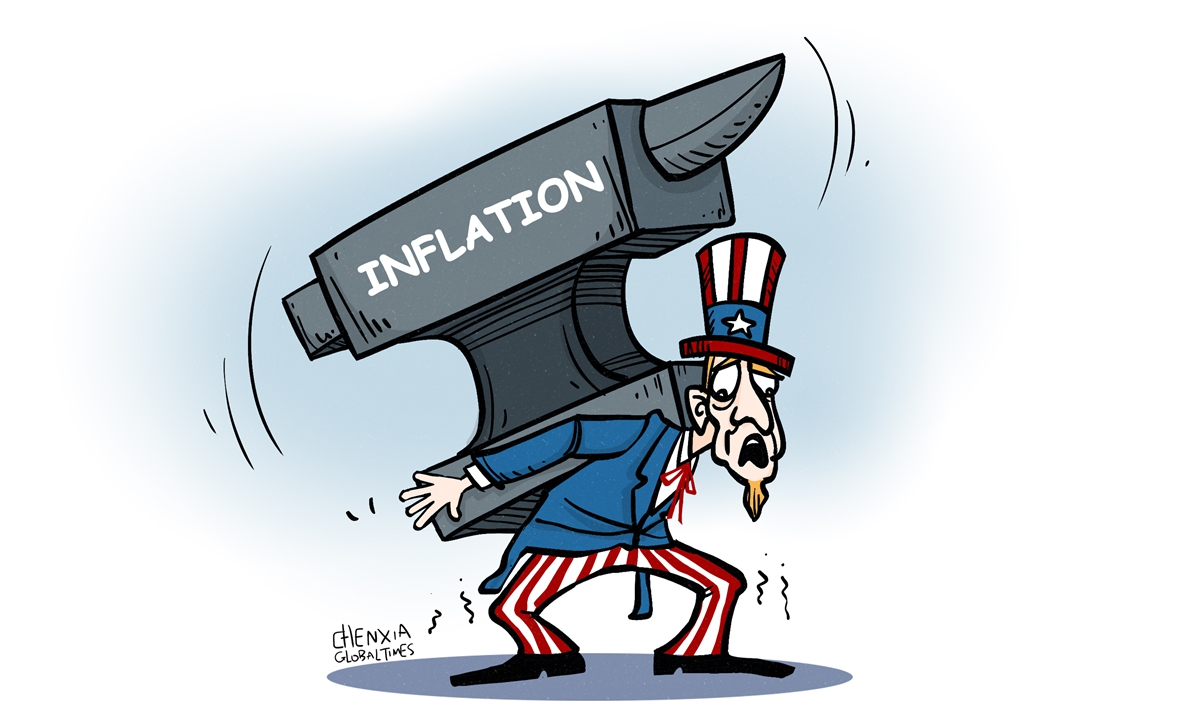

Illustration: Chen Xia/Global Times

The US economy is increasingly becoming "inflation-prone" despite the Federal Reserve's aggressive monetary tightening moves taken since March 2022, when the central bank started to battle creeping consumer prices which drew a backlash from the American public, as high inflation eats away at their savings and aggravates a cost-of-living crisis in the country.Recently, the US Fed hinted that the policymakers are likely to raise the benchmark federal funds rates two more times in 2023 to above 5.5 percent - a dire prospect that immediately casts a thickening cloud over Wall Street and global financial markets, as investors are already spooked by the 10 consecutive rate hikes done in the past 15 months.

Now, elevated inflation seems to have been deeply entrenched with the country's overall economic system. Consumer prices rose 4 percent in the 12 months to May, the US Labor Department reported. The figure remains much higher than the 2 percent rate the US Fed considers healthy, as prices for many items beyond food and energy continue to rise steadily.

Underlying inflation in the US and most other developed economies hasn't been effectively curbed, which has proven more persistent than previously anticipated. Despite a turn in headline inflation, the path toward sustained price stability remains uncertain and elusive, and increasingly fraught with risks.

On the whole, the Fed doesn't want to be seen to let their guards down yet with regard to reining in inflation. Even higher rates will put more pressure on the economic activity, translating to higher costs for housing mortgages, business loans, credit cards and other borrowing, which will pour cool water on growth.

A majority of economists expect the Fed's key rate to stand at a range of between 5.5-6 percent at the end of this year. In June, the US central bank kept the target for its benchmark rate at 5-5.25 percent - the highest level since the 2008 global financial crisis, noting the bank needed some time to assess the effect of rate hikes so far.

It is plausible that the US needs higher rates and perhaps even a moderate recession in order to tamp down stubborn inflation. Jerome Powell, the Federal Reserve chairman, said in June that inflation pressures continue to run high in the US, and the process to get inflation back down to 2 percent has a long way to go. That hawkish talk is weighing on the financial market as investors are unnerved by more rate hikes.

The Fed paused on raising rates in June - partially because of concerns over the impact of some commercial bank failures in March and April in the country, but Powell did not rule out the possibility that officials could return to back-to-back rate moves again. "Given how far we've come, it may make sense to move rates higher but to do so at a more moderate pace," he warned.

However, the broader American people are not expecting a return to lower inflation environment anytime soon. Many US economists blame a variety of factors such as the COVID pandemic, increased geopolitical tensions, the US government's move to "de-globalize" by disrupting global manufacturing integration and moving supply chains back to home, and recent extreme weather patterns that have distorted food supplies and prices as the culprits for higher inflation.

In the short run, it seems difficult to get the elevated inflation in the US down to around 2 percent, despite the Fed' continuing to press hard on the brakes through policy tightening. For many years in the past two decades, the country has been able to keep its inflation at a low level was largely a result of inexpensive goods provided by China, the world's factory, and other low-wage developing countries.

But Donald Trump's senseless trade war with China, by drastically raising the tariffs on $360 billion Chinese goods, triggered US inflation to raise its ugly head, which has become ever sticker and embedded with the US economy as a result of Joe Biden's reckless "decoupling" or "de-risking" agenda. After all, the US government's anti-globalization push runs counter to the gravity of global economic integration, which has largely backfired and led to a prolonged period of enduring inflation in the US and other developed countries.

Some in the US are complaining about corporate greed for aggravating inflation, but the Biden government's "de-coupling and anti-globalization" bid is causing a fracturing and fragmentation of the world economy, which rolls back on corporate efficiency, creates not unwinds bottlenecks across the global manufacturing chain, resulting in high production costs and price surges.

In a nutshell, the worst spike in inflation that the US has seen in decades underscores the global forces driving prices higher, namely the disruptions set in motion by the US' tariffs, the sweeping sanctions the West has slashed on Russia since early 2022, and the growing fragmentation and break-down of free trade and globalization. To make things worse, the exacerbating income gap among rich and poor households in the US has made the problem ever harder to address.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn