imbalance between supply and demand. However, the goal of the US, to curb the development of China's chip industry, will fail completely.

Although the current global chip "overcapacity cycle" remains ongoing, and chip manufacturers in Europe, the US, Japan, and South Korea have seen a decline in revenue and are in a difficult situation, this may mean more opportunities for the development of China's chip industry. With huge market advantages and the economic system advantages that are able to mobilize a large amount of resources, the independent innovation of China's chip industry may accelerate its rise. China's semiconductor equipment and materials industry is expected to greatly benefit from the rise of domestic chip sector.

Oversupply in the semiconductor field means that prices will drop, which is undoubtedly good news for China, a major market of semiconductor products.

The current global oversupply of chips is partly due to weak demand amid global economic gloom, but also partly because the US has comprehensively curbed and blocked China's semiconductor industry, forcing China to increase its self-sufficiency rate. If the US coerces more countries and regions to impose chip export restrictions on China, China's self-sufficiency rate will only further increase, which means opportunities for China's chip manufacturing industry.

In 2019, China's chip self-sufficiency rate was around 30 percent. In the context of the US strengthening restrictions on China in the semiconductor field, China aims to raise the figure to 70 percent by 2025, which means that when the global chip industry is hit by oversupply, China's chip industry still has room for further growth.

Boosted by strong supports from the government, the revenues of Chinese chip manufacturing have seen rapid growth. For instance, SMIC's 2022 revenue totaled $7.2 billion, up 34 percent year-on-year while its gross margin stood at a record 38 percent. That's the second year of sales growth above 30 percent for the company.

China is also accelerating the improvement of supply chains such as semiconductor manufacturing equipment and materials. Large-scale manufacturing equipment and materials companies are promoting increasing investments to promote industrial development and fight against US containment. As SMIC plans to maintain the same investment level of $4 billion as the previous year in 2023, large Chinese companies that are striving to expandtheir own investment

As of April 18, 101 Chinese listed companies in the semiconductor industry chain have announced their revenues for 2022, realizing total revenues of 436.6 billion yuan ($63.2 billion), an increase of nearly 10 percent compared to 2021, according to media reports.

For overseas semiconductor companies, although China's chip self-sufficiency rate has increased, the vast Chinese market still represents a major opportunity. For example, while the US is working hard to coerce South Korea and other allies to impose restrictions on exporting chips to China, data from China's semiconductor industry research institute ChipInsights showed that China accounted for about 30 percent of the operating income of the three major US semiconductor manufacturing equipment companies in 2022, according to nikkei.

South Korea's chip manufacturing sector is facing great pressure amid weak demand and US coercion. Many semiconductor manufacturers are struggling to find a balance between their inventories and current demand.

Samsung said earlier this month that it will cut memory chip production after reporting operating profits of 600 billion won ($455 million) in the first quarter of 2023, down 96 percent year-on-year, amid cooling demand for memory chips and sluggish business performance.

Such data fully exposed the core purpose of the US' "decoupling" and breaking chains is at the expense of the interests of its allies. If its allies cannot withstand the pressure from the US and fall into its trap, they will only become victims of the US strategy and suffer more severe losses from the imbalance between supply and demand in the global semiconductor industry chain.

The author is director-general of the Beijing-based Information Consumption Alliance. bizopinion@globaltimes.com.cn