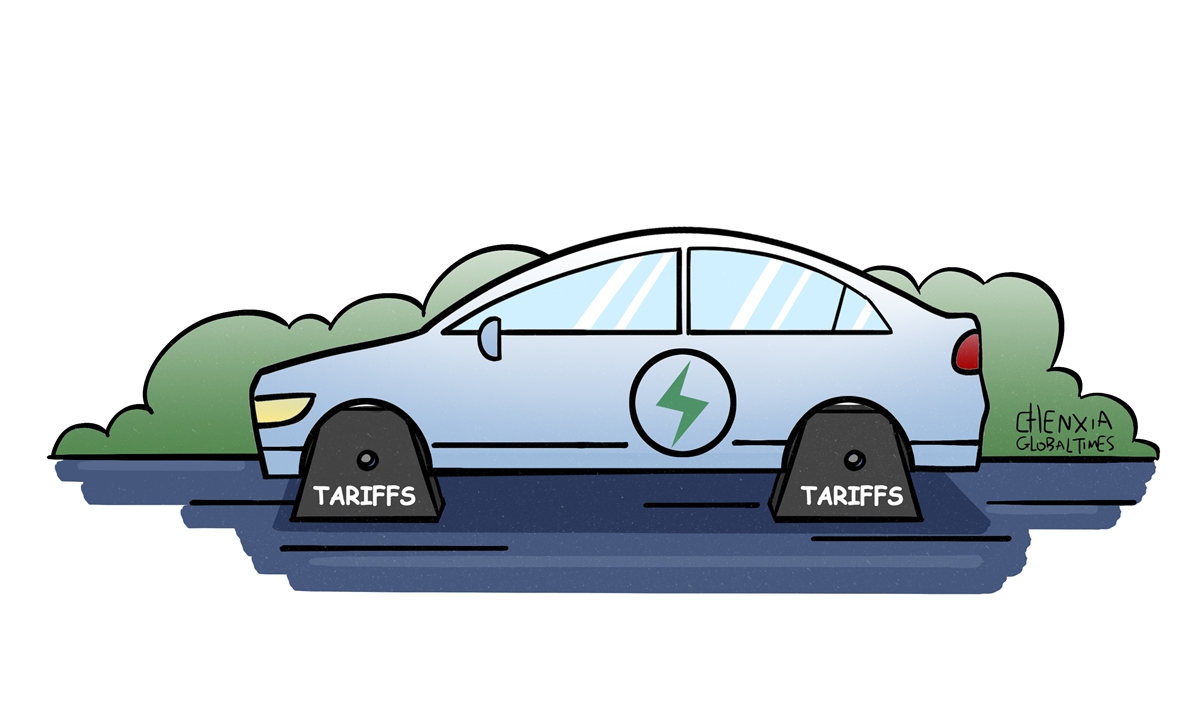

Illustration: Chen Xia/Global Times

Amid a global transition to clean energy technologies, competition is fierce in the new-energy vehicle (NEV) industry, and against such a backdrop, protectionism worsens while the "decoupling" China theory continues to cloud the world economy. In the latest example, a report released Tuesday by the unit of German insurer Allianz said Chinese-made electric vehicles (EVs) pose the greatest risk to Europe's carmakers and could cost them 7 billion euros ($7.7 billion) a year in lost profits by 2030 unless policymakers take action. Policymakers have been called to "meet the challenge with reciprocal tariffs on imported cars from China," Reuters reported.Amid fierce market competition, currently, Chinese carmakers have cultivated a lead in some key segments and their rise has been powered by NEV models that are gaining share at home and abroad. It is perhaps with little surprise that the success of Chinese enterprises' expansion of markets overseas has made them a target of trade protectionism, with some locals considering Chinese imports to be a threat to local auto industry. What's worse, at a time when the introduction of industrial subsidies in the US has significantly accelerated the global competition, US' political elites have taken the "China threat" theory to an extreme, trying to persuade European countries to "decouple" from the Chinese economy.

European policymakers should maintain their strategic sobriety. Once European countries pursue trade protectionism by increasing import tariffs and non-tariff barriers on Chinese-made EVs, it will undoubtedly hit Chinese auto manufacturers, but in the long run, protectionism will eventually backfire and restrict their own development in the auto sectors. China is the world's largest vehicle market by both annual sales and manufacturing output, with many European automakers viewing the nation as an important overseas market and production base. Those who suggest increasing tariffs on Chinese-made EVs are playing a dangerous game by trying to create conflicts between European countries and China, where rising EV sales are propping up European companies' global performance. If trade disputes cause a lose-lose situation for both Chinese and European automakers, the ultimate winner will be American EV companies.

Escalated protectionism in Europe in recent years has caused increasing difficulties for Chinese-funded enterprises to invest and operate in the market. According to the report on the EU business environment released by the China Council for the Promotion of International Trade (CCPIT) in March, 33.04 percent of the interviewed companies believe that the EU business environment has deteriorated, an increase of 5.86 percentage points from last year.

Bowing to trade protectionism cannot enhance the competitiveness of the European auto industry. On the contrary, cooperation is always an effective way to promote development. The fact that China is a global leader in new energy sector with the huge market, low-cost production capacity and advanced technology, determines the EU cannot afford to give up cooperation with China. The EU's need to speed up its energy transition, revitalize the auto industry, and China's huge advantages in related industries still represent great potential for China-EU cooperation.

To attract Chinese companies to expand investment, Europe needs to provide a fair and open business environment. Chinese companies' willingness to invest in Europe remains high although EU business environment is declining. The flow of Chinese companies' investment in EU reached $7 billion in 2022, and the investment stock totaled $102.9 billion. Chinese greenfield investment in Europe in battery production for electric vehicles accounted for 57 percent of total foreign direct investment by China in Europe in 2022, according to 2022 data analyzed by independent research providers MERICS and Rhodium Group, Reuters reported on Tuesday.

Both China and the EU should respond to the rising investment enthusiasm of companies. Against the backdrop of the US "decoupling" push, if China and the EU can resist external interference and accelerate the ratification and implementation of China-EU Comprehensive Agreement on Investment (CAI), it will bode well for both economies. According to the survey conducted by CCPIT, if the CAI is passed and implemented, 40.87 percent of the surveyed Chinese-funded enterprises will increase their investment in the EU market.

The auto industry is a traditional pivot for the EU economy. The rapidly developing NEV industry plays an important role both for future economic growth and energy transition across the world. To deepen cooperation with China in the field is in line with EU's interests. Hopefully, the EU will abandon unilateralism and trade protectionism in this field, deepen practical cooperation with China, jointly promote the technological progress of both parties in the NEV sector, and jointly promote global green transition.

The energy transition and deepening cooperation with China are both unavoidable trajectory for the EU. Strengthening cooperation with China's NEV sector and attracting investment from Chinese companies is conducive to the development of the European NEV industry. Protectionism can only hinder the development of the European new-energy industry. The EU should have the determination to avoid falling into the trap of US "decoupling" push and protectionism.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn