Illustration: Chen Xia/Global Times

After the US and it's key allies announced the establishment of the Minerals Security Partnership, a US-centered cliques serving US national interests under the pretense of critical mineral supply security, some Western forces have turned their eyes on lithium resources in Australia.

The New York Times wrote in an article published on Tuesday that Australia mines about 53 percent of the world's supply of lithium, and virtually all of it is sold to China. "But now the Australian government wants to break the world's dependence on China for processing the minerals driving the green revolution," the report said.

On Saturday, US President Joe Biden and Australian Prime Minister Anthony Albanese signed a statement of intent to advance cooperation in areas including critical minerals and clean energy. Amid a global transition to clean energy technologies, competition is fierce in the new-energy vehicle industry, and against such a backdrop, lithium resources in Australia have become a much-coveted source of wealth for Washington, which is busy cracking down on Chinese enterprises and maintaining US economic hegemony in strategic emerging industries.

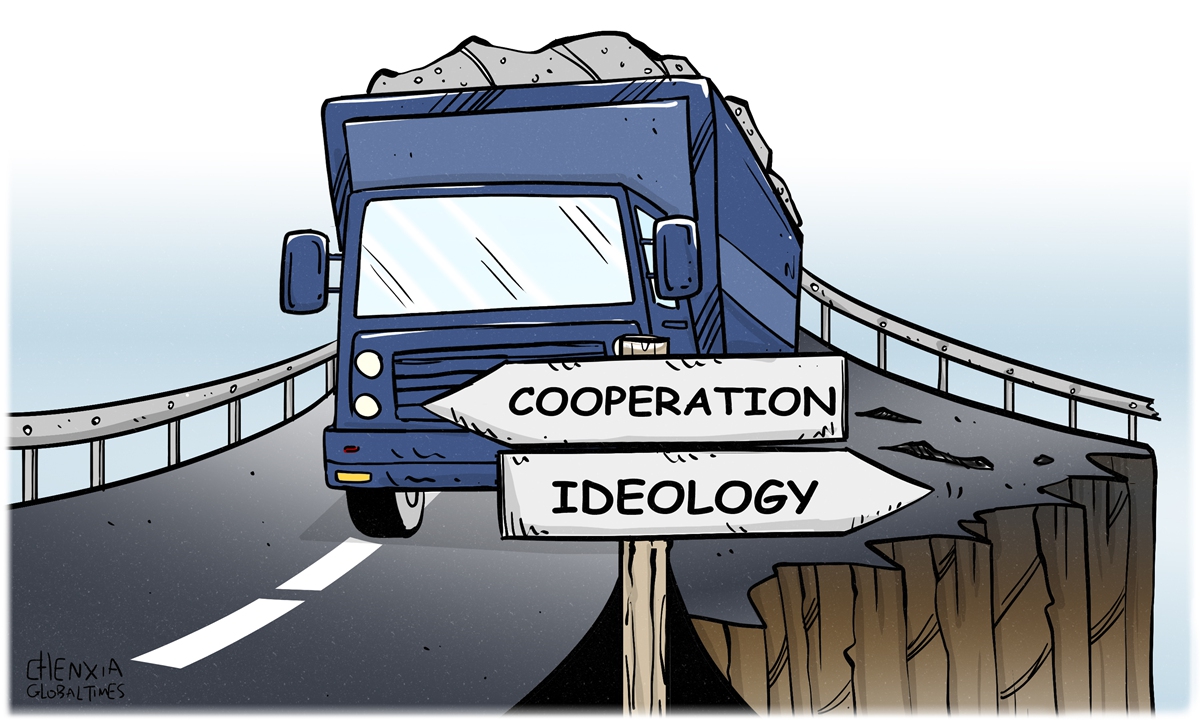

However, such an attempt to form a small clique in the supply chain of lithium has a serious flaw: Any country cannot establish a refining capacity by relying solely on ideological and geopolitical partners. The economic complementarity of China and Australia creates potential for cooperation in the field of lithium refining, which shouldn't be sabotaged by Washington's "decoupling" or "de-risking" push.

As the top lithium producer globally, Australia is home to many mines focused on the commodity, but the country has limited success in building processing and refining capabilities for its mineral wealth. For a long time, Australia has been hoping to increase local refining capability to move up the value chain. This is normal and understandable, and it does not necessarily mean a "de-risking" effort targeting China.

The New York Times said in its article that an Australian government report last year forecast 20 percent of global lithium refining could take place in Australia by 2027, up from less than 1 percent.

Lithium is a key mineral used in the production of powerful batteries. The White House said in a statement last year that as the world transitions to a clean energy economy, global demand for minerals such as lithium and graphite used in electric vehicle batteries is set to skyrocket by about 4,000 percent over the next several decades. Using national security as an excuse to recklessly interfere in economic affairs, the US is trying to build a "green alliance" to strengthen the US position in global critical minerals supply chains. To preserve its selfish interests, the US has politicized, weaponized and ideologized critical minerals. This will wreck and hinder rather than promote efforts by Australia in building up local refining capability.

As for issues about refining capability, we should focus back on the economy, rather than geopolitics. Downstream buyers will vote with feet by choosing the most cost-effective products. This is a basic principle in the business world. If Australia wants to achieve the goal to improve its lithium refining capacity, it should develop relevant technologies, attract foreign investment and reduce costs. Only in this way can its industrial competitiveness be improved. Relying solely on geopolitical and ideological games cannot help the country achieve its economic goals.

China takes the lead globally in lithium processing and refining. Chinese enterprises have accumulated rich experience and good reputation in the sectors and some of them have sufficient fund for overseas investment. China's development is an opportunity for Australia and the two sides share cooperation potential in clean energy and critical mineral industries.

It is too exaggerated to say Australia has monopoly over global lithium supply chains. It has been estimated that South America's Lithium Triangle - Argentina, Bolivia, and Chile - hosts more than half of the world's lithium resources. Some US political elites may try to provoke anti-China sentiment in Australia and use Australia's lithium resources as leverage to curb China's development in new-energy industries, but those people are going to be deeply disappointed by the result. Australia has no ability to contain China's lithium industry. As for the two countries' lithium supply chains, what is needed is cooperation rather than the West's "decoupling" or "de-risking" push.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn