China raises basic retiree pensions by up to 3.8% to better cope with aging society

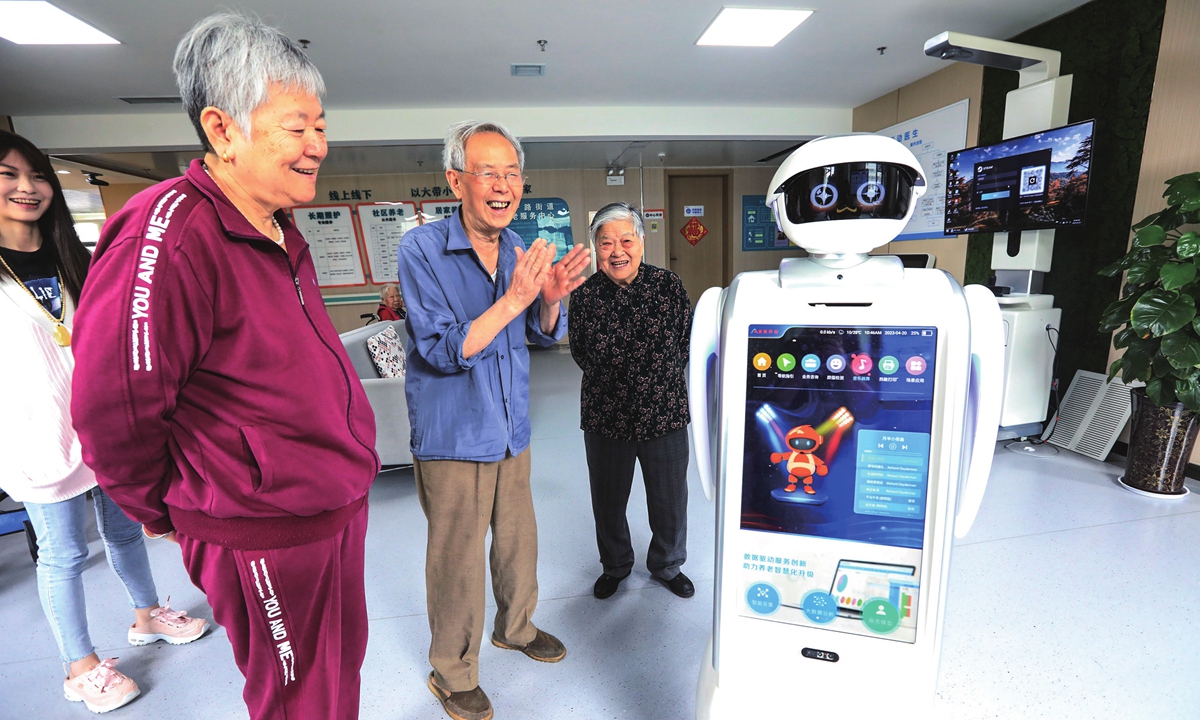

Elderly people interact with a robot at a service center for the elderly in Zhengzhou, Central China's Henan Province on April 20, 2023. Photo:VCG

China has raised the basic monthly pension for retirees nationwide by up to 3.8 percent from the level of 2022, together with the launch of a fairer and more balanced distribution mechanism, as the nation strives to secure and improve livelihoods, a joint notice issued by the Ministry of Human Resources and Social Security and the Ministry of Finance said on Monday.

Every year since 2005, the basic pension has been increased. Experts said that the move is part of the government's constant efforts to provide stronger guarantees for the quality of life for retirees, as the nation prepares for an aging society.

In order to ensure a fair pension distribution, incentive mechanisms are being adopted, such as paying more to get more and paying for longer periods to get higher payouts, the notice said.

Each provincial level region determines its own adjustment ratio and level with the national adjustment ratio as the upper limit.

The level of pensions can be correspondingly adjusted in favor of elderly retirees and retirees in remote areas.

The notice also urged localities to take practical measures to strengthen the management of the income and expenditure of the pension insurance fund, while making financial arrangements in advance to ensure that the basic pension is paid in full and on time and no new arrears will occur.

The raising of the pension on an annual basis fully reflects the importance that the government attaches to people's livelihoods and has a very positive effect on improving the retirement benefits of the elderly, Li Changan, a professor at the Academy of China Open Economy Studies of the University of International Business and Economics, told the Global Times on Monday.

"The significance of the continuous increase in pensions is obvious. It is conducive to improving the pension benefits of retirees as well as boosting the consumption level and capacity of the elderly," Li said.

As of the end of 2022, there were more than 280 million people aged 60 and older in China, accounting for 19.8 percent of the population. Of the total, 210 million were aged 65 and above, accounting for 14.9 percent of the total, according to media reports.

While the pension is rising, the growth ratio is dropping year-on-year. In 2020, the ratio was 5 percent and it has dropped by about 0.5 percent yearly.

The adjustment in pensions is based on the basic principles of the economic development level and the stable treatment of retirees, Li said.

Data released by the Ministry of Human Resources and Social Security shows that China's working-age population has declined since 2012, with an average annual decrease of more than 3 million, and it is expected to decrease by 35 million during the 14th Five-Year Plan period (2021-25).

The increase in the retired population means that all of the society needs to pay more pensions, which puts forward higher requirements for the social pension service system.

China has established the largest social security system in the world. As of the end of 2022, the number of people participating in the national basic pension insurance had reached 1.05 billion, a year-on-year increase of 24.3 million.

The national basic pension has continued to rise over the years, benefiting hundreds of millions of retirees.

To further do a good job on the pension system, China is expanding the payment basis of pensions by expanding the coverage of social security and strengthening management.

"The investment scope should be expanded, including the scale of state-owned capital in enriching pension insurance," Li said.