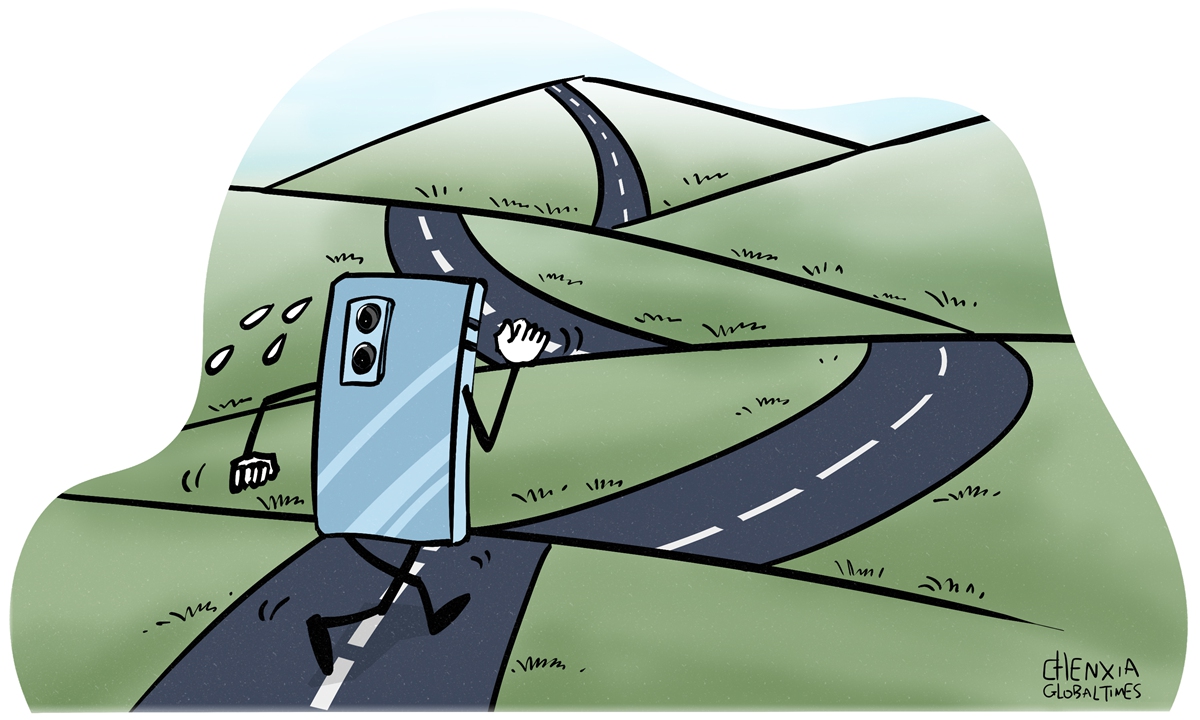

Illustration: Chen Xia/Global Times

After doing business in India for more than fifteen years, Wistron, an iPhone assembler, is reportedly winding up its local operations. The Hindu Business Line said in a recent report that the Taiwan-based assembler will mostly withdraw from India, and likely to approach the National Company Law Tribunal and the Registrar of Companies to dissolve its India operations within the next year.The news has not yet been confirmed by Wistron, but, for several months, there has been several media reports saying that India's industrial giant Tata Group has been in talks with Wistron to purchase its iPhone manufacturing facility in India. If the reports turn out to be true, Wistron's withdrawal and Tata's takeover may help offer a window to observe India's efforts in making itself a global manufacturing hub.

While the Western media outlets have been hyping the transfer of the industrial and supply chain from China to India since the COVID-19 pandemic, India's capability to undertake Apple production has not improved as they hoped. JPMorgan analysts said in a note in September 2022 that Apple could make 25 percent of all iPhones globally in India by 2025. Yet, India only undertakes 5-7 percent of Apple's production now, according to Piyush Goyal, India's minister of commerce and industry, US media outlet CNBC reported in January.

Apparently, there still remains a huge gap between India's manufacturing ambition and its reality. There are multiple reasons why India's manufacturing industry is finding it difficult to develop rapidly. According to Indian business magazine Insights Success analysis, lower power availability, lower labor productivity, unsatisfying intellectual property protection, and cost and fragmentation of transportation and logistics are all severely restricting the development of India's manufacturing industry.

In line with India's efforts to make itself a new "factory of the world," it has obviously placed more emphasis on developing Indian homegrown enterprises, but the country seems reluctant to open a larger market for foreign businesses. While many have been focusing on whether Wistron's iPhone manufacturing facilities will be acquired by Tata, less attention has been paid to why Wistron is reportedly winding up its India operations, giving up made-in-India iPhone, and what does it mean for Indian manufacturing industry. Wistron's reported withdrawal and Tata's takeover have, to some extent, become a massive boost for national pride. However, what is needed is rationality rather than emotionality, pragmatism rather than idealism.

India still has a long way to go in realizing its economic ambitions. In this process, the country cannot rely solely on Indian homegrown companies to make itself a global manufacturing hub; it should maintain and enhance its attractiveness to foreign investment. However, the inflow of foreign direct investment in India was only $45 billion in 2021, down nearly 30 percent from 2020, according to a report by the United Nations Conference on Trade and Development in 2022. For India, in order to revitalize its manufacturing industry, attracting foreign investment to drive the development of domestic industries is an inevitable step. That's why some foreign companies' withdrawal deserves serious attention.

China's experience can be used as a reference point. Looking back to the process of the rapid development of China's manufacturing sector in the past several decades, reform and opening-up strategies have been significantly benefited the growth of domestic industries. If India wants to step up the revitalizing of its domestic manufacturing industry, it is also inseparable from opening its market and actively integrating into the existing international industrial chain.

Moreover, India is now facing a more complex international environment than when China was developing its manufacturing industry. When China developed its manufacturing industry back then, there was ample space for mid-to-low-end light and heavy industries. Emerging markets themselves grew up together with these industries in China. However, the market has now become saturated and the industry has matured. India has to compete with advanced opponents with its own rudimentary industrial system. Hopefully India can create a fair business environment for foreign companies and continuously improve its manufacturing competitiveness.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn