Illustration: Chen Xia/Global Times

Ever since early 2022, the Chinese yuan has been increasingly stocked up by central banks and enterprises of various countries as an alternative payment currency to the US dollar. The strength of the yuan is backed up by China's growing colossal economy. Simultaneously, the US government's move to weaponize the dollar and impose sweeping monetary sanctions on Russia also drives other nations to alienate the US currency.By punishing Moscow and Russian companies, the Biden administration has wielded the monetary club of the dollar, cutting Russia off from global transactions based on the currency, including the dollar-based SWIFT interbank messaging platform, a move that leads to an unintended result - the rapid rise and broad acceptance of the yuan throughout the world.

Now from Southeast Asia, the Middle East, Africa to Latin America, scores of sovereign countries, taking their economic security into account, have started to reduce their reliance on the dollar by diversifying their foreign currency reserves. Pundits refer to it as "de-risking from the greenback," a precautionary measure to deflect or mitigate economic sanctioning by the US government.

In China, policymakers started the "de-risking" process and tried to cut the country's reliance on the dollar in the woeful aftermath of the 2008 financial crisis, which originated from the US government's chaotic management of the subprime housing loans that eventually imploded and caused a worldwide economic recession.

The collective drive by the world's developing countries to insulate their economies from the US government's wanton, dollar-based sanctions will continue to gain pace in the coming months and years, as the countries fret about indiscriminate penalties from Washington, including its confiscation of their lawful dollar-denominated assets. And, the countries are also concerned about the on-again-off-again intermittent banking system crisis in the US, which may cause another global financial debacle and economic meltdown.

Now, acting out of prudence, many central banks are cutting their holdings of US Treasury bonds. In 2022, China reduced its US Treasury securities holdings by $173.85 billion, the second most in a single year, according to official statistics. Wary of the anti-China posturing by American politicians who trumpet a "technology decoupling" in order to stifle China's growth, more Chinese scholars and the general public are asking Beijing to take precautions.

To align more closely with China's trade partners and reduce transaction cost too, China has signed bilateral currency-swap treaties with dozens of its economic partners. As a result, in March the yuan became the most widely-used currency for cross-border transactions in China, overtaking the dollar for the first time. Official data showed the yuan was used in 48.4 percent of all cross-border transactions, while the dollar's share dropped to 46.7 percent. Cross-border payments and receipts in the yuan rose to an unprecedented $549 billion in March from $434.5 billion in February.

By all metrics, the growing political threat and economic coercion from the US government will drive more countries to store non-dollar currencies, the yuan assets in particular, to diffuse risks by sidestepping the US currency. Argentina and Brazil recently reached agreements to pay for Chinese imports in the yuan rather than the dollar, which is believed to be surely followed by more governments. In 2022, the share of all Russian imports paid for in Chinese yuan rose to 23 percent from 4 percent in 2021. Now, the yuan has overtaken the dollar as the most traded currency in Russia as Russian businesses and individuals shun the dollar.

And, the US Federal Reserve's monetary tightening policy - raising the benchmark interest rates by 500 basis points in a row since March 2022 - is siphoning dollars from many developing countries back to the US and starting to harm the developing economies. Naturally, these countries aspire to seek a strong alternative to the dollar.

For the sake of protecting China's foreign trade and safeguarding the country's comprehensive economic security, friendly trade partners should be encouraged to adopt the yuan for international transactions. As a first step, China could accelerate the pace of current-and-capital-account yuan convertibility on the basis of market regulation, so that the currency's liquidity and viability are enhanced.

Secondly, China's self-developed interbank messaging and payment system based on the yuan, the Cross-Border Interbank Payment System (CIPS), should be vigorously promoted for global use, to support settlement of global trade in goods and services, cross-border investment, financing and individual remittance. Supported by the People's Bank of China, the country's central bank, the CIPS was launched in 2015 to internationalize the yuan's use. Last year, the system processed more than 96.7 trillion yuan ($14.1 trillion), with over 1,420 financial institutions in 109 countries and regions having already connected to the CIPS platform.

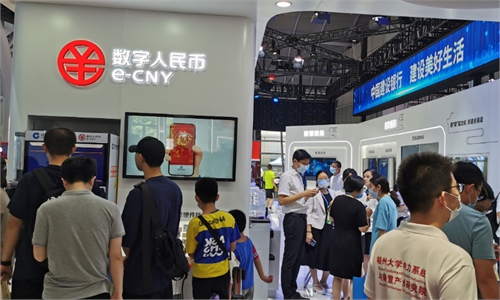

Thirdly, China could trial out its digital currency, the e-CNY, in growing use scenarios of cross-border transactions, as financial technology innovations, which China is leading the world, are important that will influence the yuan's international prestige. Last year, China's digital currency was the most actively transacted token in a $22 million pilot program to settle cross-border trades, according to a report by the Bank of International Settlement (BIS).

Expanding use of CIPS and e-CNY in both domestic and overseas transactions will effectively promote the internationalization of Chinese yuan, and at the same time, cut into the dominance and hegemony of the US dollar on global market, which will withstand the US government's threat to use the dollar to sanction the Chinese and other economies.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn