Argentina promotes yuan integration, reducing costs and democratizing international currency basket

China Argentina Photo:VCG

Argentina's central bank's enabling of Chinese yuan accounts in the Argentine banking system is a great advancement in reducing exchange rate costs, promoting financial efficiency and currency diversification, Argentine Ambassador to China Sabino Vaca Narvaja told the Global Times in an exclusive written interview on Friday.

The remark was made in response to the latest move by the Central Bank of Argentina to allow the country's commercial banks to open customer accounts in yuan. According to a statement published on its website, the central bank on Thursday said it had granted banks permission to take deposits in yuan, while it increases its yuan sales almost daily to finance imports.

This new measure is aimed at alleviating the scarcity of US dollar reserves and promoting the use of the Chinese currency for international transactions, according to media reports.

Expert said this development marks another manifestation of the mutually beneficial cooperation model between China and Argentina, and sets a regional collaboration precedent. It is expected to encourage other Latin American countries to establish similar yuan financial operations, especially amid ongoing economic recovery efforts.

The decision of the Central Bank of Argentina is very important because China and Argentina, in addition to supporting the internationalization process of the yuan, are betting on a more diverse monetary system in which both sides will not have to use a third currency for exchanges between each other or with main trading partners.

This has a double positive effect: first, it reduces financial costs, and second, it promotes the democratization of the currency basket on the international level, the ambassador said.

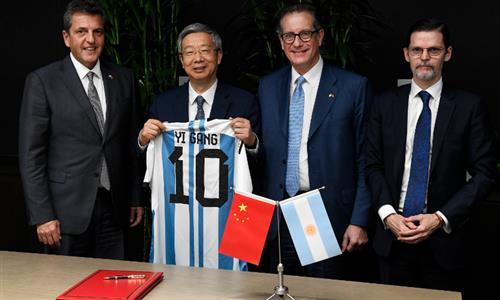

The move came just three weeks after the recent visit by the Argentine Minister of Economy, Sergio Massa, to China together with other government representatives in early June, during which a cooperation plan to promote Belt and Road Initiative was signed, which includes, among its 13 working sectors, a central element such as cooperation in monetary and fiscal matters.

During the visit, the People's Bank of China and the Central Bank of Argentina renewed the bilateral local currency swap agreement, with a swap scale of 130 billion yuan per 4.5 trillion pesos in a validity period of three years, as the two countries ramp up efforts to enhance financial cooperation and trade facilitation.

The renewing of the currency swap mechanism has consolidated the path of expanding the use of local currencies, which has been very successful for economic exchanges between Argentina and China, Narvaja said.

Since the activation of this mechanism, announced in the bilateral meeting between the leaders of the two countries during the G20 summit in Bali last November, exchanges using yuan as the currency have grown exponentially, the envoy said.

"This new step announced by the Central Bank of Argentina to enable yuan accounts in the Argentine banking system is a great advancement in this direction of using local currencies, and it adds to many previous actions such as the opening of an electronic open market for spot and futures transactions in yuan," Narvaja said.

Likewise, the recent authorization granted to the Chinese credit card issuer, UnionPay, for the operation of transactions by all its clients in Argentina, allows them to settle with non-residents at the same value as financial dollars. The ambassador said that such moves are extremely relevant both for promoting Chinese tourism and consumption in Argentina and for ensuring traceability.

Narvaja stressed that the expansion of the use of yuan is possible due to the complementary economic nature that China has with most countries in the Latin American region and the spirit of shared work proposed for joint collaboration without any impositions.

"Argentina, like many emerging countries, advocates for a change in the global financial architecture in international organizations so that it is not oriented toward a speculative matrix. That is why we support the reform of the system in all multilateral forums, aiming to direct it toward the real economy and productive system," the ambassador further noted.

The ambassador highlighted the recent words by Brazilian President Lula Da Silva during his recent visit to China when he asked, "Why all countries have to base their trade on the dollar? Why can't we do trade based on our own currencies? Who was it that decided that the dollar was the currency after the disappearance of the gold standard?"

The ambassador said that institutions such as the People's Bank of China, the Asian Infrastructure Investment Bank (AIIB), and the New Development Bank (NDB), are doing a lot to build a fairer financial system.

"Argentina is betting on this new path and has recently joined as a member of the AIIB and formally requested to join the NDB of the BRICS…we firmly believe that a more harmonious and balanced multi-polar world, without any impositions, will be a reality if we work together," he said.

"In this sense, the concrete progress that many emerging countries are making in that direction is a good example," he further noted.

The latest move by the Central Bank of Argentina did not come out of the blue. On April 26, the Argentine government announced that it will use yuan to settle trade in goods imported from China.

Data from the Argentine Ministry of Economy shows that, in April and May, Argentina's imports settled in yuan accounted for 19 percent of the country's total imports in the two months.

Argentina's move came amid the rising wave of de-dollarization in Latin American countries, particularly in trade transactions, as the regional countries see greater prospects in the Chinese yuan as an alternative and more reliable currency while reducing risks brought by the US dollar.

China and Brazil signed an agreement to settle trade in their respective currencies, a move widely regarded by international media as a sign of "de-dollarization."

Wang Youming, director of the Institute of Developing Countries at the China Institute of International Studies in Beijing, told the Global Times on Friday that the recent decision by the Central Bank of Argentina to offer yuan-related services is significant and groundbreaking progress. He noted "it not only contributes to the internationalization of the yuan but also strengthens the economic and trade ties between China and Argentina."

"This move also reflects the high level of trust and creditworthiness associated with the Chinese yuan in Argentina, and more importantly, it sets a precedent for other Latin American countries to follow suit," Wang said.