Illustration: Chen Xia/Global Times

What we have seen recently, and should be watching closely, is that risks to the global financial system are rising. We have seen turmoil across both US and European banking stocks recently, with Credit Suisse's share price down 85 percent. Silicon Valley Bank (SVB) tumbling 100 percent. The Dow Jones US Banks Index fell more than 20 percent. European bank stocks also fell sharply.As I said at the China Development Forum 2023 on March 25, the collapse of the SVB itself does not pose systemic risks, but what the incident exposes is systemic risks hidden in the global financial system.

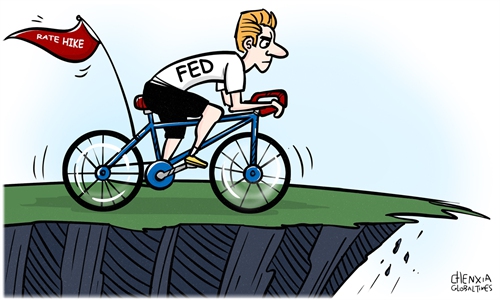

The main causes for the failure of SVB include poor management and supervision, and of course the mismatch of assets and liabilities of the bank. SVB holds a large number of US bonds. As the Federal Reserve (Fed) quickly raised interest rates, the bank's assets underwent major changes. In the grand scheme of things, this is a common problem in the US banking sector.

Modern technology, especially online bank withdrawals and social media communication, hastened the process of SVB's bankruptcy. Banking problems can happen very quickly these days. It took just three days for SVB to collapse, showing how quickly a banking crisis can spread under the influence of technology, media and communications. This is a lesson to be learned.

Why emphasizes that there is a systemic risk? This is related to the asset-liability structure of the entire financial industry. The background is the expansion of central banks' balance sheets around the world. In 2008 and 2009, the Fed doubled its size from $1 trillion to $2 trillion, and the global figure rose from about $4 trillion in 2008 to a little over $6 trillion. Today, 10 major central banks in the world have expanded to a scale of $24 trillion, which is 6 times that of 4 trillion at that time, which is hard to imagine. With the rapid expansion of the central banks' balance sheet, funds went to various financial institutions, especially into the bank's balance sheet.

Then, in order to curb high inflation caused by long-term easing, the Fed radically raised interest rates. During this period, it is very difficult for financial institutions to adjust the structure of Treasury bond assets that they have bought at zero interest rates. If they want to retain more flexibility, they will face the current scale of losses. This is a particularly big challenge and pressure for financial institutions, especially banks.

The Fed's borrowing is on the rise, and global liquidity is in a state of tension. This gap is huge because it is a mismatch between banks' asset and liability. The US is already seeing the fourth bank -PacWest - in risk, and if it is gradually extended, the exposure to government bailouts is very large.

Sovereign bond liquidity is starting to tighten, spreads are rising, and returns are falling sharply because of changes in valuations. In the corporate bond market, due to the holding of equity bonds, changes in companies' operating conditions have caused changes in the corporate bond market, which in turn have caused changes in the stock market.

Fundamentally, this is a mismatch of assets and liabilities in the banking market, so it is difficult to quickly repair over the short term. This crisis will continue, and the pressure on market liquidity will continue to increase. To what extent will it form a financial crisis? In 2023, we need to pay close attention to the spread of the crisis in the structural system of small and medium-sized banks, or the impact on the entire financial system.

The article was compiled based on a speech made by Zhu Min, vice chairman of the China Center for International Economic Exchanges and former Deputy Managing Director of the International Monetary Fund, at the Tsinghua PBCSF Chief Economists Forum on Saturday. bizopinion@globaltimes.com.cn