Indian refiners’ reported yuan purchase for Russian oil to accelerate de-dollarization: experts

A view of a railway station in Agartala, the capital city of India's northeast state of Tripura. Photo: Xinhua

Indian refiners have begun paying for some oil imports from Russia in the Chinese yuan as an alternative to the US dollar for settling payments, according to media reports. Experts highlighted the move as a forward step in the de-dollarization process of the three major economies amid the yuan's increasing internationalization.

Some refiners are paying in currencies like the yuan if banks are not willing to settle trade in dollars, Reuters reported on Monday, citing an Indian government source. The report also indicated that at least two of India's three private refiners are paying for some Russian imports in the yuan, citing another two anonymous sources.

Indian Oil Corp, the country's biggest buyer of Russian crude oil, in June became the first state refiner to pay for some Russian purchases in the yuan, the report said.

Chinese experts noted that India's reported settlement in the yuan will also boost the internationalization of the currency as it will have a demonstration effect on more emerging economies.

The reported move will enhance the yuan's international influence and increase the market share of the yuan in the global circulation and settlement, while facilitating the advancement of the yuan's internationalization process, Pan Helin, joint director of the Research Center for Digital Economics and Financial Innovation affiliated with Zhejiang University's International Business School, told the Global Times on Tuesday.

Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, echoed that it will speed up the de-dollarization process in China, India and Russia amid the accelerated de-dollarization push.

"It will further expand the use of the yuan in international trade. As India and Russia are both BRICS members, their use of the yuan in settlement will also inspire more emerging economies and developing countries to follow the path," said Dong.

The BRICS countries have been stepping up efforts to replace the use of the dollar in international trade, as the group will likely discuss the feasibility of introducing a common currency at a summit in South Africa later this year.

The yuan's global share went up to 2.54 percent in May from 2.29 in April, according to the Society for Worldwide Interbank Financial Telecommunication, as the yuan remained the fifth most active currency. The share was also the third-highest since tracking begun in October 2010, per media reports.

The trade channels between Russia and India can be further broadened with more trading categories following the reported settlement in the yuan, said Dong.

India's imports of Russian oil hit another record in June, Bloomberg reported. The daily volumes climbed to 2.2 million barrels a day in June, rising for a 10th month. Russian purchases exceeded the combined shipments of Saudi Arabia and Iraq, according to the report.

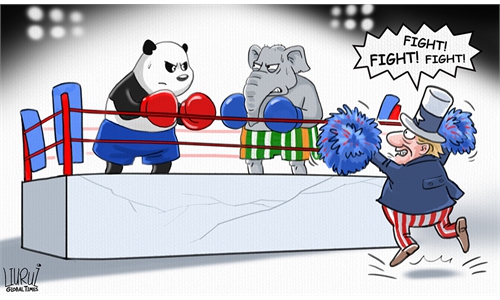

Multiple countries have been adapting the yuan as a settlement option amid its continuing internationalization and the rising wave of de-dollarization against US hegemony.

Earlier in June, Pakistan paid for its first government-to-government import of discounted Russian crude oil in the yuan, per media reports, citing Pakistan's Petroleum Minister Musadik Malik.