Chinese provinces add sea links to Belt and Road market to accelerate economic recovery

A view of the Dapukou terminal at the Ningbo Zhoushan Port, East China's Zhejiang Province on January 17, 2023 Photo: Li Hao/GT

Merchant fleets run by Chinese provinces are actively exploring Belt and Road markets through setting up more shipping routes linked with overseas ports to bank on the opportunities created by the initiative.

Ningbo Ocean Shipping Co, based in Ningbo, East China's Zhejiang Province, told investors through an online channel on Monday that the company attaches great importance to the Belt and Road markets and has proactively implemented a targeted strategy.

It has so far opened up shipping links with Ho Chi Minh City and Haiphong in Vietnam and Laem Chabang and Bangkok in Thailand, the company said, noting that it will speed up the pace of going abroad and continuously optimize international operations.

The move by Ningbo Ocean Shipping Co, a local state-owned enterprise, came as other local shipping players in China are expanding their presence across Belt and Road markets.

Jiangsu Ocean Shipping Co, based in Nanjing, East China's Jiangsu Province, has extended its reach to over 60 percent of the Belt and Road market, according to media reports in March.

Newly added shipping routes include one from Nanjing to Haiphong and Ho Chi Minh City in Vietnam, and one linking Yancheng port and Busan in South Korea. The company said it has been strengthening its logistics capacity to receive and collect cargo bound for countries and regions including South Korea and Southeast Asian countries.

This year marks the 10th anniversary of the China-proposed Belt and Road Initiative (BRI), a global cooperation platform that reflects China's vision and provides solutions for the reform of the global governance system addressing multi-faceted challenges. Chinese shipping giant such as COSCO SHIPPING has long expanded its reach in such markets.

Chinese shipping experts said that the routes follow the flow of goods, and the change reflected weakening or slowing trade between China and the US, and the EU, noting the newly added routes will not only win opportunities for China, but also directly contribute to the economic and trade recovery of Belt and Road markets.

Local SOEs contribute to about 20 percent of China's overall shipping footprint in the Southeast Asia, while central SOEs such as COSCO SHIPPING accounts for the remainder, Wu Minghua, a veteran Chinese shipping analyst, told the Global Times on Monday.

According to data with General Administration of Customs, the growth rate of Belt and Road markets in the first four months of this year reached 16 percent, rising to 4.61 trillion yuan ($650 billion), outpacing the overall foreign trade growth of 5.8 percent.

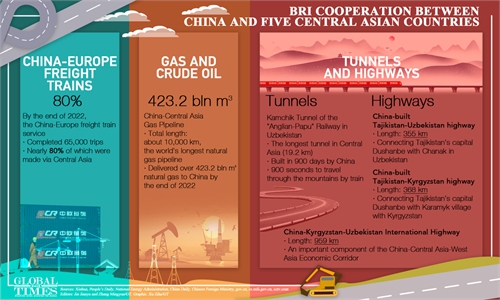

Along with the rapidly expanding China-Europe freight train services, the expansion of sea routes and the shuttling overland trains go hand in hand. Belt and Road markets are expected to become a new benchmark for maritime trade, Wu said.

A Ningbo-based shipping agent surnamed Zhu said the newly added shipping routes are aimed at tapping the dividends of the BRI and capturing rising trade potential across SE Asia, South Asia and Russia as pragmatic way of doing business.

Six major Chinese provinces including South China's Guangdong, Jiangsu, Zhejiang and Shandong provinces, all posted higher growth rates than the national average of 5.8 percent over the period. All posted foreign trade over one trillion yuan, with Guangdong hitting 2.52 trillion yuan.