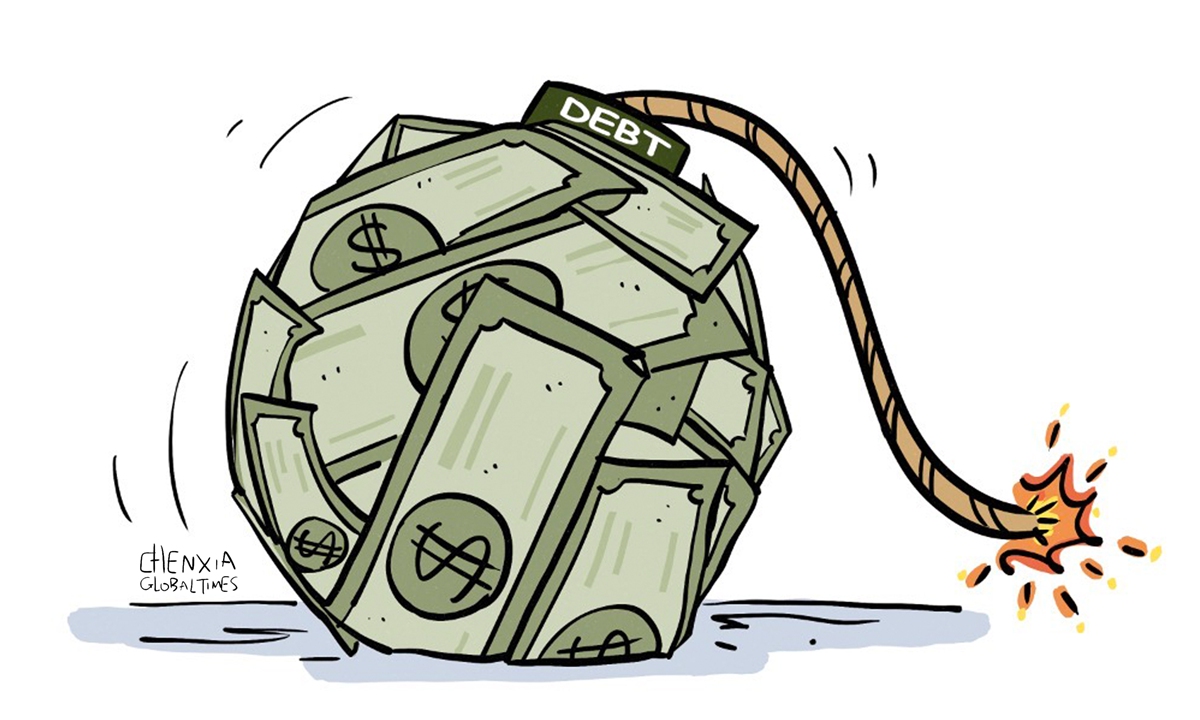

Illustration: Chen Xia/Global Times

The Biden administration is barreling into a new crisis as some US lawmakers in Congress refuse to raise the $31.4 trillion national debt ceiling unless the White House agrees to a meaningful cut in government spending. The tussle between Democrats led by Biden and their Republican opponents could become more partisan in the coming days, which will probably have enormous adverse implications for the country and the global economy.Coupled with deeply entrenched inflation and an evolving banking crisis, a possible US government default is likely to cause an economic recession of historic proportion in America, and severe market distress throughout the world.

By whatever metric, lawmakers are exercising responsible oversight over US government borrowing, and they are implementing a duty that is legally bound and financially prudent. When Joe Biden took office in January 2021, the level of federal debt stood at $27.8 trillion. Now just 28 months later, it has swelled to $31.4 trillion, a record high.

To make things worse, the US Federal Reserve, to fight inflation, has raised its benchmark interest rate to 5-5.25 percent now, highest since August 2007. Higher interest rates mean the US government will have to pay more for its huge borrowings which raises questions about its ability to service its own debt.

If the US government does not change course by reining in its fiscal splurge and endorsing some level of austerity, the country's national debt will continue to rise and reach at least $50 trillion by 2030, according to estimations by credible organizations in America.

Facing these dire circumstances, whether the country could still be able to service its hefty debt or whether the US dollar could retain viability and its current purchasing power is anybody's guess.

Now, Biden and his fellow Democrats are launching a media offensive to press their Republican opponents in Congress to abolish or at least raise the debt ceiling so they can spend freely. The Biden administration has accused the Republican-controlled House of disregarding America's economic security and taking the debt ceiling hostage to "blackmail America."

But isn't the ceiling a "hostage worth ransoming," if only Biden and Democrats agree to reduce their prodigal fiscal spending at the negotiation table? Frugality is always a living merit, according to Confucius, the Chinese philosopher.

For the country's long-term economic security, the lawmakers are obliged to attach some strings to US government's spending largesse.

Facing a showdown at the negotiation table, the Biden administration is warning that the wolf has come to the US door. Treasury Secretary Janet Yellen cautioned last week that the US could default on its debt as early as June 1, if legislators do not raise or suspend the nation's borrowing authority before then and avert what could potentially become a global financial crisis, according to the Associated Press.

But Republican lawmakers are, righteously, holding to their ground - unless there was an agreement on the negotiation table to balance the US' national budget within 10-20 years by axing wasteful government spending, they won't compromise and agree to raise the debt ceiling.

Jerome Powell, the Federal Reserve chairman, took the side of the Biden administration, saying that "Congress really needs to raise the debt ceiling," according to media reports. He remarked the "consequences" of failing to raising the debt limit may be extraordinarily adverse and could do longstanding harm to the country.

Perhaps there is an effective measure to prevent the US' national budget deficit from drastically increasing - to proportionately raise taxes on wealthy American households and giant corporations, coupled with a moderate reduction in government spending. Only when the country's revenues grow and expenditures are curtailed, can it avoid a fiscal implosion and economic depression in the coming years.

The spendthrift of the US government has caused serious fiscal problems for the nation. For the first time in history, the US' national debt outstanding is hitting near $31.4 trillion and the debt is enlarging at every passing minute, becoming a ticking time bomb for the country and the world economy too. According to US Treasury Department data, the country's indebtedness has deteriorated since the 2008 financial crisis. When Barack Obama took office in 2009, the national debt was only $10.6 trillion. By 2023, the debt has nearly tripled in size.

Facing a banking system crisis and a struggling economy, and now locked with Congress in a standoff over how to raise the debt limit, the Biden administration seems to have steered the US into unchartered territory. The whole world hopes the policymakers in Washington could this time temper their political posturing and reach an early deal on debt ceiling and avoid creating another 2008-style financial debacle.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn