Davos attendee praise China’s role in filling global funding gap, urging global cooperation to tackle debt woes: expert

Global cooperation is needed to resolve debt woes, other thorny issues

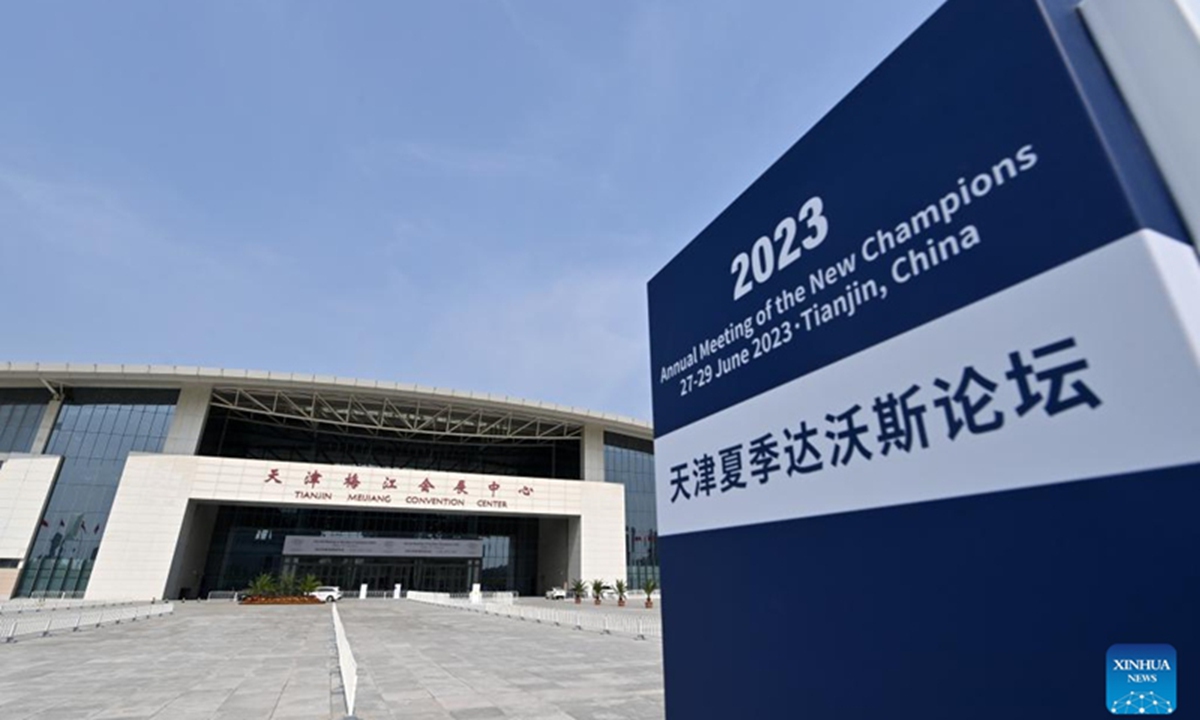

This photo taken on June 25, 2023 shows a view of the Tianjin Meijiang Convention Center, the venue for the 14th Annual Meeting of the New Champions, also known as the Summer Davos Forum, in north China's Tianjin Municipality. Photo: Xinhua

Officials and businessmen attending the World Economic Forum's 14th Annual Meeting of the New Champions (AMNC) in North China's Tianjin have called for enhanced global collaboration to address the thorny issues of debt and the financing gap for the emerging market economies. China has a major role to play, they noted.

Observers said collaboration is urgently needed as the world braces for the first year post-pandemic, and that the advanced economies should honor their pledges to developing countries by providing them with more funding aid.

Global debt has ballooned to a record high of about $300 trillion as of the first quarter of 2023, IMF data showed in May. The arrears are now complicated by US Fed's massive interest rate hikes, and the capital exodus from developing countries, which face glaring funding shortages. A UN estimate puts their funding gap at $3.7 trillion.

At a seminar titled Global Debt Explosion during the Summer Davos Forum on Wednesday, delegates said different views on the debt issue have prevented the emerging markets from getting desperately needed financing and the world needs more collaboration to address the matter.

Jin Keyu,a professor of economics at the London School of Economics, noted that lenders from developing countries and developed countries tend to think on different terms. International coordination, which requires the involvement of members of Paris Club and China, under the G20 framework, is needed to sort out these issues faced by the emerging markets.

Developing countries, led by China, think of borrowing as a long-term developmental issue, while developed countries' mindset is more on short-term economic cycle, Jin said.

"Chinese funding to the developing world is very important," Sri Lankan Foreign Minister Ali Sabry told the panel. "As the Western debtors often take a wait-and-see approach, China would come in and invest big-time. As a result our economy has grown at 7 or 8 percent for about 10 years," the minister said.

"Although we are facing a challenging time, we can work together so that more investment will come, and Chinese companies are bullish on Sri Lanka as an emerging and regional power," the Sri Lankan foreign minister told the Global Times, commenting on the recent trend of investment by Chinese companies in the country.

As the Summer Davos started on Tuesday, delegates also refuted the attempts by some politicians in the West to smear China on debt issues, who suggested that loans related to the Belt and Road Initiative (BRI) cause some developing economies falling into debt woes.

"China has provided stable financing for infrastructure and developmental goals for many emerging markets. China has been very helpful, and of course, it can do better with greater transparency and international coordination," Jin told reporters on the sidelines of the forum on Wednesday.

Thomas Lembong, director of Singapore-based Consilience Policy Institute and former Indonesian minister of trade, told the Global Times that the BRI is very important in terms of providing financing to developing countries, and they would otherwise struggle to secure funding for infrastructure build-up. "Blame game is never productive. The constructive way forward is to work on solutions including restructuring and tuning projects and approaches," he said.

China attaches great importance to debt sustainability and has been working to provide necessary support to the best of its capacity to developing countries facing financial hardship, Chinese Foreign Ministry spokesperson Mao Ning said in May.

According to a report by Boston University, China's cooperation with emerging countries over investment and funding was based on the actual needs of recipient countries, which proved useful in tackling development bottlenecks. Such cooperation is expected to boost global revenue growth by about 3 percent.

Chinese experts observing the debt issue called for the international community to view the debt issue from a developmental perspective and urged a more responsible approach to address the financing gap faced by emerging markets.

The cooperation between major powers, especially China and the US, will be conducive to addressing the global debt issue, which is in essence a developmental issue, they noted.

Song Wei, a professor at the School of International Relations and Diplomacy at Beijing Foreign Studies University, said that the root cause of the global debt woes is the fact that the developed countries have prematurely pushed developing countries into privatized capital markets.

China, the World Bank and the IMF are the primary funding sources for developing countries but the funding from the World Bank and the IMF were not handed out in an equal manner, Song said.

During the pandemic years, the two lenders lent far more to advanced economies than to developing countries, with $280 billion lent to G7 countries while a meager $8 billion went to the world's least developed countries, Song noted.

G7 countries owe $13 trillion in unpaid aid and funding for climate action to the Global South, and their bankers are even demanding that Global South countries pay $232 million a day in debt repayments through 2028, according to a recent report by Oxfam International.